Much has been made of Tesla (NASDAQ:TSLA) CEO Elon Musk’s potential $1 trillion compensation package, but one market watcher doesn’t understand what all the fuss is about.

Meet Your ETF AI Analyst

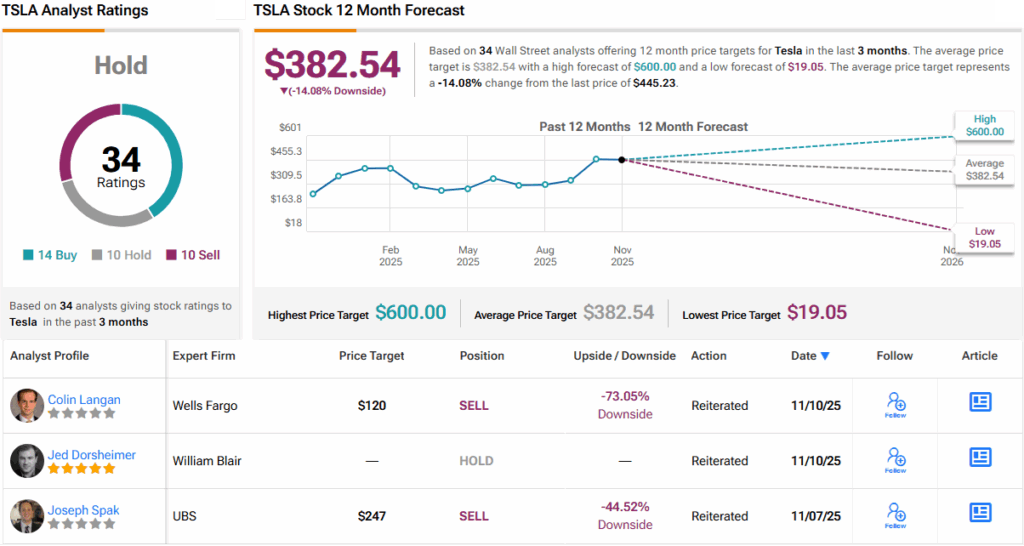

William Blair’s Jed Dorsheimer, an analyst who ranks among the top 3% on Wall Street, thinks that given 75% voted in favor, Tesla shareholders will be relieved the package has received the nod of approval – and that makes perfect sense.

“Although the headline figure of $1 trillion is garnering attention, we fail to see the issue,” the 5-star analyst said. “A founder owning 25% of a company is not beyond the pale, and we note that Board Chair Robyn Denholm stated Tesla would have pursued a ‘super-voting’ share structure to give ownership without the value, similar to other tech companies, but that option is not available since Tesla is already public.”

Other items worth noting from the shareholder meeting include the proposal to let Tesla invest in xAI. That received more votes in favor than against, though a significant number of abstentions were counted as “against” under Tesla’s bylaws. The board will consider the next steps, but Dorsheimer expects the proposal to eventually pass.

Dorsheimer also points to his white paper, Pain at the Plug, in which he explained the thesis on using batteries to boost utilization of existing “baseload generating assets,” which currently run at about 50% capacity. Musk echoed this at the meeting, noting that batteries could provide most of the new electricity on the grid by increasing output and storing energy from the present baseload. Tesla is expanding Megapack and Megablock production from 80 to 130 GWh, starting lithium refining and LFP cell manufacturing at its new sites, and reportedly has LFP supply contracts with LG and Samsung as it converts two EV lines for grid storage.

On the robotaxi and FSD, in recent podcast interviews, Musk said Tesla expects to have 1,500 robotaxis on the road by year-end, reaching in five months what took Waymo five years. At the shareholder meeting, he also confirmed that the upcoming V14.1 release will let FSD subscribers “text and drive,” while V14.3 will enable “sleep and arrive.” The next rollout cities are Las Vegas, Phoenix, Dallas, Houston, and Miami, with China planned for March, but no timeline for Europe due to stricter regulations.

“We believe the data will be difficult to deny, as Tesla showed miles between accidents of humans at 700,000 compared to almost 5 million for FSD, reducing crashing by 85% and theoretically saving 35,000 people a year,” Dorsheimer opined.

That all sounds like a positive assessment, and following the successful vote, the analyst thinks the shares “may find new wind at their back.” However, Dorsheimer is not the first to highlight a niggling issue.

“The valuation is heavily dependent on robotaxi,” he said. “We feel the risk/reward is fairly valued at these levels, and we will look for incremental data points on the rollout.”

Accordingly, Dorsheimer assigns Tesla shares a Market Perform (i.e., Neutral) rating, without offering a fixed price target. (To watch Dorsheimer’s track record, click here)

9 other analysts join Dorsheimer on the TSLA sidelines, while an additional 14 Buys and 10 Sells all add up to a Hold (i.e., Neutral) consensus rating. The forecast calls for a 12-month loss of 14%, considering the average price target stands at $382.54. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link