The stock of Papa John’s (PZZA) is up 12% on Nov. 10 amid reports that the pizza restaurant chain has received a new take-private offer.

Meet Your ETF AI Analyst

Media reports say a group of investors, led by private-equity company TriArtisan Capital Advisors, has made a new offer to buy out Papa John’s shareholders and take the pizza maker private. Neither TriArtisan Capital nor Papa John’s has commented publicly on the media reports.

If true, the new bid to take Papa John’s private would be welcome relief to shareholders, who saw PZZA stock plunge last week after another private-equity firm, Apollo Global Management (APO), backed away from a plan to acquire the restaurant chain and take it private, delisting its shares from the Nasdaq (NDAQ) exchange on which it trades.

Offer Details

TriArtisan Capital has reportedly offered $65 a share for Papa John’s. That’s a 58% premium over the closing price of PZZA stock on Nov. 7. The all-cash offer values the U.S. pizza chain at about $2.7 billion, according to estimates.

TriArtisan already has ownership stakes in several well-known restaurant chains, including privately held P.F. Chang’s and Hooters. The company recently struck a deal to acquire restaurant chain Denny’s (DENN) for $620 million, which further grows its footprint in the restaurant sector. Analysts have been quick to say that Papa John’s would fit with TriArtisan Capital’s portfolio.

Is PZZA Stock a Buy?

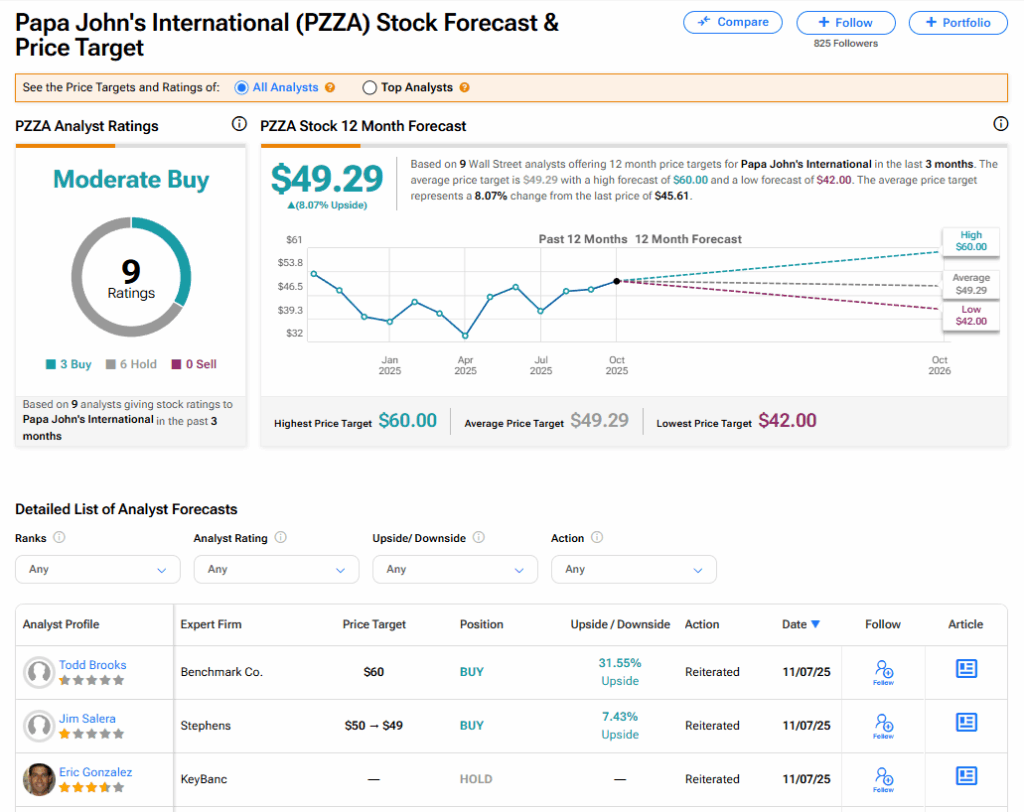

The stock of Papa John’s has a consensus Moderate Buy rating among nine Wall Street analysts. That rating is based on three Buy and six Hold recommendations issued in the last three months. The average PZZA price target of $49.29 implies 8.07% upside from current levels.

Source link