Micron Technology (MU) is set to report its Q4 results for FY25 on September 23, with Wall Street looking for EPS of $2.78 on revenues of $11.12 billion. Ahead of the print, Deutsche Bank analyst Sidney Ho reiterated his Buy rating and raised the price target to $175 from $155. The 5-star analyst sees continued tailwinds from tight DRAM supply and stronger NAND pricing, which should drive gross margins above 50%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, DRAM is fast memory for data a computer or server needs immediately, while NAND is long-term flash storage used in devices like Solid-State Drives (SSDs) and smartphones.

Why Ho Is Bullish on Micron Stock

Ho pointed out that DRAM supply is likely to stay constrained into 2026 as high-bandwidth memory (HBM) absorbs a growing share of bit capacity. He said the favorable supply-demand balance is lifting average selling prices and should support sustained margin expansion.

In NAND, Ho sees momentum building as device makers increase storage content. He said recent phone launches and stronger enterprise SSD demand from hyperscalers are helping support NAND pricing.

The analyst also addressed investor concerns over HBM pricing in 2026, which he views as overstated. He believes Micron can hold market share and profitability in HBM even if pricing normalizes, given its strong position in AI-related demand. He now expects CY26 revenue of $54.3 billion, up 3% from prior estimates, and EPS of $15.45, up 6% from $14.55.

He added that management is unlikely to provide new details on HBM contract talks, given uncertainty around 2026 supply and customer product launches.

Is Micron a Good Stock to Buy?

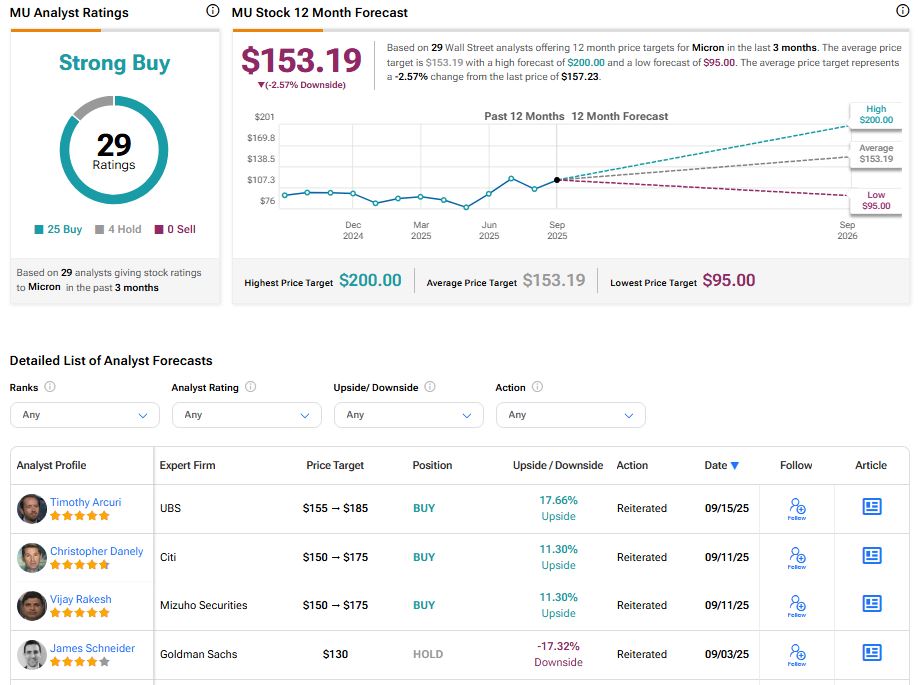

Wall Street analysts maintain a Strong Buy rating on Micron stock, with 25 Buys and four Holds assigned over the past three months. The recent rally has brought the stock close to Micron’s average price target of $153.19, implying about 2.57% downside from current levels.

Source link

:max_bytes(150000):strip_icc()/GettyImages-2213626502-271d8c0d2f414bda9aa6f9b1bf7e2153.jpg)