If you’re a D.C. cop this minute, to whom are you actually supposed to report? According to Attorney General Pam Bondi, it’s Drug Enforcement Administration head Terry Cole, to whom she assigned the “powers and duties vested in the District of Columbia Chief of Police” in an order last night. But D.C. Attorney General Brian Schwalb immediately denounced that order as unlawful, saying in a memo of his own that “members of MPD must continue to follow your orders and not the orders of any official not appointed by the Mayor.”

The courts will doubtless have to get involved very soon. Until then: Such law! What order! Happy Friday.

by Andrew Egger

Right now, the U.S. economy has a lot in common with Wile E. Coyote.

Like the hapless Looney Tunes predator, Donald Trump’s economy went charging off a cliff after his April 2 “Liberation Day” tariffs, which—despite endless tweaks, revisions, abrupt extensions, and equally abrupt reversals—are gradually settling into a new status quo in which the costs of global trade are far higher than before.

But we’re just starting to feel the true impact of that status quo. Because until recently, a series of ameliorating factors have kept things looking artificially normal.

Trump’s sudden about-face on the most psychotic tariff rates reassured markets that he wouldn’t simply melt the economy down to slag on a whim. Instead, he introduced traders to the TACO model and gave them an object lesson in the pleasures of buying the dip. Monthly jobs reports kept coming in strong, seeming to complicate expectations that tariffs would force companies to be more aggressive managing their payroll. And consumer prices continued to rise relatively slowly, making Trump’s insistence that companies would simply “eat” the cost of the tariffs look facially plausible.

But much of this now appears to have been a mirage. The latest jobs report found that earlier estimates of strong job growth post-April 2 had been incorrect; hiring has slowed dramatically under our new tariff regime. And the temporary lifelines that had been holding consumer prices at reasonable levels are quickly vanishing too: Companies that stampeded to import as much as they could before tariffs took effect are burning through that pre-tariff inventory.

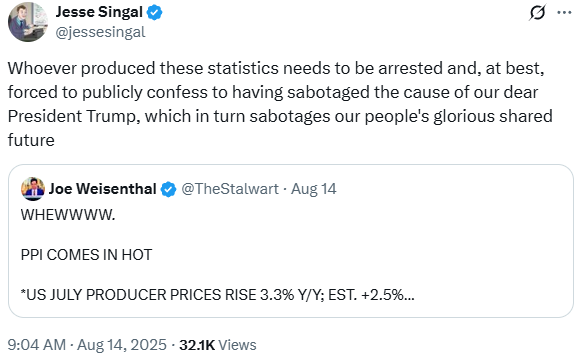

The result is the alarm-bell price report we got yesterday: a 0.9 percent single-month jump in the Producer Price Index, the largest since the bad old inflation days of 2022. That jump pushed PPI 3.3 percent higher compared to this time last year, while “core” PPI—which excludes more naturally fluctuating prices of food and energy—rose all the way to 3.7 percent year-over-year.

In contrast with the Consumer Price Index, which tracks the cost of final goods, PPI tracks costs through every step of the supply chain, including raw material inputs and intermediary manufacturing. PPI and CPI are closely related measures, of course, and ordinarily they track closely together. But the fact that PPI is spiking ahead of CPI right now suggests that economists’ warnings about the costs of tariffs were right. What we’re seeing is tariff-induced upward price pressure on every step in America’s globally integrated supply chains, all while businesses use every trick in the book to delay passing those costs on to consumers. But delay is all they can do; soon, consumers will be feeling the burn too.

It’s remarkable to ponder the gap between this economic picture and what voters thought they’d be getting with Trump on inflation. Many Americans seem simply to have swallowed his incredibly simplistic campaign pitch of “Biden makes prices go up, Trump will make prices go down.” The fact that they’ve kept going up even modestly so far this year has scanned as a disappointment to many. How they’ll respond to Trump actively making that inflation worse in the weeks and months ahead remains to be seen, but support for his ability to handle the economy only continues to soften. In early July, Pew found 54 of Americans either very or somewhat confident that Trump would make good decisions about economic policy. In a similar poll this week, that number was down to 44 percent.

So now we, like Wile E., are discovering too late we’ve run straight off terra firma.

But maybe a cliff isn’t quite the right analogy. What we’re seeing probably isn’t the prelude to some sort of free-fall market crash. Instead, we appear to be running headlong into a bog, sinking waist-deep in muck. Trump’s tariffs are congealing around the economy, making all international trade that much more sluggish and costly. The result is a straightforward hit to prosperity. Prices will rise, growth will slow, interest rates will stay elevated. Maybe the economy will bear up under it all and the arrow will keep pointing upward. But if it does, it’ll be doing so through a thick miasma of tariff-induced drag.

by Cathy Young

As Donald Trump and Vladimir Putin meet in Anchorage later today, two things are important to remember.

The first is that Putin heads into this summit with a very clear idea of what he wants: a negotiation in which he and the American president can look like two equal masters of the world deciding the fate of lesser countries and drawing the lines of their spheres of influence. He wants an agreement that goes as far as possible toward reducing Ukraine to his vassal state.

The second is that Trump goes into it with a mindset that a Russian idiom colorfully describes as “seven Fridays in a week.” He’s unreliable, unpredictable, and prone to changing his views depending on who is in the room. No one can predict what he’ll say about Russia and Ukraine on any given day (other than maybe, yet again, that he was a victim of the “Russia hoax” and that “it’s Biden’s war”). Maybe there’ll be “land swapping,” maybe not. Maybe Volodymyr Zelensky is fine, maybe he’s the one who decided to “go into war and kill everybody.” Maybe Putin wants to make a deal, maybe he can’t even be persuaded to stop raining rockets on nursing homes and apartment buildings. And so on.

As the summit approached, Trump and various administration officials were clearly trying to keep expectations low. Press Secretary Karoline Leavitt even compared the meeting to a mere “listening exercise.” Trump said that if things went well, there would be “a quick second meeting between President Putin and President Zelensky and myself if they’d like to have me there.” He also estimated the chances of failure at “25 percent” and promised “very severe consequences” if Putin wasn’t amenable.

Russia, meanwhile, is framing the meeting as being primarily about rebuilding U.S.-Russian relations and maybe even reaching a new strategic arms reduction agreement. There are no signs at all that Putin is prepared to make any concessions on Ukraine.

The good news is that Europe seems resolved to back Ukraine in its demands for a just peace. Also good news: reports of a possible dramatic Russian breakthrough in Eastern Ukraine a few days ago seem to have been vastly exaggerated. Russian troop movements near Pokrovsk seem to have been more a case of infiltration by small reconnaissance units than an actual breach of Ukrainian defenses, and Ukraine has been able to contain the damage by deploying additional troops. While Putin clearly wants to project the image of negotiating from a position of strength—and very likely believes he is—this is not a situation in which Ukraine is losing.

So, what to expect? The joint Trump-Putin press conference the White House has announced will almost certainly happen, unless Putin is clumsy enough to seriously piss off Trump during their talks (almost certainly not). There will be no peace deal—which, given the various options for a deal floated so far, is a good thing. Even an announcement of specific plans for a trilateral Trump-Putin-Zelensky summit seems very unlikely. There may, however, be enough vaguely positive talk for Trump to back down on those unspecified “severe consequences.”

What we do know is that, even if very little actually happens, Trump is already set to proclaim himself the winner. As he told Fox’s Brian Kilmeade the other day, while conceding that the war may not be solved, “We didn’t lose any soldiers, we didn’t lose anybody. But if this was a war—if I didn’t get in there, this could have been World War Three.”

With the president, every day is Friday.

ACCOUNTABILITY FOR FEMA: It’s been only a month since deadly floods raged across central Texas, killing at least 135 people and causing more than a billion dollars in damage. As the crisis unfolded, the victims’ difficulties were compounded by the sputtering response from the Federal Emergency Management Agency, whose rescue and relief efforts were straitjacketed by penny-pinching policy. DHS Secretary Kristi Noem mandated that every contract and grant for more than $100,000 across her department required her personal approval. This created a dramatic FEMA bottleneck. In one striking example, CNN reported that Noem did not authorize FEMA to deploy Urban Search and Rescue crews until more than 72 hours after the flooding began.

In the wake of the disaster, the White House seems to have sheepishly shelved plans to dissolve FEMA altogether. But the $100,000 expenditure policy remains in place—and Senate Democrats are demanding to know why. In a letter to Noem and FEMA acting administrator David Richardson this morning, first reported by The Bulwark, Sens. Patty Murray (D-Wash.) and Gary Peters (D-Mich.) called the budgetary threshold “grossly misaligned with the operational needs of FEMA” and warned it would lead to more dangerous delays in the future, “placing lives at unnecessary risk.”

“In the context of large-scale disaster response, where millions of dollars are often mobilized within hours, requiring Secretary-level approval for expenses of this size is not oversight, but obstruction,” the senators write. “It has turned what should be rapid action into a system mired in unavoidable bureaucracy.”

Murray and Peters are, respectively, the vice chair of the Senate Appropriations Committee and the ranking member of the Senate Committee on Homeland Security and Government Affairs—two bodies with oversight of FEMA’s budget. In their letter, the senators request further clarity about whether FEMA has requested an exemption from the $100,000 threshold, an accounting of FEMA’s above-threshold expenditures and how long it took for Noem to approve them, and any after-action report conducted by DHS “to assess how the Secretary’s review policy affected the response to the Central Texas flood or other disasters.”

In addition to questions about the $100,000 threshold, there is plenty of reporting suggesting that the White House still sees FEMA as a ripe target for cost-saving measures. The Washington Post reported last week that DHS is holding up more than $100 million in funds already approved for storm damage cleanup in North Carolina, which was pounded by Hurricane Helene last year. And DHS has also temporarily reassigned dozens of FEMA workers to Immigrations and Customs Enforcement in recent weeks, as that department attempts to staff up dramatically following the massive budget expansion signed into law by Trump in July.

THE DOOMSCROLL ECONOMY: The consumer habits of the young have always baffled their elders. But as Amanda Mull argues in this piece for Bloomberg News, there’s more going on in today’s world of algorithmically driven fads, which even the kids seem to be noticing are increasingly, bizarrely content-free:

Kids these days seem just as baffled as their elders by many of the things that they—and to a significant extent, we—are expected to latch onto. On social media, the confusion of teens and twentysomethings has become a meme unto itself, with users across platforms posting lists of trend nonsense: Labubu Dubai chocolate Sonny Angel matcha latte Love Island Crumbl cookie Pretty Little Baby moonbeam ice cream. . .

Consumer trends that thrive in this ecosystem are highly stimulating, above all else. They’re strange or cute or delicious-looking or outrageous or confusing. These attributes have long been part of what helps trends spread, but now they’re the primary attribute required for a shot at ubiquity. Traditionally, this kind of stimulation-first pitch was reliable only when marketing to children, susceptible as they are to the bright, the cuddly, the sweet. It’s not a coincidence that stuffed animals and sugary treats are such frequent beneficiaries of this system now, even if adults drive their popularity. Content served by algorithms is effective in part because it’s disorienting, which helps to short-circuit the defenses against inpulse—discernment, self-restraint, patience—that are the hallmarks of emotional maturity, rendering most of us a little bit more childish.

So, no. You weren’t going crazy when you started having that niggling suspicion that trends these days were more inscrutable than ever. It’s a good thing nothing like this is happening to our politics. That would be a real shame.

Source link