Entertainment giant Warner Bros. Discovery (WBD) has had a pretty good run of things recently, especially as potential buyout plans emerged from several different fronts. But the plan did not sit well with everybody, including one of the most legendary names in journalism of all time, and perhaps more immediately important, an analyst with TD Cowen. This news combined to send Warner shares on a rocket sled down, losing nearly 6.5% in the closing minutes of Tuesday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TD Cowen analyst Doug Creutz, who has nearly a five-star rating on TipRanks, cut his rating on the stock from Buy to Hold, and has a $14 price target in place as well. So what prompted the cut? Uncertainty surrounding the potential for a deal between Warner and, well, just about anybody. The uncertainty alone could send Warner shares stumbling back to the $11 to $12 range should the deal fail to materialize.

And the problem may not just be a buyer. The idea that Comcast (CMCSA) could step in will face regulatory hurdles as it means more television consolidation. And most tech companies would likely stay out of it as they lack the potential synergies that another deal might offer, particularly Paramount Skydance (PSKY).

“Change CNN Forever”

That was when no less than Dan Rather kicked in. The former anchor of CBS Evening News expressed deep concern about “…huge billionaires getting control of nearly all of the major news outlets.” Rather noted that he didn’t want to be “…unfair to the Ellisons,” but noted that them buying up Warner would mean that “…it would change CNN forever and it might be another very serious wound to CBS News.”

Rather summed up by saying, “I do think…without preaching about it, but that we, all of us, all the Americans, have to be concerned about the consolidation of huge billionaires getting control of nearly all of the major news outlets. This is not healthy for the country, and it is something to worry about. …It’s pretty hard to be optimistic about the possibilities of the Ellisons buying CNN.”

Is WBD Stock a Good Buy?

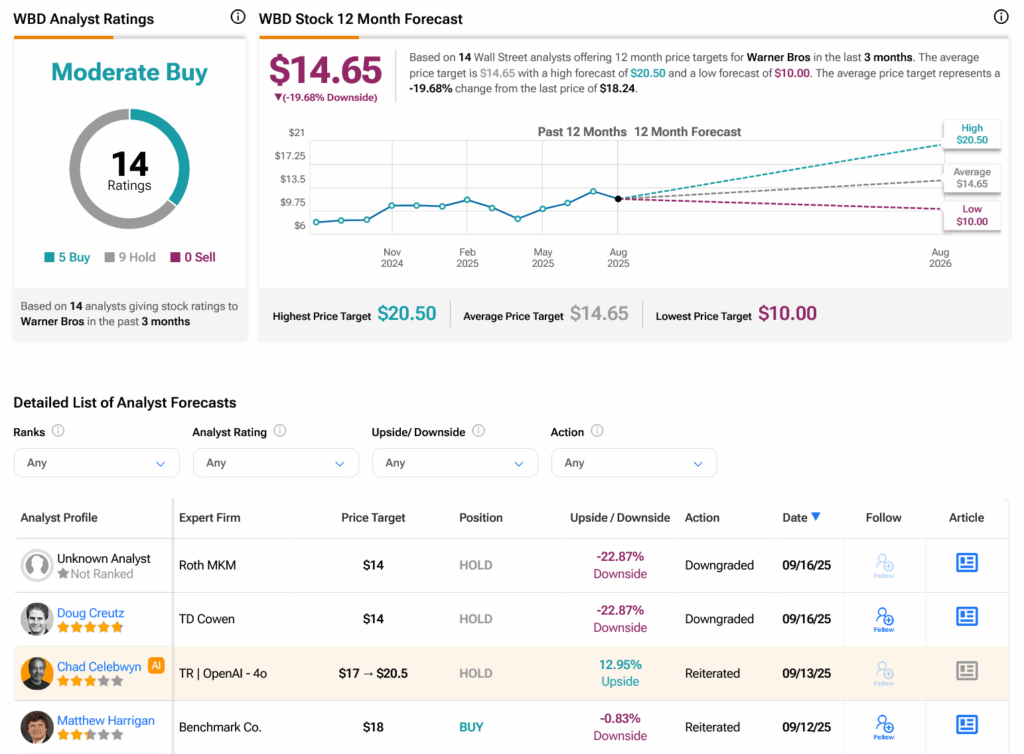

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on five Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 130.3% rally in its share price over the past year, the average WBD price target of $14.65 per share implies 19.68% downside risk.

Source link