Tech giant Google (GOOGL) begins its antitrust trial as the U.S. government pushes to break up parts of its advertising business. Indeed, the Department of Justice and several states want Google to sell its ad exchange, AdX, where publishers currently pay a 20% fee to sell ads through instant auctions. Regulators also want Google to make the auction system open source so that it’s more transparent. Interestingly, this case has become the government’s best chance to challenge Google’s market power after a judge recently rejected a separate attempt to force the company to divest its Chrome browser.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The trial will be overseen by Judge Leonie Brinkema, who earlier ruled that Google holds illegal monopolies in web advertising technology. In addition, executives from DailyMail.com, Advance Local, and even a former News Corp (NWSA) executive are expected to testify. They claim that Google forced publishers to use its ad server by tying it to AdX, which let the company favor its own advertisers by giving them the first and last chance to bid.

Unsurprisingly, Google argues that the DOJ’s proposals are unworkable and would only create uncertainty for publishers and advertisers. Instead of selling AdX, the company offered to make policy changes to make it easier for publishers to use competing platforms. Still, regulators say that isn’t enough and have suggested that if competition doesn’t improve within four years, Google should also be forced to sell its publisher ad server.

Is Google Stock a Good Buy?

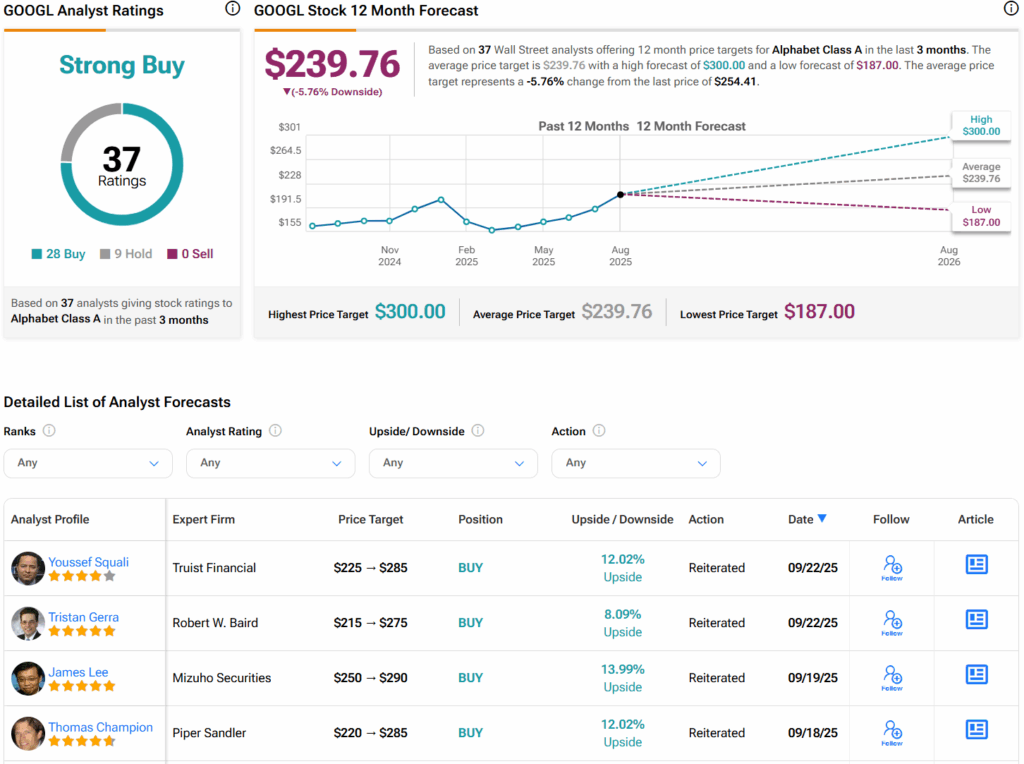

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 28 Buys and nine Holds assigned in the past three months. Furthermore, the average GOOGL price target of $239.76 per share implies 5.8% downside risk.

Source link