08/19 update below. This post was originally published on August 18

Bitcoin—alongside other major cryptocurrencies ethereum and XRP—have fallen sharply, raising fears of a crypto market crash after it bubbled up to an all-time high of $4.2 trillion this month (just as Tesla billionaire Elon Musk breaks his silence on crypto).

Sign up now for CryptoCodex—A free newsletter for the crypto-curious

The bitcoin price has plunged from an all-time high of $124,000 per bitcoin just last week, dropping around 10% to $114,000, while ethereum and Ripple’s XRP have seen similar declines despite U.S. president Donald Trump dropping a surprise $12.2 trillion crypto bombshell.

Bitcoin and crypto’s decline, coming just as JPMorgan makes a game-changing Federal Reserve flip, follows Wall Street giants issuing a warning that the recently passed Genius Act stablecoin bill could trigger a $6.6 trillion flood of account withdrawals.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

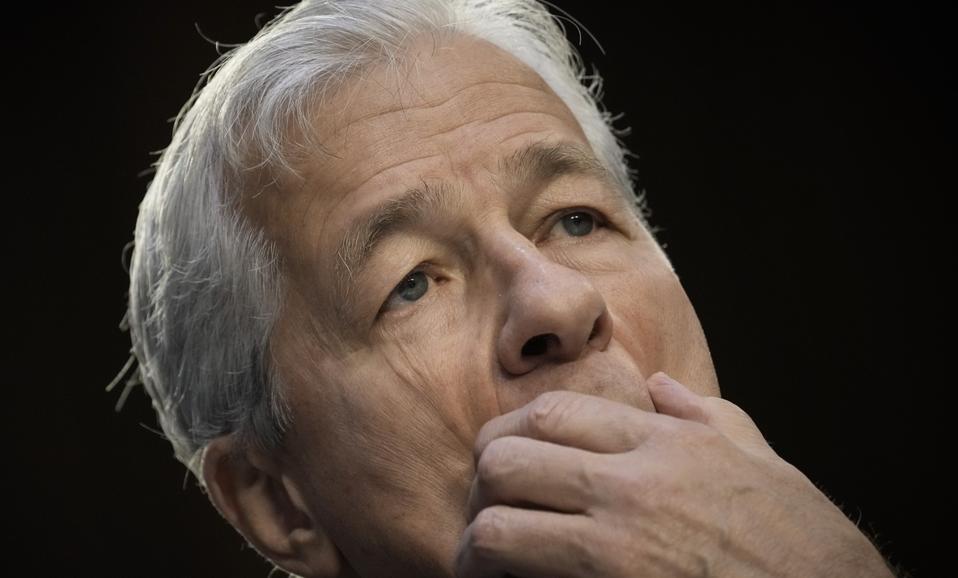

JPMorgan Chase chief executive Jamie Dimon is one of the most outspoken critics of bitcoin, but has embraced the underlying technology that powers dollar-pegged stablecoins.

Getty Images

U.S. banking groups that count Wall Street giants such as JPMorgan and Bank of America as members have urged Congress to close a loophole in the recently passed Genius Act stablecoin bill that allows issuers of the dollar-pegged cryptocurrencies to offer yields via affiliates, warning it could trigger huge account deposit flight that would undermine the banking system.

08/19 update: The bitcoin price and crypto market has swung wildly as fears swirl a widespread crypto market crash could be gathering pace.

The bitcoin price dropped towards $113,000 before bouncing back to around $115,000, dragging down the wider crypto market that’s seen $250 billion in value wiped out since last week.

“Cryptocurrencies traded sharply lower,” David Morrison, senior market analyst at Trade Nation, said in emailed comments.

“Bitcoin continued to pull back away from Thursday’s all-time high just below $124,500. Ethereum came under heavier selling pressure, dropping over 5%. These losses highlight the continued volatility within the crypto sector. The bigger question is whether this is simply a round of profit-taking following the sharp rally over the first two weeks of August, or if it is the beginning of a deeper and more protracted sell-off.”

The closely-watched crypto fear and greed index has swung from a reading of 68 last week to just 56, its lowest reading since the bitcoin price dropped to under $112,000 at the beginning of August and putting it on the verge of “fear” territory.

This week, the three-day Jackson Hole economic policy symposium begins in Wyoming, with Federal Reserve chair Jerome Powell’s Friday speech topping the agenda as traders brace for what’s widely expected to be a Fed interest rate cut in September.

“Markets are shoring up their focus on upcoming commentary from the Fed chair at the Jackson Hole Symposium,” Joel Kruger, market strategist at LMAX Group, said in emailed comments. “Fed reserve timelines and geopolitical developments are shaping flows across equities, FX, and crypto.”

Last week, Treasury secretary Scott Bessent said the Federal Reserve could cut interest rates by 50 basis points in September, mirroring a surprise 2024 interest rate cut that powered a bitcoin price boom into the November election.

“If Powell signals a slower path to easing at Jackson Hole, markets could reprice aggressively, tightening financial conditions and putting pressure on crypto prices in the near term,” Carolane de Palmas, market analyst at Activtrades, said in emailed comments.

“While bitcoin is often framed as ‘digital gold,’ its short-term performance is still highly sensitive to liquidity cycles. Traders need to recognize that Fed policy directly shapes dollar liquidity, and by extension, influences the flows into and out of bitcoin. If the Fed looks more cautious on rate cuts, we could see reduced momentum in the crypto space through the fall. But there’s a second layer here—beyond just liquidity. The symbolism of Jackson Hole matters. This is where Powell sets the tone for policy direction, and any hint that rate cuts are still firmly on the table could restore confidence in the crypto rally. On the flip side, if the Fed appears hesitant because of tariff-driven inflation concerns, bitcoin could remain trapped in consolidation until a clearer macro catalyst emerges. In the next quarter, bitcoin’s path will be closely tied to Fed expectations.”

In April, a Treasury Department report estimated that stablecoins could trigger up to $6.6 trillion in deposit outflows, depending on whether they can offer interest or yield, with the stablecoin market expected to grow to $2 trillion by 2028, up from $280 billion today.

“Congress must protect the flow of credit to American businesses and families and the stability of the most important financial market by closing the stablecoin payment of interest loophole,” the report, posted to the Bank Policy Institute website, and addressed to lawmakers, read.

“Banks power the economy by turning deposits into loans. Incentivizing a shift from bank deposits and money market funds to stablecoins would end up increasing lending costs and reducing loans to businesses and consumer households.”

The plea to lawmakers was also signed by the American Bankers Association, Consumer Bankers Association, Independent Community Bankers of America and the Financial Services Forum.

Stablecoin adoption wars are heating up following the passage of the Genius Act that laid down rules of the road for the crypto-based dollars.

Tether’s USDT remains the dominant stablecoin but is facing a tidal wave of competition from all angles, including Wall Street giants themselves, technology companies such as Facebook’s Meta, as well as financial technology companies like PayPal and Stripe.

Earlier this year, David Sacks, a technology investor and U.S. president Donald Trump’s crypto czar, said on the All In Podcast he hosts with three other investors that he hopes that eventually the rules will swing in favor of stablecoin issuers, allowing them to directly offer interest to stablecoin holders.

Trump’s sons Eric and Don Jr have publicly said their World Liberty Financial crypto project is a direct challenge to Wall Street following their claims of being “de-banked” in the aftermath of Trump’s 2020 election loss. “Honestly, I would love to see some of the big banks go extinct, because, honestly, they deserve it,” Eric Trump said in May.

Sign up now for CryptoCodex—A free newsletter for the crypto-curious

The bitcoin price has fallen from its all-time highs, raising fears the market could be headed for a correction or even a full-blown price crash.

Forbes Digital Assets

The bitcoin price and crypto market’s latest downturn, coming as just as traders celebrated a fresh all-time high, have raised fears the market could see further declines in coming weeks.

“The crypto market continued its decline on Monday after a pause over the weekend,” Alex Kuptsikevich, FxPro’s chief market analyst, said in emailed comments.

“The total capitalisation fell back to $3.88 trillion, reaching its lowest level in more than two weeks. As expected, altcoins are falling the hardest, with ethereum and XRP losing about 5% in the last 24 hours, twice as much as bitcoin. Bitcoin fell to $115,000, the lowest level in the last 11 days. It is now testing the 50-day moving average, which has been the bullish trend line since April. A consolidation below it will sharply increase the chances of a deeper correction, and a failure below $112,000—the area of recent lows—will confirm the correction, opening the potential for a decline to $105,000-107,000.”

Source link