Earlier this month, Microsoft (MSFT) inked a $17.4 billion AI-compute deal with AI infrastructure firm Nebius (NBIS), and it appears to be one of those quiet catalysts that Wall Street may notice late. In an AI world starved for GPUs, power, and floor space, this deal buys time in the form of fast, ready capacity while Microsoft builds out its own sites. It slots neatly into Azure’s growth spurt and record capital expenditure (capex), which should give sales teams confidence they can actually deliver the compute they’re pitching.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It all boils down to less waiting on hardware, more throughput for copilots, models, and enterprise AI rollouts. So if the question is whether MSFT can grow into its now-premium multiple, locking in supply is how you stack the odds. Therefore, I remain Bullish on MSFT stock, even as it approaches its all-time highs.

What Microsoft Really Bought

On paper, the agreement secures dedicated GPU capacity from Nebius, starting with a new 300-megawatt data center in Vineland, New Jersey, so Microsoft can provision training and inference workloads without waiting for its own sites to come online. The base value is $17.4 billion over five years, and Microsoft can increase it further through add-on services.

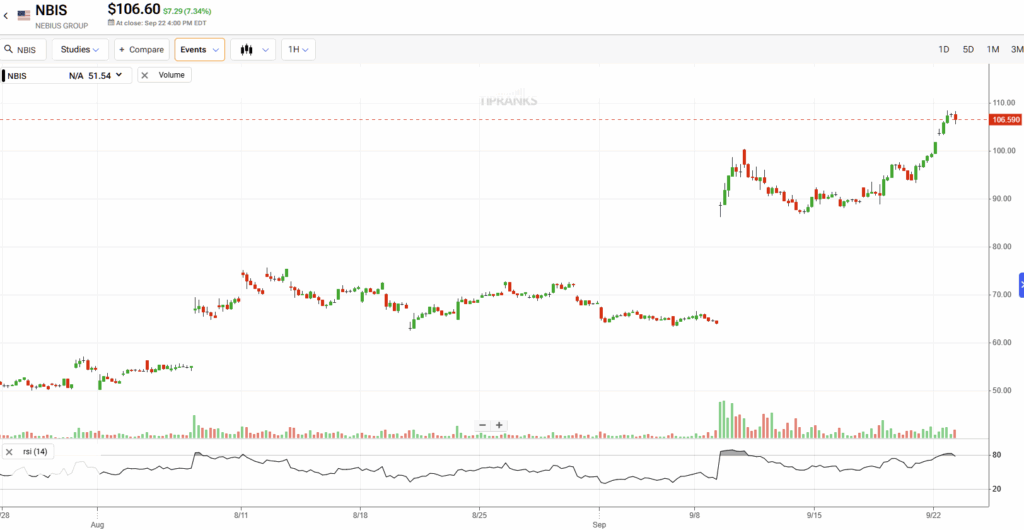

Note that Nebius itself is a Yandex spinoff based in Amsterdam that has built a specialty cloud around NVIDIA-based AI clusters. Accordingly, its own stock spiked on the news as investors digested the scale and the validation of a hyperscale customer. At the close of trade yesterday, the stock was just below its all-time high of ~$107 per share.

For Microsoft, the clever part is here because it’s likely buying months or even years of serviceable capacity, exactly when demand is at its highest and when chip and power constraints can delay internal builds. And this isn’t happening in a vacuum. After all, Microsoft has long owned a balanced infrastructure with outside partners in AI compute (CoreWeave among them), and the industry is striking multi-billion, multi-year capacity contracts to keep models fed.

Why the NBIS Deal Supercharges Azure

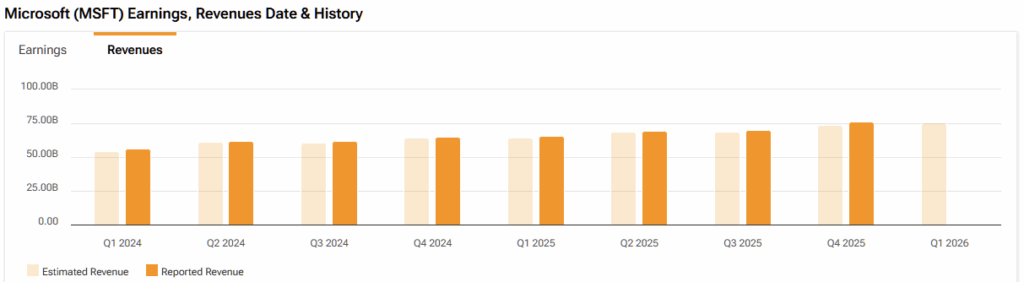

Azure’s momentum is already clear, with 39% growth last quarter, and management pointing to record near-term capital spending to sustain it. By securing Nebius’ capacity, Microsoft gains a buffer against supply chain bottlenecks and enables its sales teams to pursue larger deals without the usual GPU availability hurdles.

The geographic angle matters, as well, since New Jersey adds East Coast latency advantages for enterprise inference. At the same time, Microsoft continues to seed other regions with CAPEX (a $30 billion U.K. plan and an expanded Wisconsin AI campus). The mix of on-prem build and third-party leases should hence spread grid risk, speed delivery, and help Microsoft match capacity to where demand is landing.

There’s also a competitive context, as its customers, which include anyone from OpenAI to Fortune 500s, are diversifying clouds to secure more compute. Locking in Nebius capacity basically keeps Azure in the pole position when those multi-cloud workloads are awarded, even as rivals chase similar supply. So the simple takeaway is that more GPUs under Azure’s umbrella translates into more AI consumption revenue and stickier enterprise commitments.

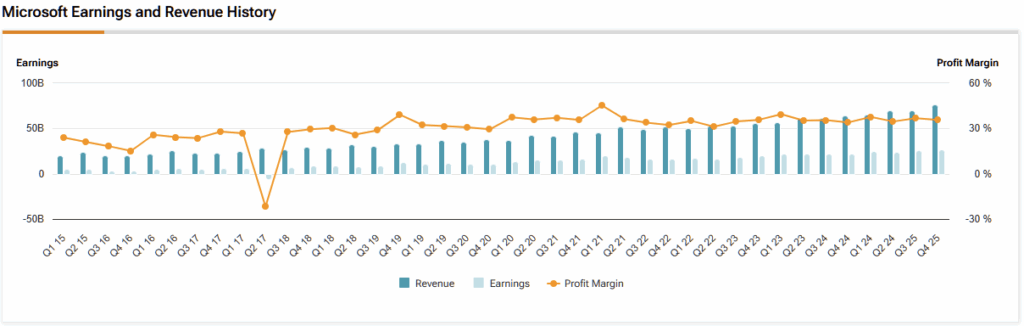

MSFT Earnings Playing Catch-Up to its Expanding Multiple

Here’s where valuation anxiety collides with hard numbers. Consensus EPS (fiscal years ending in June) outlines a glide path from $15.52 in FY26 to $30.55 by FY31, with interim marks at $18.20 (FY27), $21.68 (FY28), $25.00 (FY29), and $27.17 (FY30). Based on these estimates, Microsoft’s forward P/E compresses from roughly 33.4x in FY26 to 16.9x in FY31 as earnings scale. The growth cadence—running in the high teens through FY28—signals Wall Street’s expectation that AI monetization will remain a durable driver of EPS.

Does the Nebius deal help Microsoft “grow into” that curve? It should. Capacity is the gating factor for AI services, and Nebius effectively advances supply into the window when Azure demand is strongest and when Microsoft expects elevated capex. That can smooth gross-margin optics (capacity available when revenue arrives) and keep Azure’s high-margin services like Model-as-a-Service and copilots expanding.

In other words, the stock’s premium multiple assumes that Microsoft will continue to translate AI buzz into booked and delivered compute. By removing compute bottlenecks, without waiting for every new Microsoft-built campus to power on, the Nebius contract tilts the odds in favor of those EPS estimates potentially being conservative. In any case, at ~33x this fiscal year’s expected earnings, I don’t believe MSFT stock is overvalued considering its incredibly critical role in the AI race.

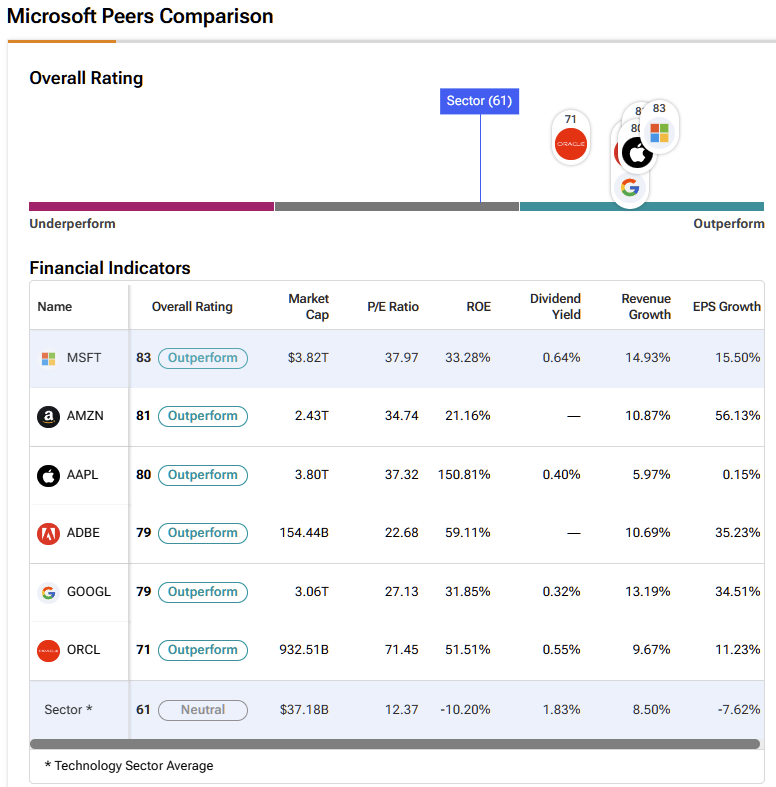

Placing MSFT in the Tech Peloton

Microsoft today trades at a trailing P/E of roughly 37x and a forward P/E in the low 30s. Meanwhile, possibly its biggest rival, Apple (AAPL), trades at around 39x its forward earnings, with forward projections of 35x for this year. Alphabet (GOOGL) is lower, with current and forward P/E in the mid‐20s. Oracle (ORCL) is much higher with a P/E ratio of 76x and a forward P/E at 67x.

So Microsoft is priced near sector norms but trades at a premium relative to some peers (like Alphabet) and a discount to others (like Oracle). Its valuation reflects expectations of strong growth—particularly from AI, Azure, cloud infrastructure, and recurring enterprise revenues.

Is MSFT a Buy, Sell, or Hold?

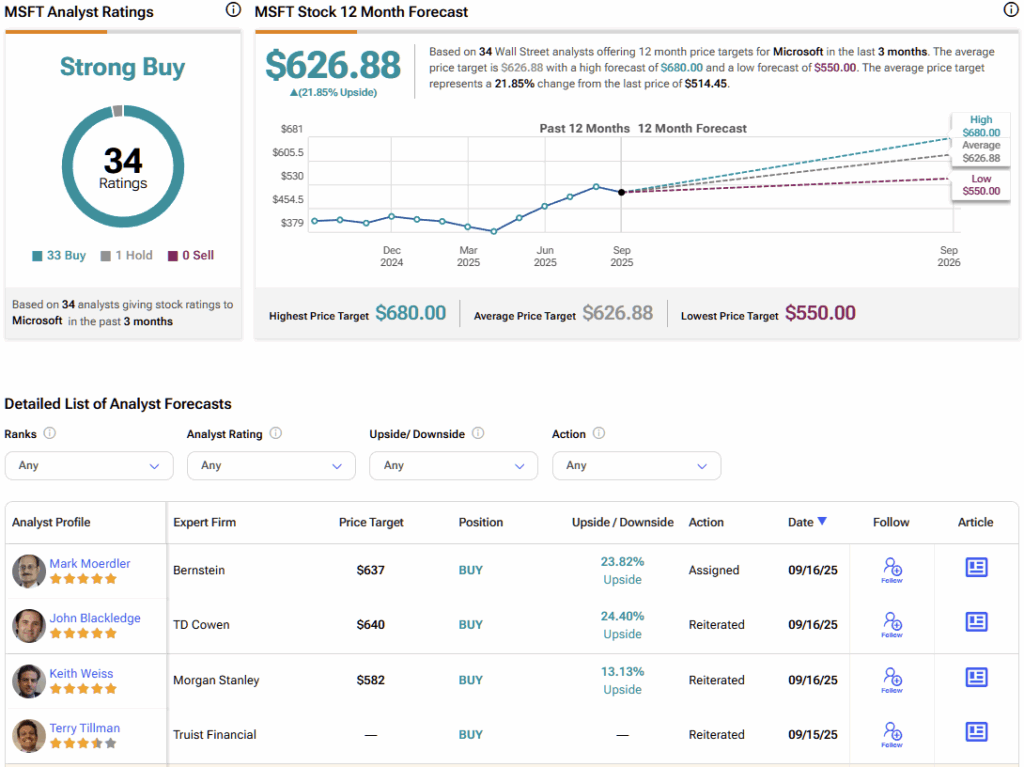

Turning to Wall Street, MSFT has earned a Strong Buy consensus rating based on 33 Buys and just one Hold assigned in the last three months. Additionally, the average MSFT stock forecast of $626.88 implies a ~22% upside potential over the coming year.

NBIS Deal Buys Time, Scale, and Flexibility

If AI demand is truly peaking, this NBIS deal fades into the background. But if we’re still in the early innings of AI-driven software and infrastructure, Microsoft just bought itself critical time and flexibility. The $17.4 billion Nebius agreement locks in GPU supply where Azure needs it most, reinforces the company’s record data center expansion, and keeps sales cycles running smoothly. For MSFT holders, it represents a quiet yet meaningful catalyst—one that supports today’s valuation while helping Azure extend its lead.

Source link