SM Energy (SM) and Civitas Resources (CIVI) have agreed to merge in an all-stock transaction that will create a larger U.S. oil and gas producer valued at about $12.8 billion, including debt. Under the deal, each Civitas share will be exchanged for 1.45 shares of SM Energy. Once the deal closes, Civitas shareholders will own about 52% of the combined company, while SM Energy shareholders will hold about 48%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new company will retain the SM Energy name and continue to trade under its current ticker. It will be based in Denver, Colorado. The merger has been approved by both companies’ boards and is expected to close in the first quarter of 2026, pending shareholder and regulatory approvals.

CIVI shares have fallen about 34% this year, but the stock gained nearly 3% in pre-market trading following the merger announcement. SM shares have also endured a rough 2025, with the stock losing 44% of its value. However, investors seem to view the deal as a strategic move that could help both companies cut costs and increase returns in a competitive energy market.

A Larger Footprint and Cost Savings

Together, the two companies will control around 823,000 net acres across several major U.S. oil basins. This broader footprint is meant to strengthen their scale and boost operational efficiency. The companies estimate annual cost savings of about $200 million, with the potential to reach $300 million through improved operations and lower overhead.

Moreover, the merger is expected to enhance key financial metrics, including operating cash flow, free cash flow, and net asset value per share. SM Energy will issue about 126.3 million new shares to Civitas shareholders as part of the agreement.

Leadership and Outlook

After the merger, SM Energy’s current Chief Executive Officer, Herb Vogel, will lead the combined company, while Julio Quintana will serve as non-executive chairman. The new board will include eleven members, with six from SM Energy and five from Civitas. The previously planned CEO transition to Beth McDonald will remain on track.

Once the merger is complete, the combined firm will stand as one of the larger independent oil and gas producers in the U.S., positioned to pursue growth while aiming for stronger cash flow and higher efficiency.

Is SM Stock a Buy?

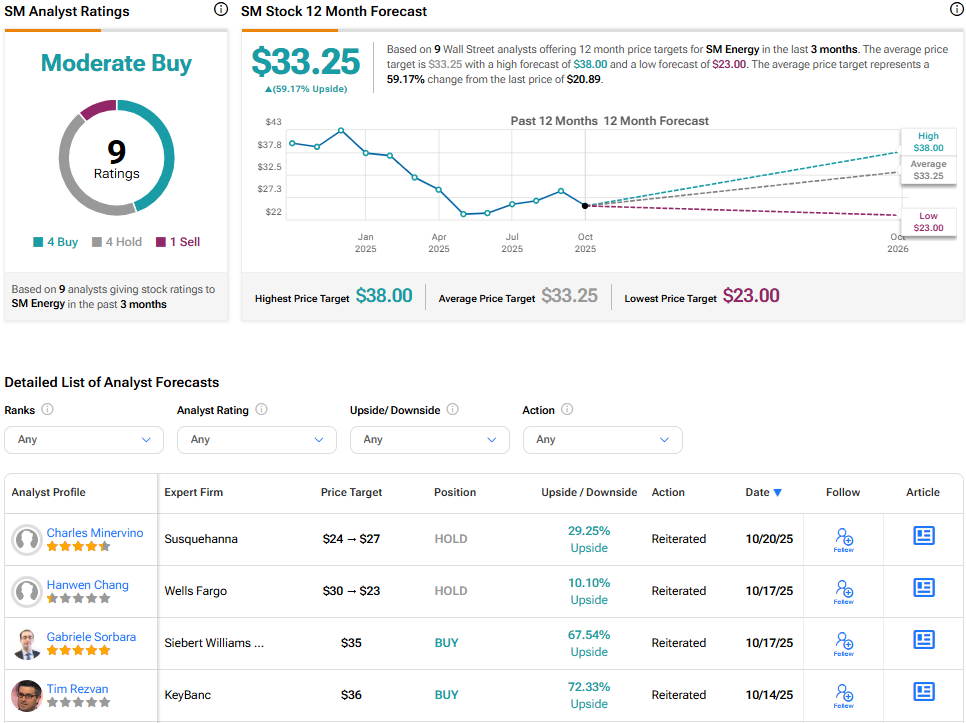

As the new entity will continue to trade under the SM ticker, let’s examine how the Street’s analysts currently view the stock. SM Energy has a Moderate Buy consensus rating, with the average SM stock price target standing at $33.25, implying a 59.17% upside from the current price.

Source link