Huawei Technologies unveiled its long-term chip plan on Thursday, marking the first time the company has shared a public timeline for its core products. The announcement highlights China’s effort to rely less on foreign suppliers such as Nvidia (NVDA) and Advanced Micro Devices (AMD).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

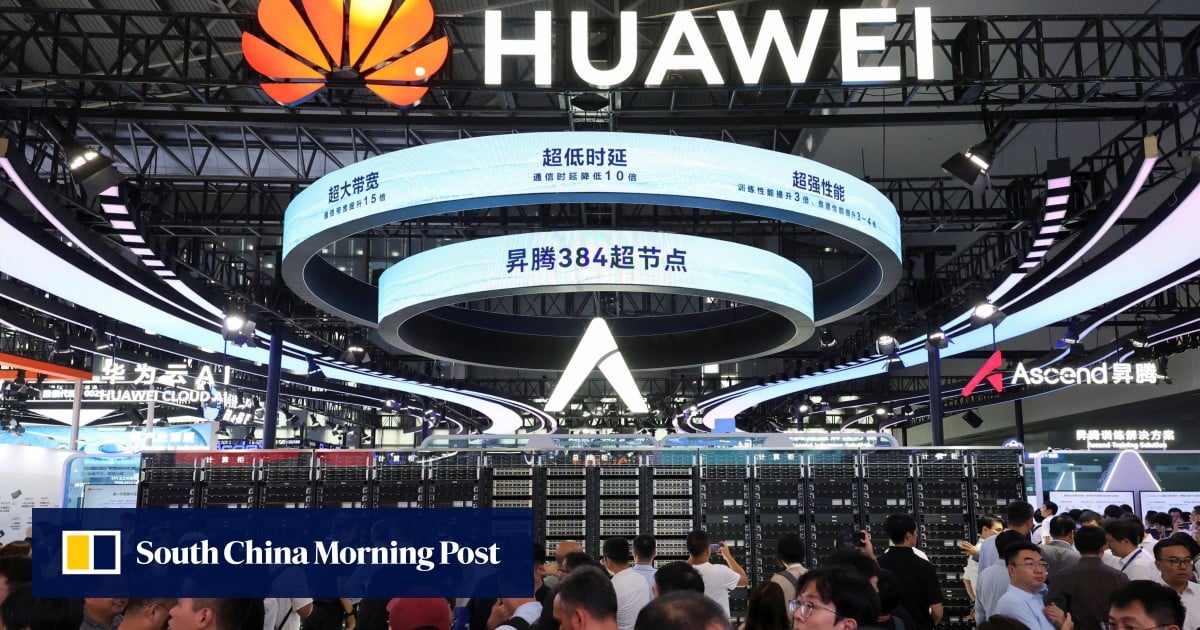

The company said it will release new versions of its Ascend AI chips every year, starting with the Ascend 950 in 2026. It also plans further updates in 2027 with the Ascend 960 and in 2028 with the Ascend 970. Huawei confirmed that each new release will double computing power compared with the prior version.

In addition, the company announced updates to its Kunpeng server chips, which will be rolled out in 2026 and 2028. Huawei also introduced its own high-bandwidth memory, a component market that is currently led by Samsung Electronics (SSNLF) and SK Hynix.

Supernodes, Rivalry With Nvidia, and Market Reaction

Huawei’s plan also features new computing clusters known as supernodes. The Atlas 950, set for launch in late 2026, will link up to 8,192 Ascend chips in a single system. The Atlas 960, due in 2027, will support 15,488 chips. These systems follow the Atlas 900, which now runs on 384 of the latest Ascend 910C chips.

Huawei stated that the Atlas 950 will deliver stronger performance than rival systems from Nvidia. The company also signaled plans for a much larger super cluster that could reach around one million chips.

The announcement came days after Chinese regulators asked local firms to stop buying certain Nvidia products. Authorities also accused Nvidia of violating the country’s anti-monopoly law. Investors reacted quickly as Chinese semiconductor stocks rose around 2% in the afternoon following reports of the restrictions.

Industry experts note that Huawei is still behind in single-chip output compared with U.S. rivals. However, its focus on scaling performance through large clusters helps offset those limits. Analysts add that the move reflects China’s broader strategy to build domestic capacity in semiconductors while reducing reliance on imports.

Is Nvidia Stock a Buy?

Since Huawei is not listed on Wall Street, we look at Nvidia, which continues to hold the Street’s endorsement with a Strong Buy consensus rating. The average NVDA price target is $211.26, implying a 24.06% upside from the current price.

Source link