CoreWeave (CRWV) stock is up 264% this year, fueled by soaring demand for its high-performance computing services and a string of major contracts. The latest is a $14.2 billion deal with Meta Platforms (META), under which CoreWeave will supply the computing power needed to run AI applications. Several analysts stayed bullish on the stock after the deal, maintaining their Buy ratings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The AI-focused cloud computing firm will also hold its shareholder meeting on October 30, which analysts view as a key near-term catalyst. Against this backdrop, it’s worth examining who the top stakeholders in CoreWeave are.

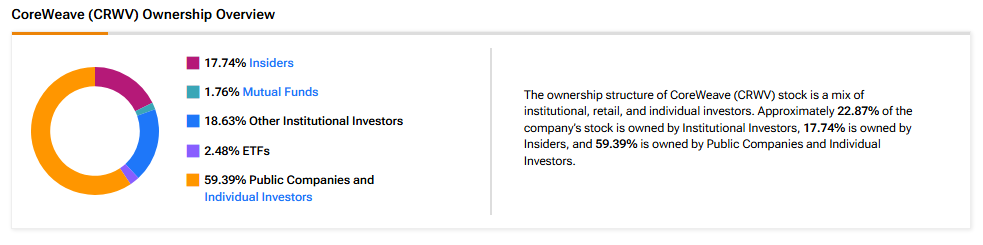

Now, according to TipRanks’ ownership page, public companies and individual investors own 59.39% of CRWV. They are followed by other institutional investors, insiders, ETFs, and mutual funds at 18.63%, 17.74%, 2.48%, and 1.76%, respectively.

Digging Deeper into CRWV’s Ownership Structure

Looking closely at top shareholders, CW Opportunity LLC owns the highest stake in CoreWeave at 7.98%. Following that is Jack D. Cogen, who owns about 4.80% of the company.

Among the top ETF holders, the YieldMax Ultra Option Income Strategy ETF (ULTY) owns a 0.35% stake in CRWV stock, followed by the Vanguard Total Stock Market ETF (VTI), with a 0.29% stake.

Moving to mutual funds, Vanguard Index Funds holds about 0.94% of CRWV. Meanwhile, J.P. Morgan Mutual Fund Investment Trust owns 0.26% of the company.

Is CRWV a Good Stock to Buy?

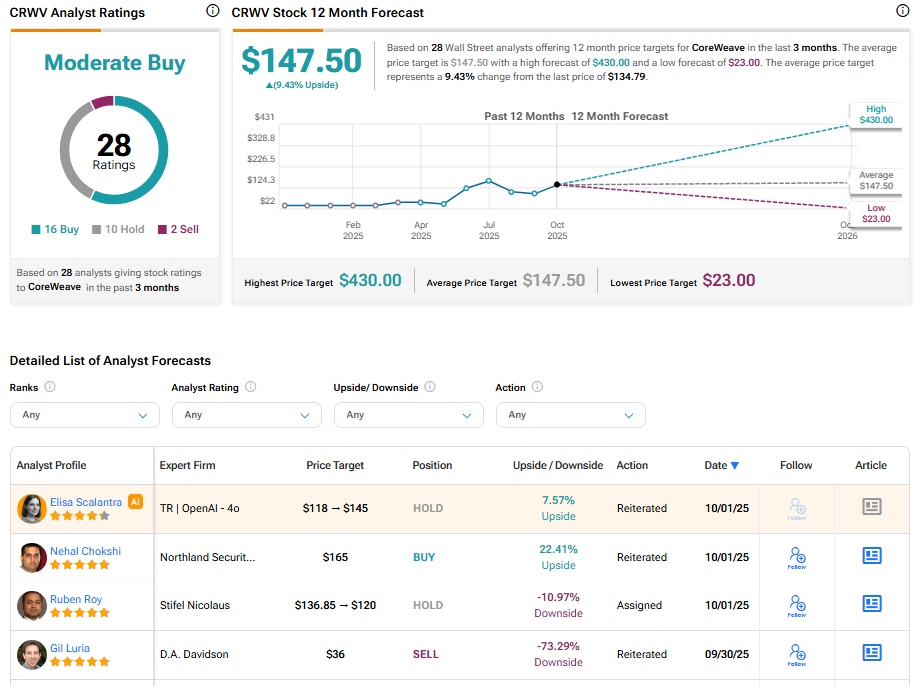

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CRWV stock based on 16 Buys, 10 Holds, and two Sells assigned in the past three months. Further, the average CoreWeave stock price target of $147.50 per share implies 9.43% upside potential.

Source link