Back in 2019, when tech giant Microsoft (MSFT) planned to back up OpenAI and fire up what amounts to the artificial intelligence (AI) movement as we know it, not everyone thought much of it. In fact, reports note, Bill Gates himself talked to Satya Nadella about it, and offered the downright disastrous assessment that “Yeah, you’re going to burn this billion dollars.” That turned out to not be the case, however. Though you would not know it to look at Microsoft shares today. Microsoft shares are down nearly 2% in Friday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nadella pointed out that, at the time, OpenAI was a nonprofit foundation, so most likely believed that monetizing it was going to be a nightmare. But Nadella also noted that, at the time, Microsoft had “…a little bit of high risk tolerance,” which opened up the possibility that this investment could ultimately go somewhere.

Indeed, it ultimately did, reports noted, as OpenAI is now the most valuable private company on Earth. But it took several years and $13 billion worth of investment to get there. That might sound like a lot, but it pales in comparison to the $135 billion worth of OpenAI that Microsoft now owns with a 27% stake in the company.

Good Timing

The news that Microsoft’s OpenAI stake is now worth a bundle comes at a welcome time, as reports note that Microsoft’s Xbox hardware is still in open decline. Reports note that Xbox hardware revenue is down 29% against this time last year, and breaking the picture down by quarters only gets worse. With Microsoft hiking console prices, that only makes things worse.

However, this really should be expected. The biggest time for console hardware sales is right about the time the console comes out, within two years or so of launch. Once most users actually have one, buying a second makes little sense unless the first is irredeemably broken. And with another likely to come out in the next two years or so, the hardware market is likely sitting out until the next launches start.

Is Microsoft a Buy, Hold or Sell?

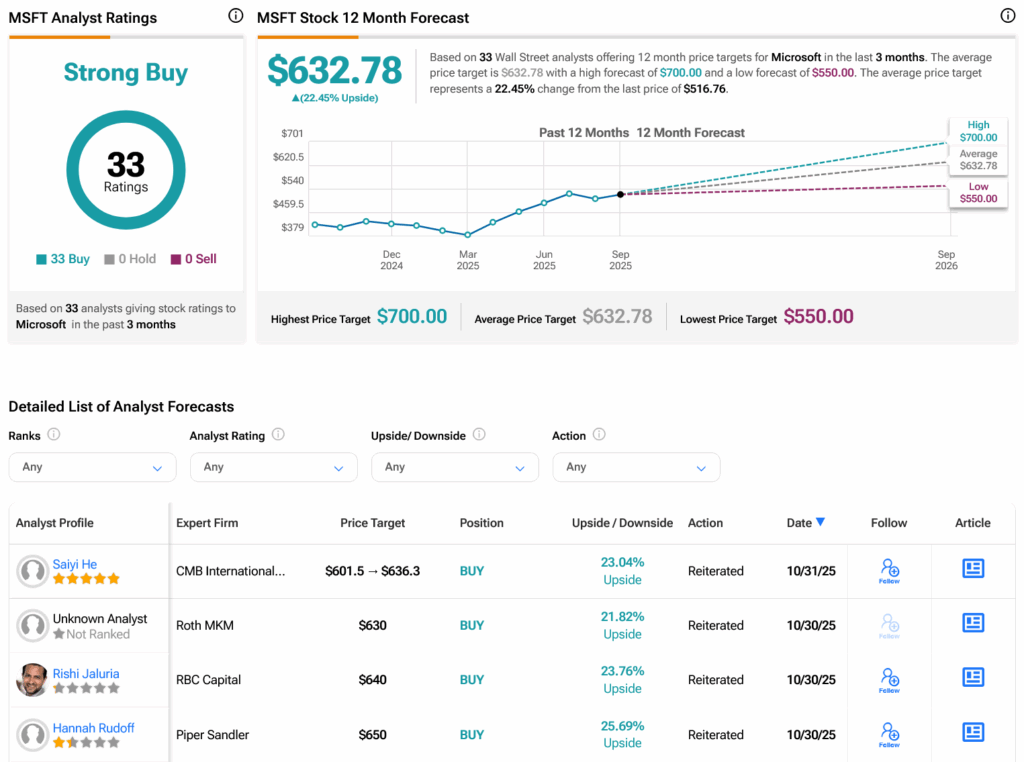

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 33 Buys assigned in the past three months, as indicated by the graphic below. After a 28.12% rally in its share price over the past year, the average MSFT price target of $632.78 per share implies 22.45% upside potential.

Source link

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)