Meta Platforms (META) is taking its next big step in technology by moving into humanoid robots. The company is not looking to lead on hardware design. Instead, Meta aims to build a software platform that other manufacturers can use, much like Google’s Android model for smartphones. Chief Technology Officer Andrew Bosworth described the effort as an investment on the scale of augmented reality, with billions set aside for the work.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

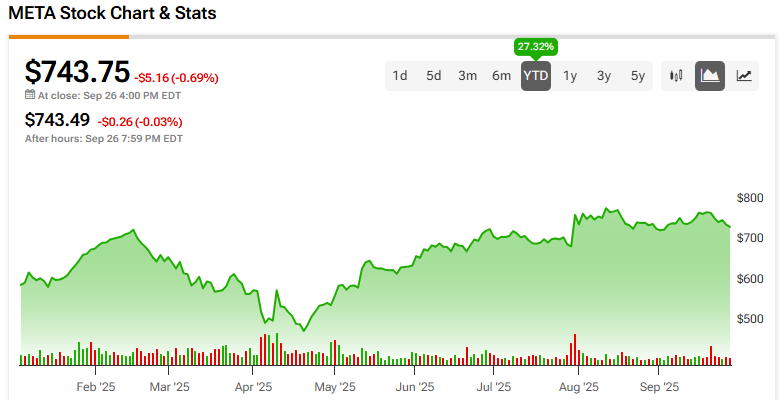

The idea is that hardware makers can focus on building their robots, while Meta provides the system that gives them intelligence. Bosworth said that the biggest challenge is not making the machines but writing the code that allows them to act in the real world. Meanwhile, META shares dropped 0.69% in Friday’s trading, closing at $743.75.

Platform Over Hardware

Meta has already started building a prototype called Metabot. However, the main plan is not to sell the robot but to license the software that powers it. The company is developing what it calls a “world model” that can simulate how objects move and interact. This allows a robot to perform tasks such as picking up a glass of water without breaking or spilling it.

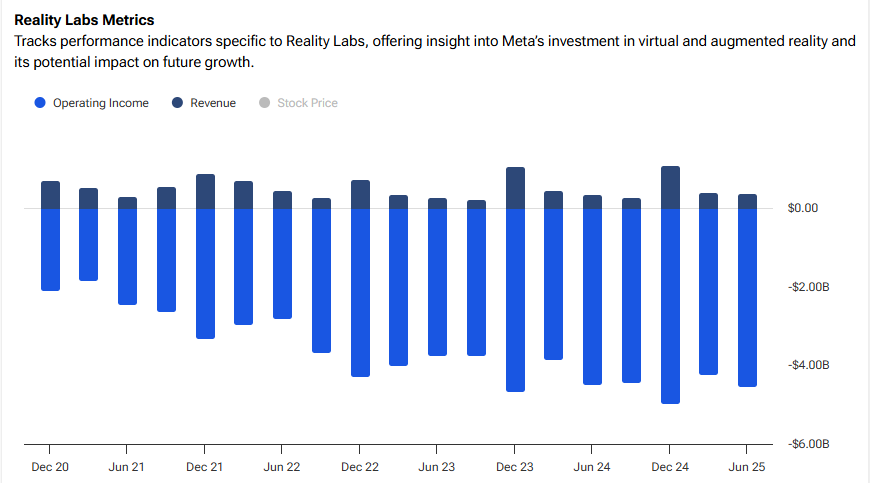

The work is being done inside Meta’s Reality Labs unit, with support from the company’s new Superintelligence Labs. Meta has also hired about 100 engineers for the robotics effort. At the same time, it is backing the project with part of its $60 billion to $65 billion in AI spending planned for 2025.

Market Setting

In the meantime, competition in robotics is heating up. Tesla (TSLA) has showcased its Optimus robot in live demos, while Apple (AAPL) is developing its own devices, with a possible launch in 2027. Another is Alphabet (GOOGL) (GOOG), which is using its DeepMind division to test new AI tools for robots. However, Meta’s strategy is to stand apart by focusing on the software layer, which could help it win partners even if other firms win the race on hardware.

Meanwhile, Meta has begun testing robots in real settings. In September, the company received a model from Circus SE in Germany for use in its Munich office. The first applications are aimed at simple home jobs such as cleaning and folding laundry.

Industry watchers note that the software approach could give Meta a path to steady returns in robotics. By avoiding the cost of manufacturing, the company may capture value if its platform becomes the standard across many different machines.

Is META Stock a Buy or Sell?

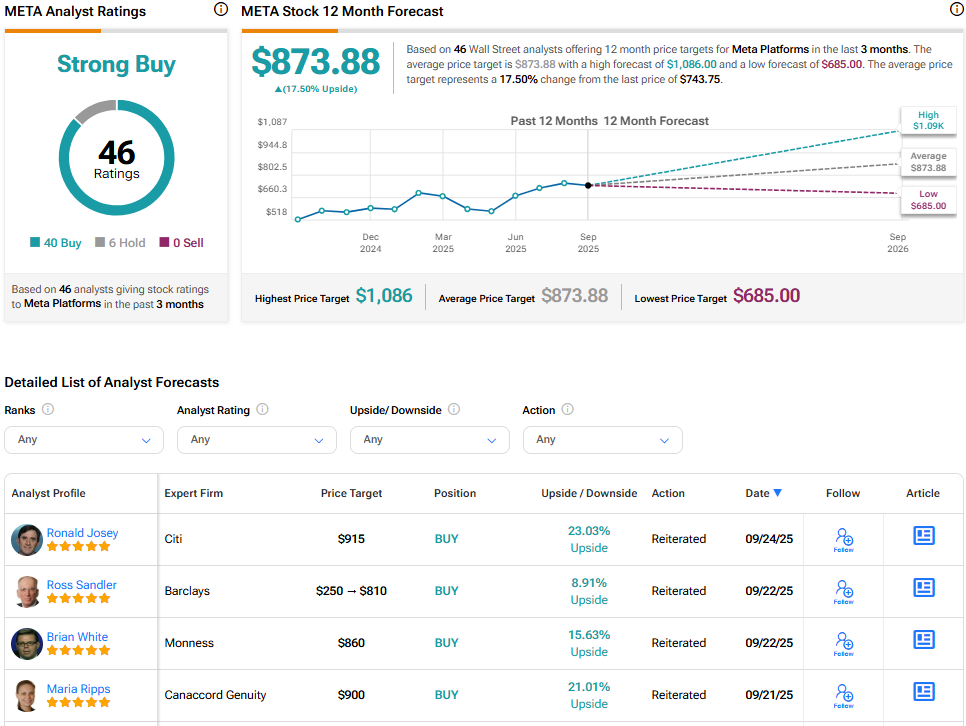

On the Street, Meta continues to boast a Strong Buy consensus rating. The average META stock price target is $873.88, implying a 17.50% upside from the current price.

Source link