CoreWeave’s (CRWV) shares rose on Thursday morning after the data center operator, which is backed by chip design colossus Nvidia (NVDA), launched an AI object storage service. The firm claims the service provides 75% lower storage costs for its existing clients’ typical AI workloads.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CoreWeave’s new offering comes with no egress charges — the cost of moving data out of cloud storage services — as well as no request and transaction charges.

Future Competitor to Amazon and Google?

The new storage offering, called the AI Object Storage, makes CoreWeave a possible future competitor to object storage providers such as Amazon Web Services (AMZN) and Google Cloud (GOOGL), both of which charge egress fees.

CoreWeave observed that the service is fully managed, meaning that it handles all activities, such as setup and maintenance, required for the storage service to function properly. In terms of pricing, CoreWeave noted that its charges are automatically determined in three tiers based on usage level.

The offering also comes with features that help to maintain the accuracy of data while being transferred between cloud service providers, the neocloud company added.

CoreWeave Strengthens Product Portfolio

Traditional object storage systems commonly tie data to a specific server, data center, or cloud provider, thereby limiting access to them. However, CoreWeave has said that its new service will remove this constraint by making a single dataset accessible across regions, on-premises, or varying cloud service providers.

The firm further pointed out that adding more resources to the storage does not slow it down as the storage “scales” to match demand.

The new offering comes as CoreWeave is building out its base to compete in the emerging AI infrastructure market. The company is one of several rising data center infrastructure companies such as Nebius (NBIS), and IREN Limited (IREN) vying to provide Big Tech with tools they need for AI cloud computing.

The launch of the object storage service comes as CoreWeave just secured a deal with Poolside, an AI startup also backed by Nvidia, to build a massive data center complex in West Texas. It has started to earn price target boosts from Wall Street analysts as a result.

Is CoreWeave a Good Buy?

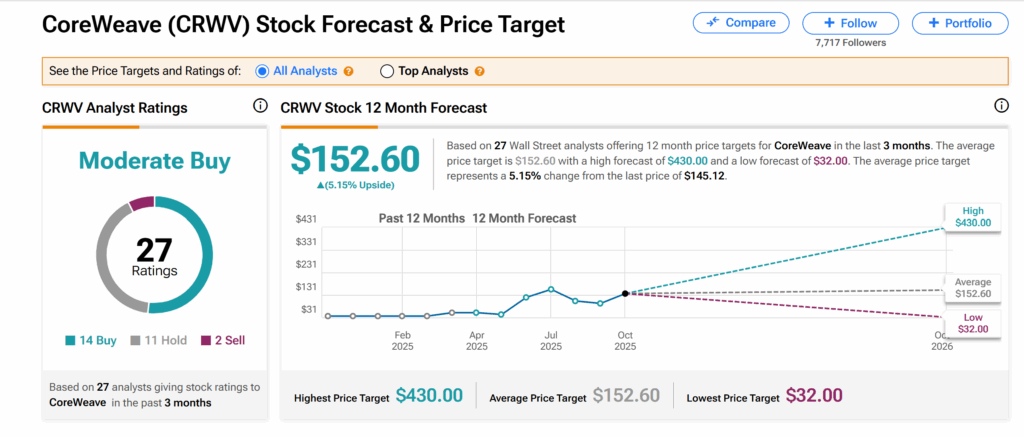

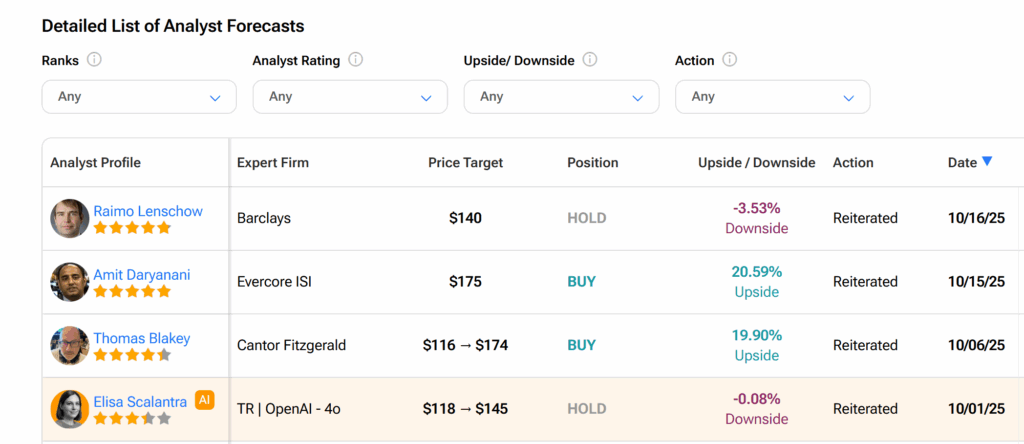

However, across Wall Street, CoreWeave’s shares currently have a Moderate Buy consensus rating. This is based on 14 Buys, 11 Holds, and two Sells assigned by 27 Wall Street analysts over the past three months.

Moreover, the average CRWV price target of $152.60 indicates a 5% growth possibility from the current level.

Source link