Breakfast cereals are displayed for sale in Medford, Massachusetts, U.S., April 22, 2025.

Brian Snyder | Reuters

Core inflation was little changed in August, according to the Federal Reserve’s primary forecasting tool, likely keeping the central bank on pace for interest rate reductions ahead.

The personal consumption expenditures price index posted a 0.3% gain for the month, putting the annual headline inflation rate at 2.7%, the Commerce Department reported Friday.

Excluding food and energy, the more closely followed core PCE price level was 2.9% on an annual basis after rising 0.2% for the month.

The headline annual inflation rate was a slight increase from the 2.6% in July while the core rate was the same.

All of the numbers were in line with the Dow Jones consensus forecast.

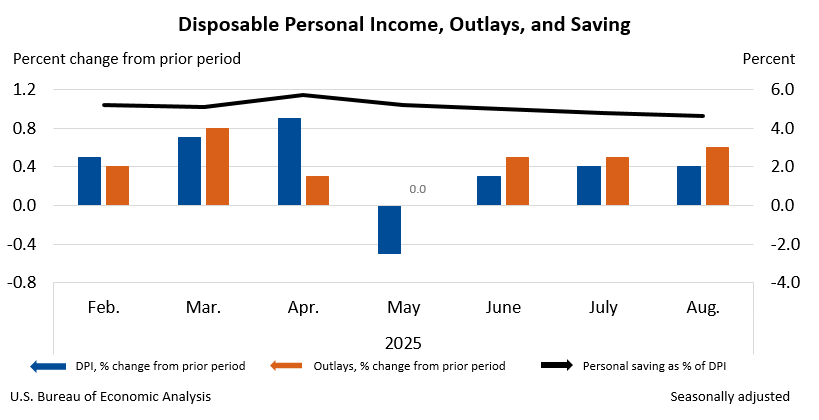

Spending and income numbers were slightly higher than expected.

Personal income increased 0.4% for the month, while personal consumption expenditures accelerated at a 0.6% pace. Both were 0.1 percentage point above the respective estimates.

Though the Fed targets inflation at 2%, the readings are unlikely to change course for policymakers who last week indicated they see two more quarter percentage point reductions before the end of the year.

The report further indicates that President Donald Trump’s tariffs have had only a limited pass-through effect on consumer prices. Though many economists expected Trump’s expansive levies to juice prices, companies have relied on a mixture of pre-tariff inventory accumulations and cost absorbing measures to limit the impact.

Moreover, the data showed that consumers have been resilient despite the round of tariffs, continuing to spend strongly as incomes have held up.

Fed officials including Chair Jerome Powell say a likely scenario for the tariffs is that they are a one-time boost to prices rather than a longer-term cause of underlying inflation. However, some policymakers have continued to express reservations and see limited room for further rate cuts.

Markets are strongly betting on a rate cut in October, though there’s less enthusiasm for another move in December. The Federal Open Market Committee last week approved a quarter percentage point reduction in the fed funds rate, the first easing of the year that took the benchmark down to a target range of 4%-4.25%.

This is breaking news. Please refresh for updates.

Source link