Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto index funds might be the next wave of adoption for digital currencies in 2025. Already, Coinbase and GrayScale have filed crypto index funds that grant exposure to top crypto assets. The news has sparked market excitement as traders rush to capitalize on its resulting bullishness.

One token now dominating news charts is DeepSnitch AI, a novel project that helps retail traders by providing real-time market analytics. DeepSnitch AI is now getting 500x projections for its strong market appeal and real-world utility.

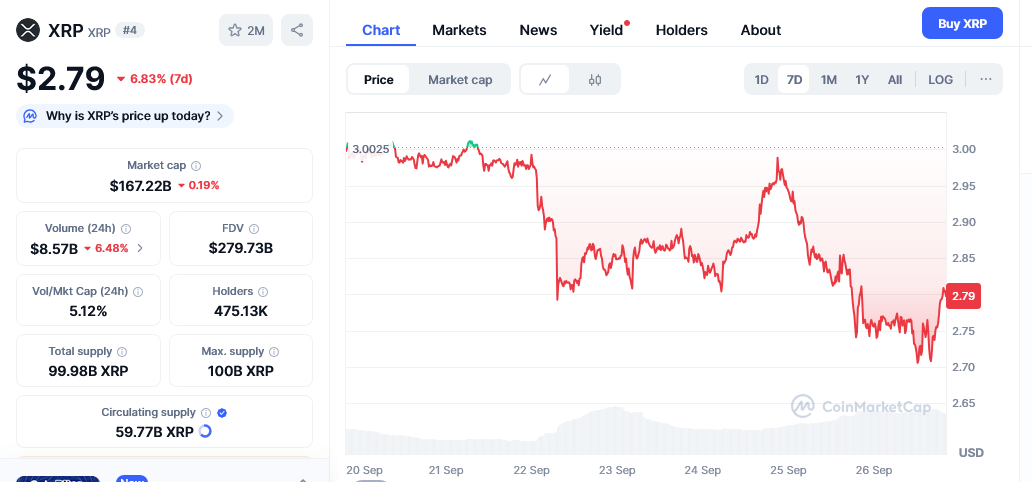

XRP tops index fund listings in September

Many companies are working hard to meet the updated listing standards for ETF regulations set by the SEC. In July, the SEC introduced a new rule change that dramatically cut the approval time for crypto ETFs from the typical 270 days to 75 days.

Since its introduction, many top altcoins like XRP have gained extra investor attention due to their being a favorite for ETF assets. Although many okens will likely get ETF launches in Q4 or early 2026, investors will likely stick to established altcoins like XRP and Stellar.

Shortly after the announcement by the SEC, GrayScale turned its Digital Large Cap fund into an ETF. That fund, now called the Grayscale CoinDesk Crypto 5 ETF, has gone live. It offers exposure to the five largest and most liquid crypto assets: Bitcoin, Ethereum, XRP, Solana, and Cardano.

Additionally, the Rex-Osprey Ripple ETF, $XRPR, had the biggest opening day trading volume in 2025. This confirms the trend of growing demand for Ripple ETF assets. Yet, despite this drop, XRP remains in the red zone following the recent market correction.

As of September 26, XRP was trading at $2.76 following a 9.03% drop over the past week. Yet, excitement around expected Ripple ETF launches in Q4 could spark a price increase.

AI demand could make DeepSnitch AI the best crypto to buy now for 100x

Institutional players pay millions for trading data. DeepSnitch is building an AI-powered ecosystem that hands retail investors similar firepower for the cost of a presale entry. That’s why stage one of its ICO is filling up fast because it offers a shot at getting in before the crypto whales arrive.

DeepSnitch will use its five AI agents to track contracts, liquidity movements, and sudden wallet shifts that often signal danger. Instead of blindly holding through a rug pull or pump-and-dump, retail traders will get alerts in time to help protect their capital. Such a layer of protection makes DeepSnitch AI a standout crypto project.

On the flip side, DeepSnitch AI also translates whale and influencer activity into actionable insights. By turning noise from Telegram, Discord, and wallets into clear dashboards, it gives everyday investors the ability to act like insiders. Aside from helping investors turn market noise into clear insights, DeepSnitch AI also offers time-saving benefits.

In addition to these factors, DeepSnitch AI is set to rise due to the ongoing expansion of the AI technology sector, which is set to grow by 25x over the next 10 years. At the presale rate of $0.01667, a $300 stake equals 17,998 DSNT tokens.

If DSNT hits $1, that stack grows to $17,998, delivering about 5,899% gains.

Can rising whale activity stop Ethereum from going below $3,500?

Ethereum’s slide has continued in the final days of September, with many now fearing prolonged bearishness. The crypto market tanked in a wave of liquidation. The resulting bearishness sent Bitcoin below $116k on the first day and lower than $110,000 on the third day.

Ethereum followed, losing most of its early September gains. As of September 22, Ethereum was trading at $3,893 following a 14.07% drop over the past week. The 30-day Ethereum price chart also shows a 15.09% drop over the past week.

Now all eyes are on Ethereum’s performance in October, as investors say it could set the tone for the rest of the year. Still, there is some hope, as traders say the recent ETH accumulation by whales could signal expected growth.

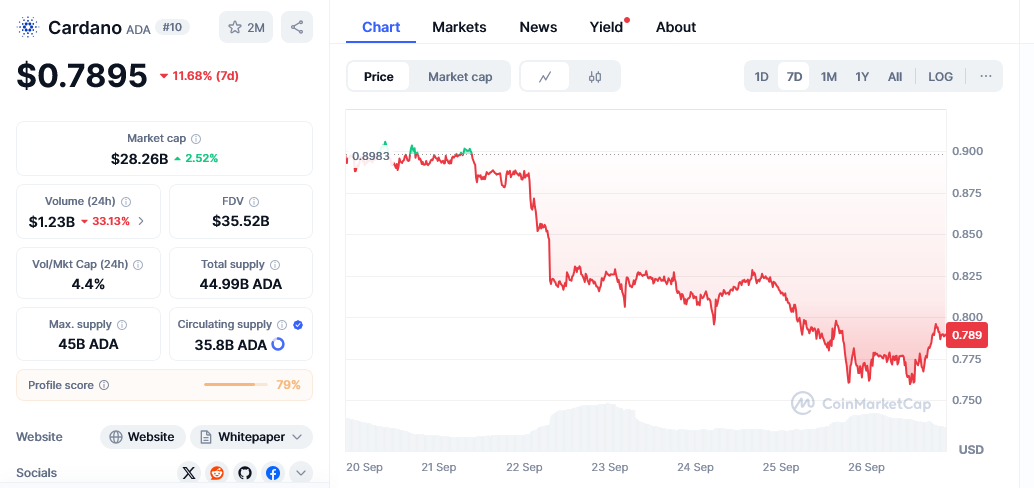

Can another interest rate cut spur a bullish Cardano turnaround?

Cardano is struggling with bearishness in late September despite being one of the top-performing altcoins in the past few weeks. As of September 26, ADA was trading at $0.7634 following an 11.22% drop over the past month.

The ongoing decline of DeFi activity will likely affect Cardano, making it harder to recover over the next few weeks. However, some traders say another interest rate cut could inject fresh capital into the market. This capital would go to established projects like Cardano, possibly spurring an ADA price surge.

Conclusion

Investors are bullish on DeepSnitch AI, saying it is a good way to capitalize on the growing demand for AI cryptocurrencies. A report by Kraken has already shown that nearly half of all investors believe that AI tokens will outshine their counterparts in 2025.

DeepSnitch AI is already outshining competitors as investors now say its growth potential could make it the best crypto to buy now. With over $240,000 raised, stage 1 is now almost out, with one token selling at only $0.01667, but not for long.

Yet, joining now is the best chance to buy a potential moonshot crypto before the next price jump, and the token price has already increased by over 10%.

To seize the opportunity to belong to DeepSnitch AI’s ecosystem, visit its official website now.

Frequently asked questions

Is XRP a good long-term investment?

XRP’s institutional demand is growing, making it a good long-term investment.

What crypto is most likely to explode?

Investors believe that AI crypto will outperform their counterparts in 2025.

What is the best cheap crypto to buy?

DeepSnitch AI’s low market cap, solid fundamentals, and investor appeal make it the best crypto to buy now.

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

Source link