Top American pharmaceutical firm Amgen (AMGN) on Monday unwrapped AmgenNow, its new direct-to-consumer platform. It kicked off the launch with a 60% discount on its popular cholesterol-reducing injection, Repatha. However, investors appear unimpressed with the move, with AMGN stock trending lower on Friday afternoon.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Amgen’s announcement, Repatha will be sold at a monthly price of $239, which is a 60% discount from its current list price (or manufacturer’s set price) in the U.S. The company also said the discounted price is the lowest price it is now selling the medication among advanced G7 countries.

“Beginning today, AmgenNow will be available to all Repatha patients, including those who participate in government programs such as Medicare and Medicaid,” Amgen noted. It added that patients who purchase Repatha directly from the new platform will not be required to get insurance or try cheaper medications first — steps those covered by insurance companies are required to take.

Trump’s Lower-Drug Crusade Sees First Deals

The launch of the platform comes about a week after pharma giant Pfizer (PFE) agreed to lower prices on select medications and obtained a three-year exemption from President Donald Trump’s administration tariff on the industry. Trump noted during the announcement that other pharmaceuticals will also be brought onboard for a similar arrangement.

The Trump administration also recently unveiled the TrumpRx website to make cheaper drugs available to Americans. Amgen has said it will soon make its new direct-to-consumer platform also accessible on the government-controlled site.

The updates come as President Trump has been clamoring for American pharmaceuticals to bring down the prices of their drugs, even as he deploys his tariff policy as a tool in his strategy playbook. In late September, the U.S. president threatened to impose a 100% tariff on foreign branded medications imported into the country.

Earlier in July, the U.S. leader also wrote to 17 major American drugmakers–including Amgen–asking that drug prices under Medicaid be sold at most-favored nation prices — or what is equal to or lower than prices in other countries.

Is AMGN a Good Stock to Buy?

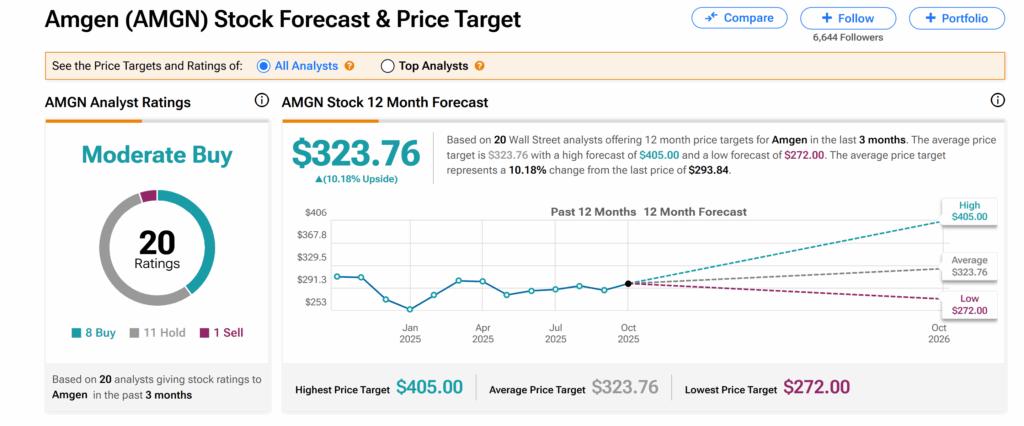

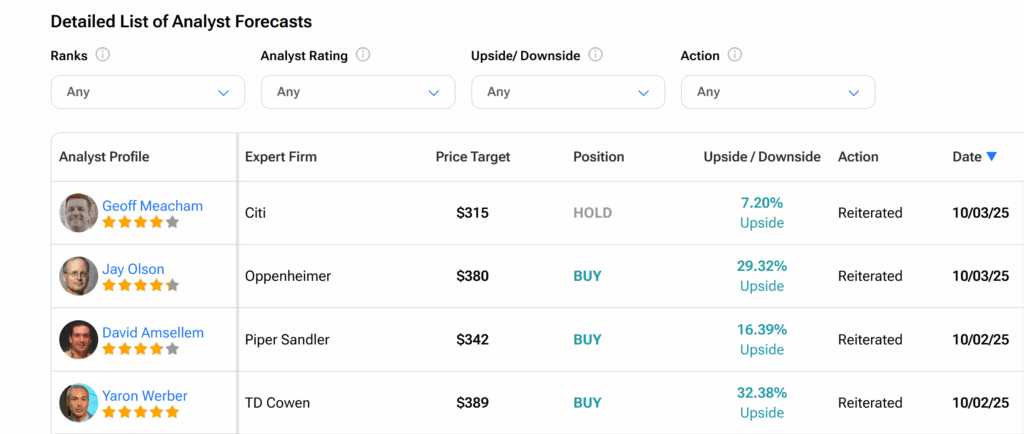

On TipRanks, Amgen’s shares currently have a Moderate Buy consensus recommendation from Wall Street. This is based on eight Buys, 11 Holds, and one Sell assigned by 20 Wall Street analysts over the past three months.

However, the average AMGN price target of $323.76 suggests a 10% upside potential from the current level.

Source link

:max_bytes(150000):strip_icc()/Mediterranean-Diet-Foods-to-Stock-Up-on-in-October--a7e0cb774d1d45a793d826ea65d5f177.jpg)

:max_bytes(150000):strip_icc()/BTCUSDChart-82ee4ab3eff1444aa3538f413772ea76.gif)