By Trevor Hunnicutt and Andrea Shalal

WASHINGTON (Reuters) -U.S. Federal Reserve Chair Jerome Powell is a “numbskull” who has kept interest rates too high, but he will be out in eight months, President Donald Trump said at a news conference on Tuesday.

“I think he’s done a bad job, but he’s going to be out pretty soon anyway. In eight months, he’ll be out,” he said from a meeting at the White House with Philippine President Ferdinand Marcos Jr.

Powell’s term as Fed chair runs through May 15, and he has repeatedly said he will not leave the post early. Eight months would mean Powell would remain in place until mid-March; it was not immediately clear why Trump picked that time frame.

Trump has been hammering at Powell for months for not cutting rates and has frequently raised the possibility of ousting him, while also saying that firing him would be “unlikely.”

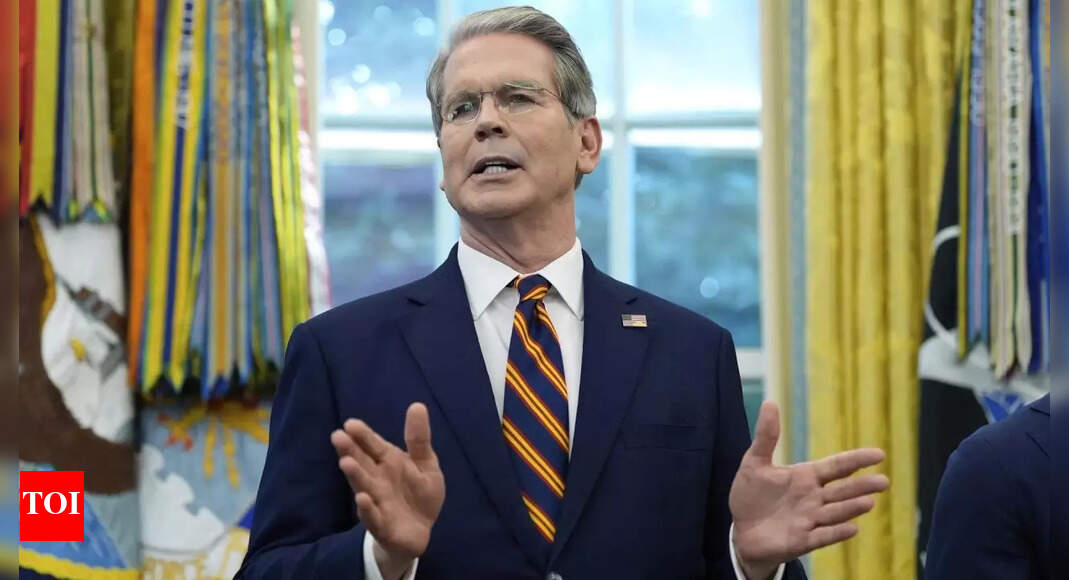

Lately, the White House has intensified Trump’s pressure campaign, launching a review of the Fed’s renovation of two buildings in Washington which they say are inappropriately lavish and may not have followed planning protocols, charges that the Fed vigorously rejects. Treasury Secretary Scott Bessent on Tuesday repeated his call for a “big internal investigation” of the Fed’s non-monetary policy operations.

Economists warn that efforts to push the Fed to loosen monetary policy could actually have the opposite effect.

They point to hyperinflation in countries from Argentina to Zimbabwe as examples of what can happen when politicians exert influence on central bank rate-setting. Some see evidence in financial markets that the Trump administration’s constant attacks on Powell are eroding confidence in the Fed’s ability to achieve its dual goals of price stability and maximum employment.

“Market participants seem to agree that the risk to Fed independence is rising,” Goldman Sachs economist Jan Hatzius wrote late on Monday, pointing to a rise in longer-term inflation expectations as captured in 5-year 5-year forward inflation swaps, which measure expected inflation over five years beginning five years out.

“A further increase could make Fed officials more reluctant to cut,” Hatzius said.

If inflation expectations rise, the thinking goes, actual inflation is likely to follow. Powell and other Fed officials believe that longer-term inflation expectations remain stable, but they say they are watching nearer-term measures closely, particularly with tariffs likely to increase upward price pressures as companies pass on more of the costs to consumers.

Source link