U.S. banks are set to gain from a large cut in capital rules that could free up about $2.6 trillion in new lending, according to new research from Alvarez & Marsal. The change reflects a friendlier stance from Washington since Donald Trump returned to the White House. As regulators ease limits that were added after the 2008 crisis, big lenders may soon have much more money to put to work. In related news, some of the U.S. big banks are scheduled for this week’s earnings releases, including JPMorgan Chase (JPM), Citigroup (C), Bank of America (BAC), and Goldman Sachs (GS).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The study found that the shift could unlock nearly $140 billion in capital across Wall Street. It is also estimated that the new rules could lower banks’ core capital needs by about 14%. As a result, earnings per share could rise by roughly 35%, while return on equity could climb by about 6%. This extra room could allow banks to lend more, fund large projects, and return more cash to investors through buybacks and dividends.

JPMorgan Leads the Pack

JPMorgan Chase is expected to be one of the biggest winners. The easing could release about $39 billion of capital for the bank. That could lift its earnings per share by around 31% and its return on equity by about 7%. Other large U.S. banks are also likely to benefit as regulators plan to revise stress tests and adjust extra buffers for systemically important banks.

Meanwhile, the research expects the UK to follow the U.S. with lighter rules, cutting capital needs by about 8%. However, it forecasts that European Union banks will see a small 1% increase, while Swiss banks could face up to a 33% rise. These moves could help U.S. and UK lenders hold or grow their market share, while Swiss and EU banks may lose ground.

Shifting Global Rules

At the U.S. Federal Reserve, Michelle Bowman, now vice chair of supervision, has voiced support for easing rules she says have pushed lending into private markets. The Fed and other agencies are preparing to soften requirements on how much high-quality capital banks must hold and how they are tested each year.

This lighter approach may arrive as the U.S. sees a surge in capital spending on AI, data centers, and energy projects. With fewer limits, banks could take a larger part in financing that growth. However, European officials such as European Central Bank president Christine Lagarde and Bank of England governor Andrew Bailey have warned that relaxing too much could carry new risks.

Overall, the changes signal a new phase for global banking. U.S. lenders may enjoy stronger earnings and more lending power, while others could face tighter rules and slower growth.

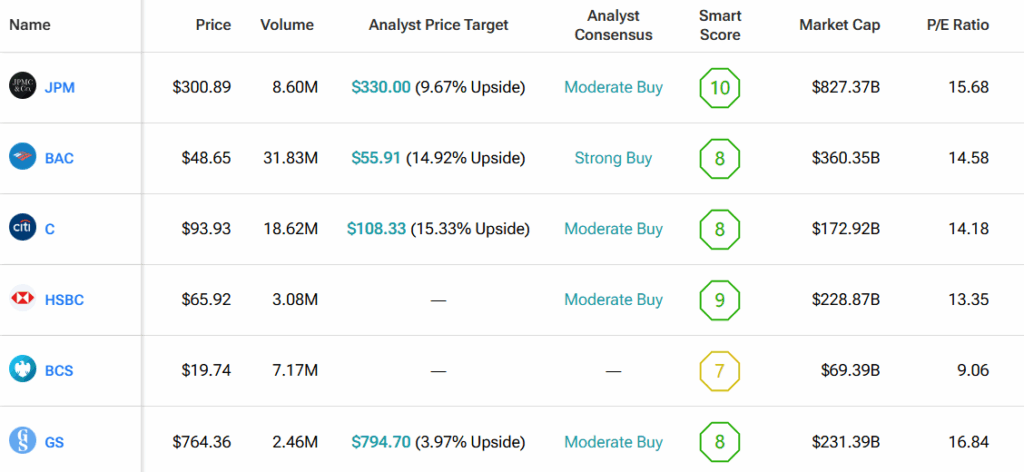

Using TipRanks’ Comparison Tool, we’ve compared some of the American and English banks that could be positively affected by the change in regulations. This tool is great for gaining a comprehensive examination of each stock and the banking industry as a whole.

Source link