President Trump is probably feeling slightly slicker today as two European oil and gas giants gave the thumbs up to his ‘drill, baby, drill,’ mantra with billions of dollars worth of deals.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fossil Fueled

British oil major BP (BP) said its $5 billion Tiber-Guadalupe project in the Gulf of America/Mexico, expected to begin production in 2030, will include a floating platform set to produce 80,000 barrels of oil a day. It has an estimated 350 million barrels in recoverable resources, BP said.

French rival TotalEnergies (TTE) also said today that it would buy a 49% stake in Continental Resources (CLR) onshore gas fields in the U.S. state of Oklahoma, for an undisclosed sum. The assets will net it around 150 million standard cubic feet per day of gas by 2030.

TotalEnergies is the largest buyer of U.S. liquefied natural gas, purchasing 10 million metric tons per year, but its own output in the United States is much smaller.

Its U.S. upstream assets last year produced 93,000 barrels a day, or about 3.8% of Total’s global production, far behind its assets in Africa, Europe, the Middle East, Asia and Latin America.

Strategic Shift

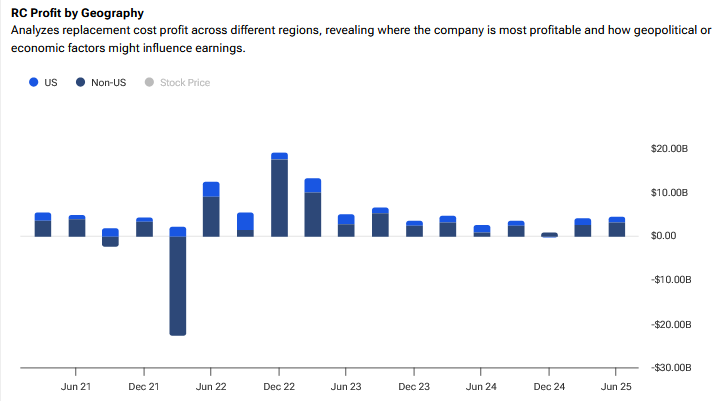

BP has vowed to increase its U.S. production to just over 1 million barrels a day by the end of the decade, or just under half of its global target of 2.3 million to 2.5 million in that timeframe. The U.S. is also a vital component of overall profits – see below:

It sees the U.S. as an ideal market to help solidify its strategic revamp back towards oil and gas and away from renewable energy.

It finds a willing partner in President Trump who has championed more investment in oil and gas since returning to office in January. That has also come at the expense of renewable energy with Trump clamping down on a number of offshore wind projects.

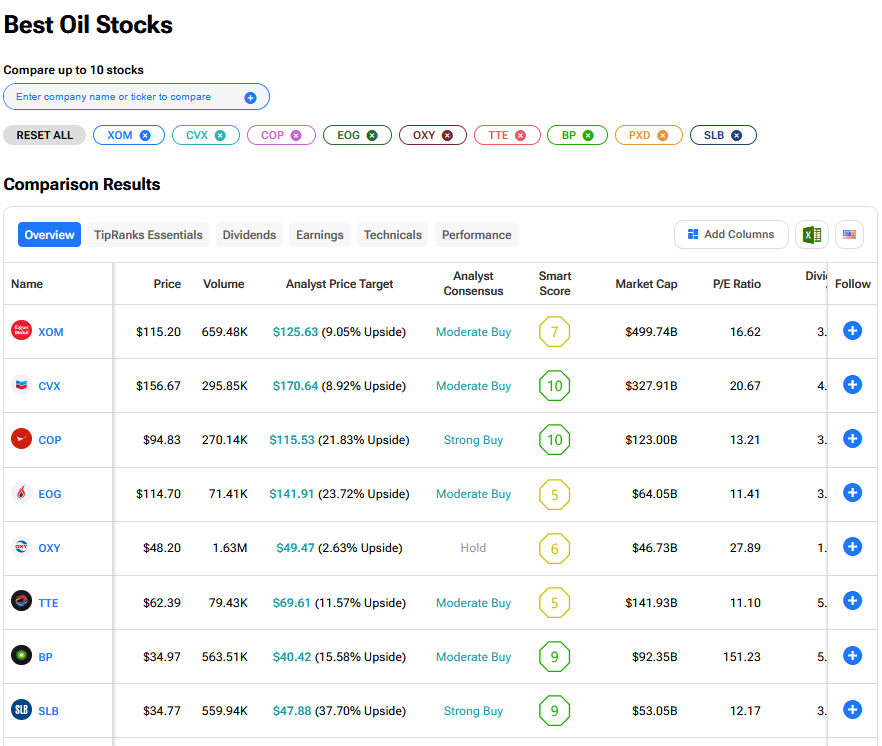

What are the Best Oil Stocks to Buy Now?

We have rounded up the best oil stocks to buy now using our TipRanks comparison tool.

Source link