Capcom (CCOEY) stock was down on Wednesday as investors reacted to the video game company’s latest game sales data. In its Fiscal Q2 2025 earnings report, Capcom revealed that Monster Hunter Wilds only sold about 160,000 units. This sales drop comes after a botched PC launch that drew the ire of gamers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors will note that Monster Hunter Wilds has experienced a major drop-off in sales since its launch. It was the largest Monster Hunter series launch, with some 10 million units delivered, but the game couldn’t keep that momentum going. That resulted in 477,000 unit sales in Fiscal Q1 2025, which Capcom considered soft. Now that negative momentum has continued into the next quarter, showing a lack of interest in the latest Monster Hunter title.

The performance of Monster Hunter Wilds is concerning for a couple of reasons. First, it’s on a trend that will see it underperform Monster Hunter World, despite the fact the two moved roughly the same number of units over a similar period of time. Additionally, sales of Monster Hunter Wilds dropped below Monster Hunter Rise in Q2, meaning there’s more interest in a game released four years ago than in one that came out earlier this year.

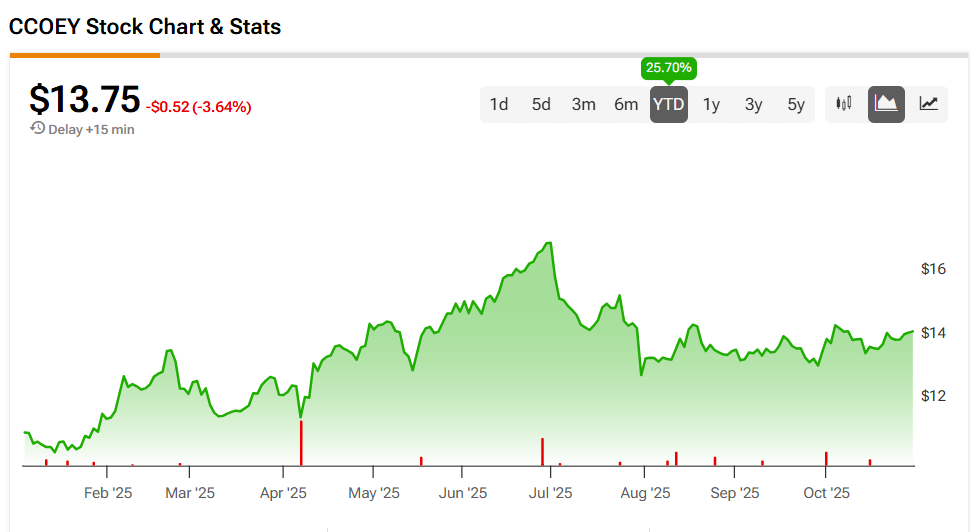

Capcom Stock Movement Today

Capcom stock was down 3.64% on Wednesday but remained up 25.7% year-to-date. CCOEY stock has also rallied 39.17% over the past 12 months. Sister stock (CCOEF) was still up 3.45%, though that’s due to the markets it trades in being closed right now. It will likely feel the effects of this news when trading resumes.

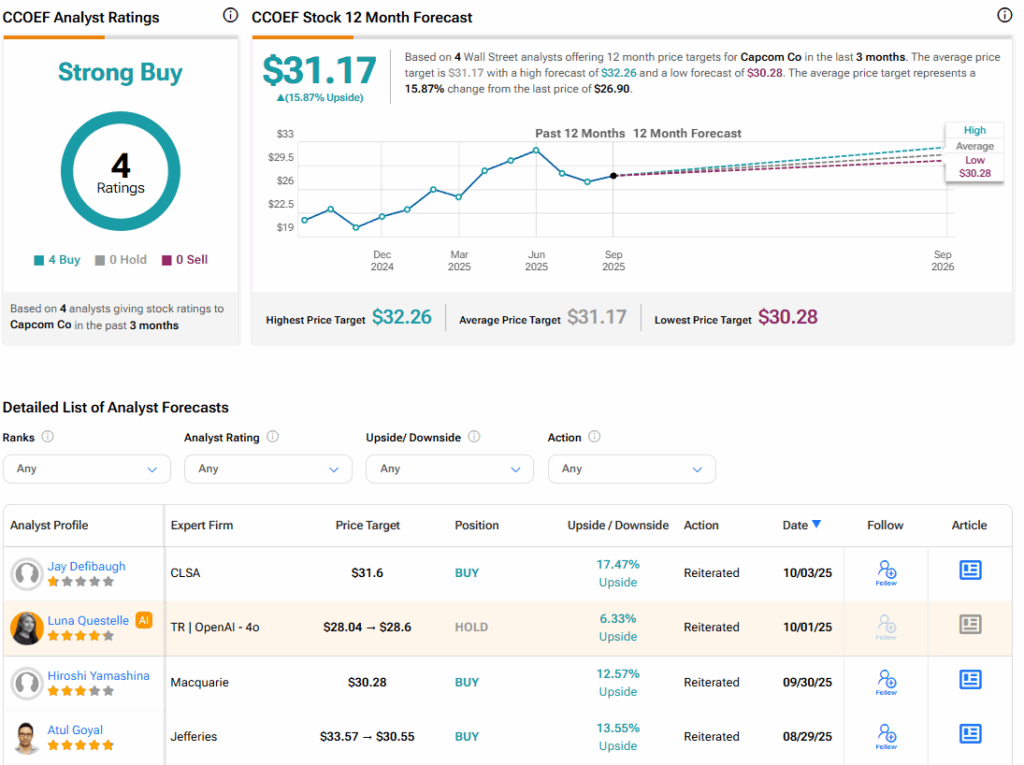

Is Capcom Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Capcom is Strong Buy, based on four Buy ratings over the past three months. With that comes an average CCOEF stock price target of $31.17, representing a potential 15.87% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.

Source link

:max_bytes(150000):strip_icc()/GettyImages-2235586492-c5b7ba6482664b99a313dc546743522e.jpg)