Stellantis (STLA), the parent company of Chrysler, is recalling 91,787 Jeep Grand Cherokee plug-in hybrid SUVs in the United States. The recall covers model years 2022 through 2026. The U.S. National Highway Traffic Safety Administration stated that the issue is linked to a software error in the battery pack control module. The error can cause a sudden loss of drive power, increasing the risk of a crash. Owners of affected vehicles will be notified by mail, with notices set to go out by October 23. In the meantime, drivers are advised to monitor recall updates through customer service or the NHTSA website.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, STLA shares have slightly dropped 0.71% on Friday, standing at $9.08.

Investor Impact and Stock Reaction

The recall is expected to cost Stellantis $30 million to $50 million. While that figure is not large by industry standards, it adds to nearly $951 million in recall costs since 2023. Of course, these developments had a negative effect on stock performance, with STLA shares falling over 40% in the last year.

On one hand, the stock’s 6.36% dividend yield continues to attract income investors. On the other hand, frequent recalls and quality control concerns weigh on long-term sentiment. Analysts remain split, with some pointing to value in the payout while others caution about financial pressure. As a result, the latest recall highlights both the ongoing risks tied to safety fixes and the potential for further swings in Stellantis’ share price.

Is STLA Stock a Buy?

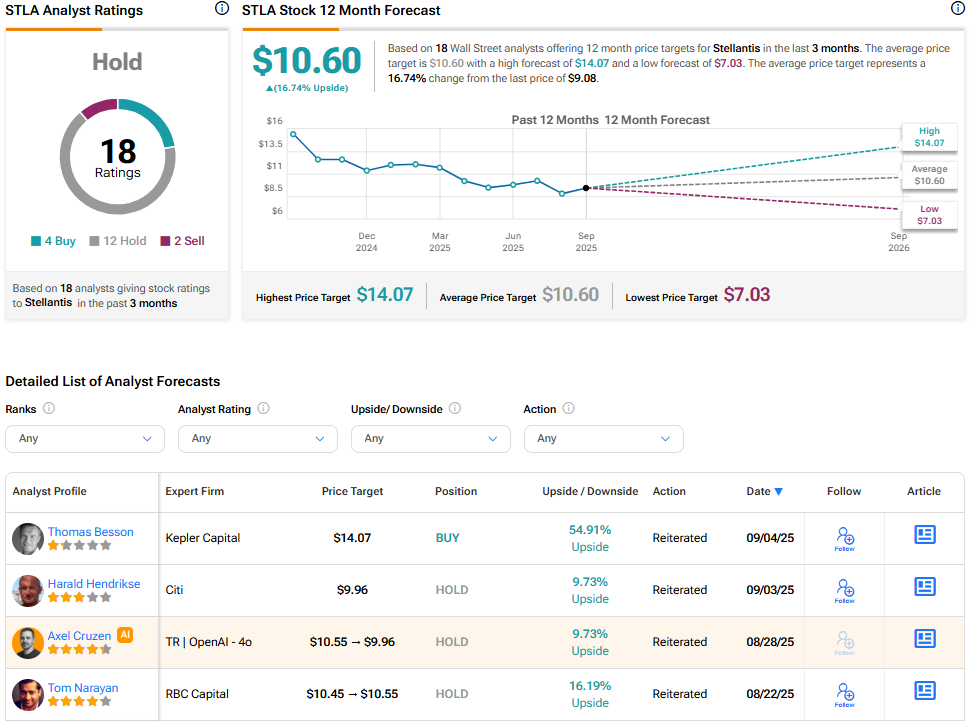

Stellantis continues to divide opinions among the Street’s analysts, with a Hold consensus rating. Out of 18 recently issued ratings, four rate the stock a Buy, 12 a Hold, and two analysts rate it a Sell. The average STLA stock price target is $10.60, suggesting a 16.74% upside from the current price.

Source link

:max_bytes(150000):strip_icc()/CopyofStockPhotoRedBadge1-2cf45a30b5834fa592715da77a3ec0dd.png)