Cathie Wood is in the middle of one of Wall Street’s most unexpected turnarounds. After a collapse that saw her flagship Ark Innovation Fund (ARKK) lose two-thirds of its value, the ETF has now tripled in three years, rising 87% over the past 12 months. The recovery is being fueled by artificial intelligence, with stocks like Palantir (PLTR), AMD (AMD), and Tesla (TSLA) leading the charge.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wood believes the skeptics are missing the point. “The companies investing in AI are some of the most profitable companies in the world,” she told Forbes. “I think there were a lot of people expecting at some point the performance would level out. It’s not leveling out at all.”

AI Stocks Lead the Revival

Ark’s resurgence has been anchored by its focus on innovation at the edge of technology. The fund’s AI-heavy portfolio has paid off, particularly with AMD, which has doubled in value this year, outpacing Nvidia’s (NVDA) more modest 36% gain. Wood says AMD’s smaller market capitalization and advanced chip memory design make it a better long-term bet.

Palantir has also been a standout, climbing 337% since last November as its data analytics tools gain traction with governments and corporations. Even after trimming her position by 70% over the past year, it remains one of Ark’s top holdings.

“If Palantir were not at its current valuation, given its position in the platform-as-a-service space, it would be right up there with Tesla,” Wood said.

Tesla Keeps Powering the Portfolio

Tesla continues to dominate Ark’s portfolio. The electric vehicle maker accounts for nearly 12% of ARKK’s total holdings, double the weight of the second-largest position. Ark’s analysts expect Tesla’s stock to reach $2,600 by 2029, driven by its emerging robotaxi business, which launched in Austin this summer.

“EVs are one and done, they’re low margin,” Wood said. “Robotaxis are recurring revenue, and very high margin.”

It Was a Hard-Earned Recovery

Wood’s comeback follows a brutal stretch. Between 2021 and 2022, Ark’s fund plunged 67%, dragged down by speculative tech names like Teladoc (TDOC) and Unity Software (U). But she says the backdrop has shifted in her favor. She credits Trump administration policies such as deregulation and lower corporate tax rates for restoring a more supportive environment for innovation-led companies.

“The amount of deregulation that is taking place in this administration is astonishing,” she said. “I don’t like tariffs, but I would take tariffs if you also gave me what this administration has given.”

ARKK’s three-year annualized return of 31.8% now outpaces the S&P 500’s (SPX) 24.9%, though its five-year return still lags behind the Nasdaq. For Wood, that long view is what matters.

“The Nasdaq lost 80% during the dot-com bust,” she said. “Decades later, that looks like a blip. I think the same thing will happen here.”

Is Ark Invest’s Innovation ETF (ARKK) a Good Buy?

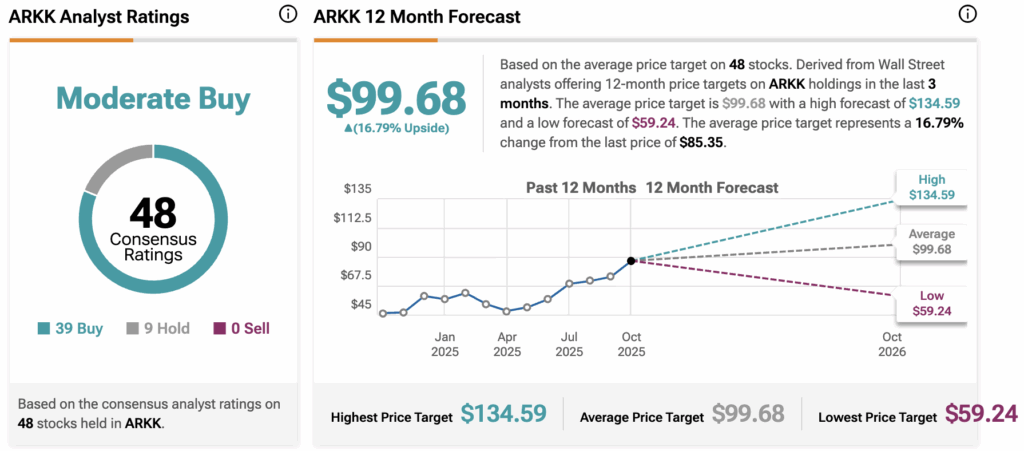

Analysts maintain a “Moderate Buy” rating on Cathie Wood’s ARK Innovation ETF (ARKK) based on 48 recent evaluations. Of these, 39 analysts rate it a Buy, while nine recommend a Hold.

The average 12-month price target for ARKK stands at $99.68, representing an expected 16.8% upside from its last close.

Source link