Nvidia, the world’s leading chipmaker, announced plans to invest $5bn in Intel and collaborate with the struggling semiconductor company on products.

One month after the Trump administration confirmed it had taken a 10% stake in Intel – the latest extraordinary intervention by the White House in corporate America – Nvidia said it would team up with the firm to work on custom datacenters that form the backbone of artificial intelligence (AI) infrastructure, as well as personal computer products.

Intel shares jumped nearly 23% after markets closed, making it the largest one-day percentage gain for the company since 1987. Nvidia rose more than 3%, bolstering its $4tn market value.

Nvidia said it would spend $5bn to buy Intel common stock at $23.28 a share. The investment is subject to regulatory approvals.

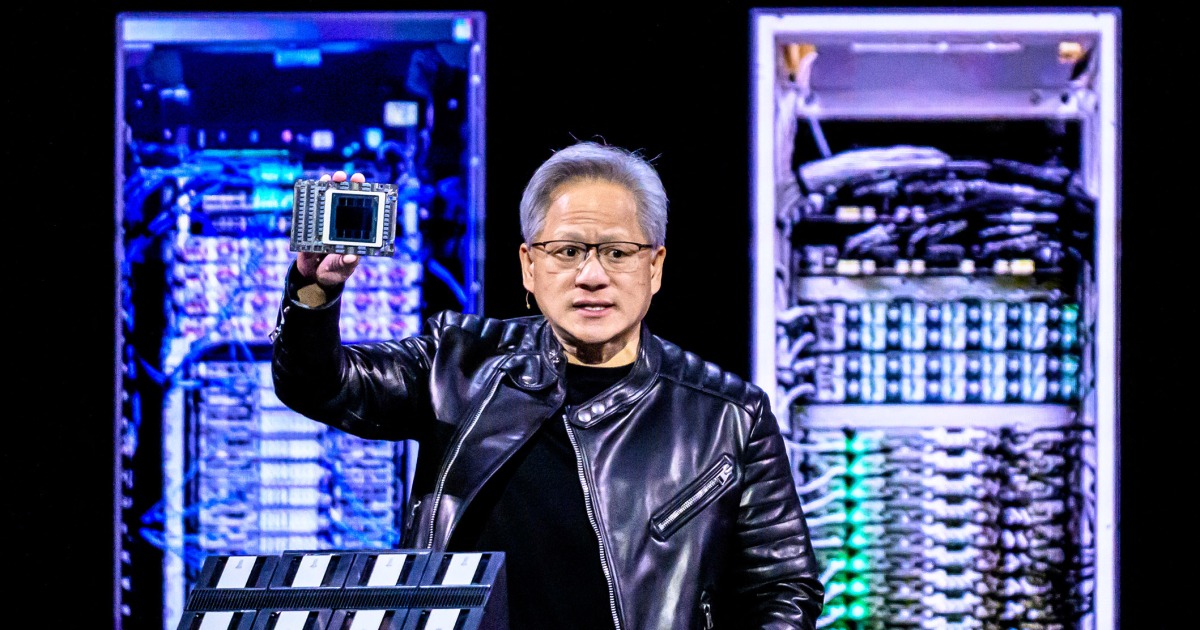

“This historic collaboration tightly couples Nvidia’s AI and accelerated computing stack with Intel’s CPUs and the vast x86 ecosystem – a fusion of two world-class platforms,” Nvidia CEO Jensen Huang said. “Together, we will expand our ecosystems and lay the foundation for the next era of computing.”

The two companies said they would work on “seamlessly connecting” their architectures.

For datacenters, Intel will make custom chips that Nvidia will use in its AI infrastructure platforms. while for PCs products, Intel will build chips that integrate Nvidia technology.

The agreement provides a lifeline for Intel, which was a Silicon Valley pioneer that enjoyed decades of growth as its processors powered the personal computer boom, but fell into a slump after missing the shift to the mobile computing era unleashed by the iPhone’s 2007 debut.

Intel fell even farther behind in recent years amid the AI boom that has propelled Nvidia into the world’s most valuable company. Intel lost nearly $19bn last year and another $3.7bn in the first six months of this year, and expects to slash its workforce by a quarter by the end of 2025.

Nvidia, meanwhile, has soared because its specialized chips are underpinning the artificial intelligence boom. The chips, known as graphics processing units, or GPUs, are highly effective at developing powerful AI systems.

Nvidia is the second firm investing billions of dollars into the flailing chipmaker. In August, Japan’s major tech investment firm Softbank announced it was investing $2bn in Intel in exchange for a 2% stake in the company’s business. Softbank’s investment came after initial reports the US government planned to take a stake in Intel first surfaced. The Intel investment would give the Japanese firm an expanded presence in the US.

Donald Trump has worked to shore up the US semiconductor industry, previously threatening to impose 100% tariffs on any imported chips. Trump has also negotiated export deals with Nvidia and its competitor AMD that allowed the companies to sell certain AI chips with lower processing power to China – in exchange for a 15% cut of any sales of those chips.

Experts say Nvidia’s latest investment in Intel is just validation of the leading chipmaker’s position – and it may provide the needed boost to finally get Intel in the AI race.

Dan Ives, tech analyst at Wedbush, said: “With AI infrastructure investments continuing to grow with the company expecting between $3tn to $4tn in total AI infrastructure spend by the end of the decade, the chip landscape remains [Nvidia’s] world, with everybody else paying rent, as more sovereigns and enterprises wait in line for the most advanced chips in the world.”

Associated Press contributed reporting

Source link