BigBear.ai (NYSE:BBAI) stock has had a year defined by wild swings. The AI software firm kicked off 2025 on a tear, more than doubling in value between early January and mid-February. But the rally proved short-lived, as macroeconomic worries rattled markets and sent BBAI tumbling sharply from its highs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

After that steep sell-off, momentum began to rebuild. Over the past several months, BBAI has regained much of its earlier gains, supported by a series of announcements that reignited investor enthusiasm.

These include a project deploying AI-driven cargo screening for ships passing through the Panama Canal, new facial recognition systems at Nashville International Airport, and a partnership with Tsecond to enhance BigBear.ai’s edge-computing capabilities.

Investors are also betting that these wins position the company to benefit from the recently passed One Big Beautiful Bill, which allocates $156 billion toward defense and security initiatives. Optimism has grown partly because CEO Kevin McAleenan previously led the U.S. Department of Homeland Security under the first Trump administration.

Still, not everyone is ready to dive in. Top investor Robert Izquierdo is keeping a cautious stance ahead of BigBear.ai’s upcoming Q3 earnings report on November 10.

“Although BigBear.ai shows promise as an AI investment, the ideal approach is to wait for its Q3 results for signs of revenue recovery before deciding to buy,” says Izquierdo, who ranks among the top 2% of stock pros tracked by TipRanks.

Izquierdo points out that government spending cuts earlier in the year dealt a blow to BigBear.ai’s performance, with Q2 revenues down 18% year-over-year and full-year guidance revised lower. While the investor acknowledges that the company’s new partnerships have helped restore market confidence, he also warns that the rebound has made the stock’s valuation look stretched.

In short, there’s reason for optimism but also for restraint. Izquierdo wants to see signs that the revenue recovery is real before turning bullish again. (To watch Robert Izquierdo’s track record, click here)

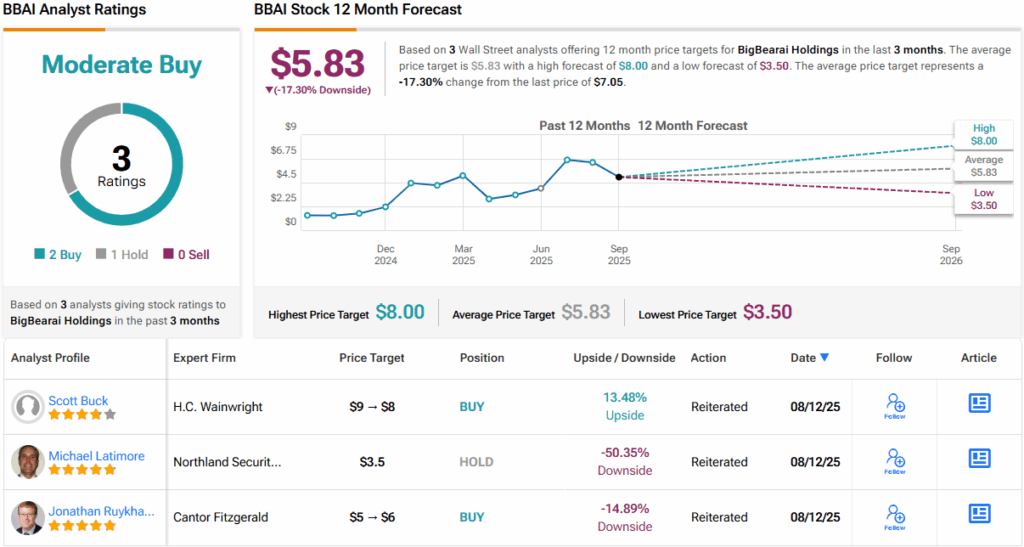

Shifting to Wall Street, analysts haven’t exactly been lining up to cover BigBear.ai. Only 3 have issued ratings in the past 3 months; 2 Buys and 1 Hold – yielding a Moderate Buy consensus. Their average 12-month price target of $5.83, however, points to a potential downside of 17%. (See BBAI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link