Palantir (NASDAQ:PLTR) doesn’t appear to be suffering from the burden of great expectations – in fact, it keeps racing ahead of them. The company blasted past projections in Q2:25 and guided for its largest sequential quarterly revenue growth in Q3, representing 50% year-over-year growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, concerns about the company’s exceptionally high valuation have done little to hamper sentiment, with PLTR’s share price continuing to rise. All told, the stock is up 165% year-to-date and has gained more than 380% over the past twelve months.

With Q3 results due Monday after the bell, investors are watching closely to see whether the company can once again outpace consensus forecasts.

Still, according to one investor, known by the pseudonym Tunga Capital, that framing misses the point.

“The real question is this: how many years of returns am I willing to give up for the promise of compounding beyond that point?” the investor says.

Tunga calculates that Palantir’s current valuation means that investors must wait at least four years before they will enjoy compounding returns. Making this task even harder is Palantir’s ever-increasing base, as it becomes more difficult to achieve significant growth rates as the company expands its revenues.

It is not as if Tunga is doubting Palantir’s exceptional business model, replete with its “transformative tech,” “sticky moat,” and “margin expansion.” None of these positives is up for debate, nor is Palantir’s ability to continue bringing in the revenues.

“The bull case doesn’t just need to be right. It needs to be so right that it can deliver growth even beyond these extreme expectations,” Tunga added.

And that’s the real crux of the matter, argues Tunga. The investor further details that for PLTR to continue on its upward trajectory, the company will need to demonstrate that 50+% revenue growth is the new baseline. Even strong 30% to 40% growth rates going forward won’t be sufficient, predicts Tunga, and could trigger painful losses.

“Just based on how difficult it gets to grow at higher bases, I am maintaining a Sell going into Q3 earnings,” concludes Tunga Capital. (To watch Tunga Capital’s track record, click here)

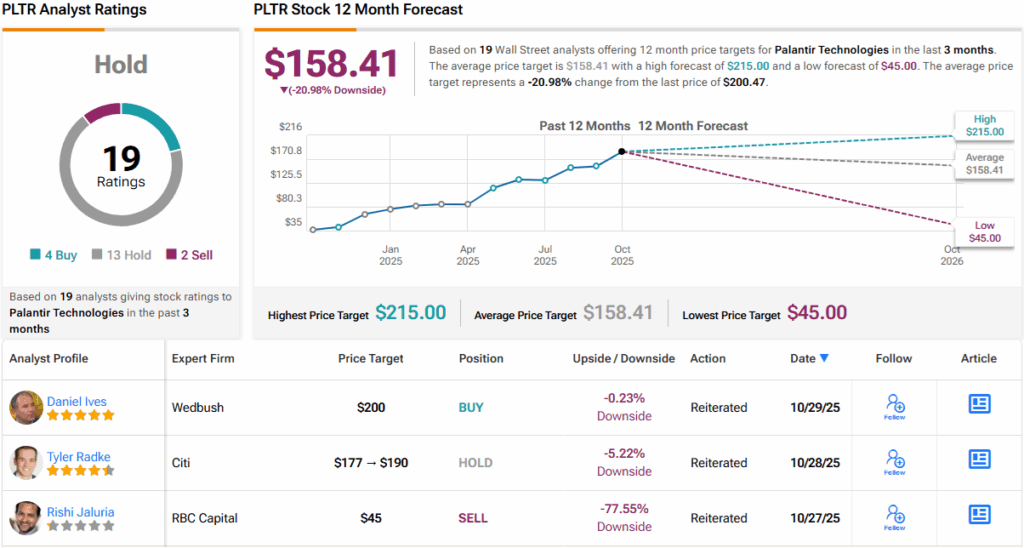

Wall Street’s broader stance isn’t exactly enthusiastic, either. The Street leans cautious, with 13 Holds and 2 Sells overshadowing 4 Buys, giving PLTR a Hold (i.e., Neutral) consensus rating. Moreover, the average 12-month price target sits at $158.41, suggesting the stock could pull back by ~21% from current levels. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link