The Baiyun Ebo mine in China’s Inner Mongolia region is the site of almost half the world’s rare earth production. (Image courtesy of NASA.)

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation.

China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the AI boom. They prompted US President Donald Trump to announce on Friday that he would impose an additional 100% tariff on China and export controls on “any and all critical software.”

The rare earth curbs may lead to weekslong delays in shipments for ASML Holding NV, the only manufacturer in the world of machines that make the most advanced semiconductors, a person familiar with the company said.

A senior manager at a major US chip company said the firm is still assessing potential impacts. But the clearest risk the company is facing now is an increase in the prices of rare earth-dependent magnets that are critical to the chip supply chain, this person said, asking not to be identified discussing operations.

An official at another US chip company said the business is rushing to identify which of its products contain rare earths from China and is worried that the country’s requirement for licenses will grind its supply chain to a halt.

It’s not clear what software products from the US might be hit by Trump’s latest proposed export ban. In July, the administration lifted export license requirements for chip-design software sales, rules that had been imposed in May as part of a raft of measures responding to Beijing’s earlier limits on shipments of essential rare earths.

China’s new rules require overseas firms to seek approval for shipping any material containing even trace amounts of Chinese rare earths — and explicitly call out parts used to make certain computer chips and advance AI research with military applications.

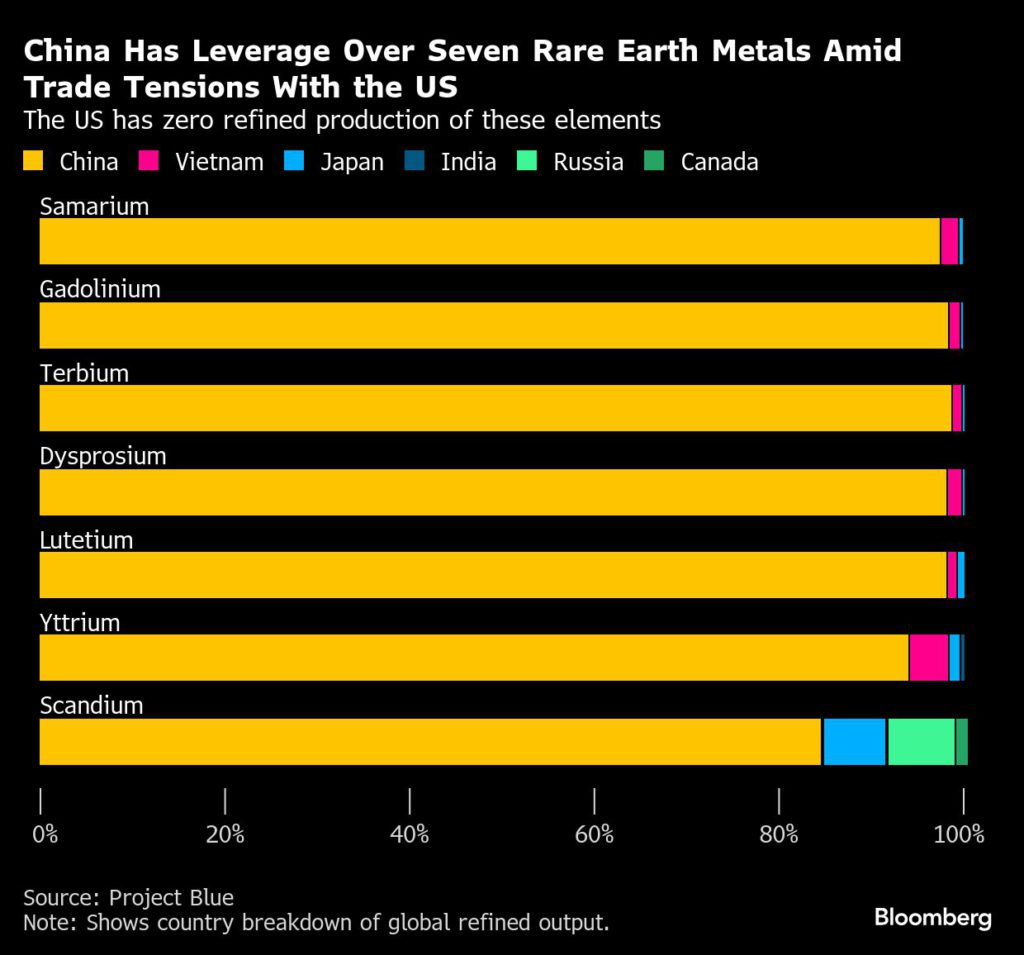

“These are the strictest export controls that China has utilized,” said Gracelin Baskaran, a critical minerals-focused director at the Center for Strategic and International Studies. “It’s quite clear that they have the sticks and the leverage to make, not just US firms, but firms worldwide comply.”

Chipmaking machines, like those sold by ASML and Applied Materials Inc., are especially dependent on rare earths because they contain extremely precise lasers, magnets and other equipment that use these elements.

ASML is preparing for disruptions, particularly due to a clause that requires foreign firms to seek China’s approval for reexports of products containing its rare earths, said the person familiar with ASML, who asked not to be identified discussing private matters and noted that ASML is lobbying Dutch and US allies for alternatives. The company declined to comment.

“Within the semiconductor value chain, China’s new export controls will likely most impact chipmakers that use rare earth-based chemicals during the chip fabrication process and toolmakers that integrate rare earth magnets into their equipment,” said Jacob Feldgoise, senior data research analyst at Georgetown University’s Center for Security and Emerging Technology.

Some have questioned how long the restrictions will last, viewing them as potential posturing ahead of a trip to Asia Trump had planned that was expected to include a meeting with Chinese President Xi Jinping later this month. It’s unclear how China would even track rare earths at such discrete levels to enforce the rules.

But China’s move has instead escalated tensions with the US. Trump’s announced tariffs would raise import taxes on many Chinese goods to 130% starting next month. That would be just below the 145% level imposed earlier this year, before both countries ratcheted down the levies in a truce to advance trade talks. On Friday, Trump also threatened to call off his meeting with Xi altogether, describing the new rare earth controls as a “hostile” action.

“I have always felt that they’ve been lying in wait, and now, as usual, I have been proven right! There is no way that China should be allowed to hold the World ‘captive,’” Trump said in a post on Truth Social.

This isn’t the first time that rare earths have landed in the center of US-China trade wars. After Trump hiked tariffs on Chinese imports earlier this year, China’s government responded by cutting off mineral exports to US companies. Officials from both sides had agreed to a truce in the spring, under which Trump lowered duties and Xi’s officials agreed to resume the flow of the minerals.

The world’s biggest chipmakers, including Intel Corp., Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co., rely on ASML to produce semiconductors. Samsung and Intel declined to comment. TSMC didn’t respond to a request for comment.

A White House official said the government and relevant agencies are assessing any impact from the new rules, which were announced without notice and imposed in an apparent effort to exert control over the entire world’s technology supply chains.

The US House Select Committee on China panned the Asian nation for the move, describing the restrictions as “an economic declaration of war against the US.” Committee Chairman John Moolenaar, a Republican, said in a statement on Thursday that China has “fired a loaded gun at the American economy.”

Germany, Europe’s biggest economy, has already introduced measures to diversify its supply of raw materials, and its economic ministry called China’s curbs a “great concern” on Friday. The government said it’s in close contact with affected companies and the European Commission to respond.

Taiwan relies mainly on Europe, the US and Japan for rare earth supplies. “We still need further assessment before deciding on the impact” on the chip industry, the nation’s economic affairs ministry said in a statement. “We will continue to monitor indirect impact from fluctuations in the pricing of raw materials and supply chain adjustments.”

(By Dasha Afanasieva, Debby Wu and Maggie Eastland)