- CATL is still in talks with government agencies to renew the permit but is prepared to extend the suspension for several months, according to a Bloomberg report.

- Previous reports indicated that CATL’s cash production cost at the lithium mine was RMB 100,000 per ton, while the current price of battery-grade lithium carbonate has dropped to about RMB 70,000 per ton.

CATL (SHE: 300750) has reportedly suspended production at a major lithium mine, which is not good news for the company but could be a positive development for lithium producers who have seen prices suppressed for a prolonged period.

The battery giant has internally announced that its lithium mine in Jianxiawo, Yichun, Jiangxi province, will temporarily cease operations for at least three months, Bloomberg reported today, citing sources familiar with the matter.

One of the sources said suspension came after CATL failed to extend a key mining license that expired on August 9.

The company is still in talks with government agencies to renew the license but is preparing for the halt to last months, the source said.

Another source said the affiliated refineries in Yichun had been informed of the closure. Yichun is often referred to as the “Lithium Capital of Asia.”

CATL’s permit trouble and production halt come as the Chinese government is cracking down on overcapacity across multiple industries and intensifying scrutiny of mining operations, Bloomberg noted in its report.

However, for an industry that has been plagued by overcapacity for over two years, the suspension of production at a key link in the supply chain will be a positive development, the report said.

Lithium is one of the key raw materials for batteries, which typically account for a significant portion of the cost of an electric vehicle (EV) model.

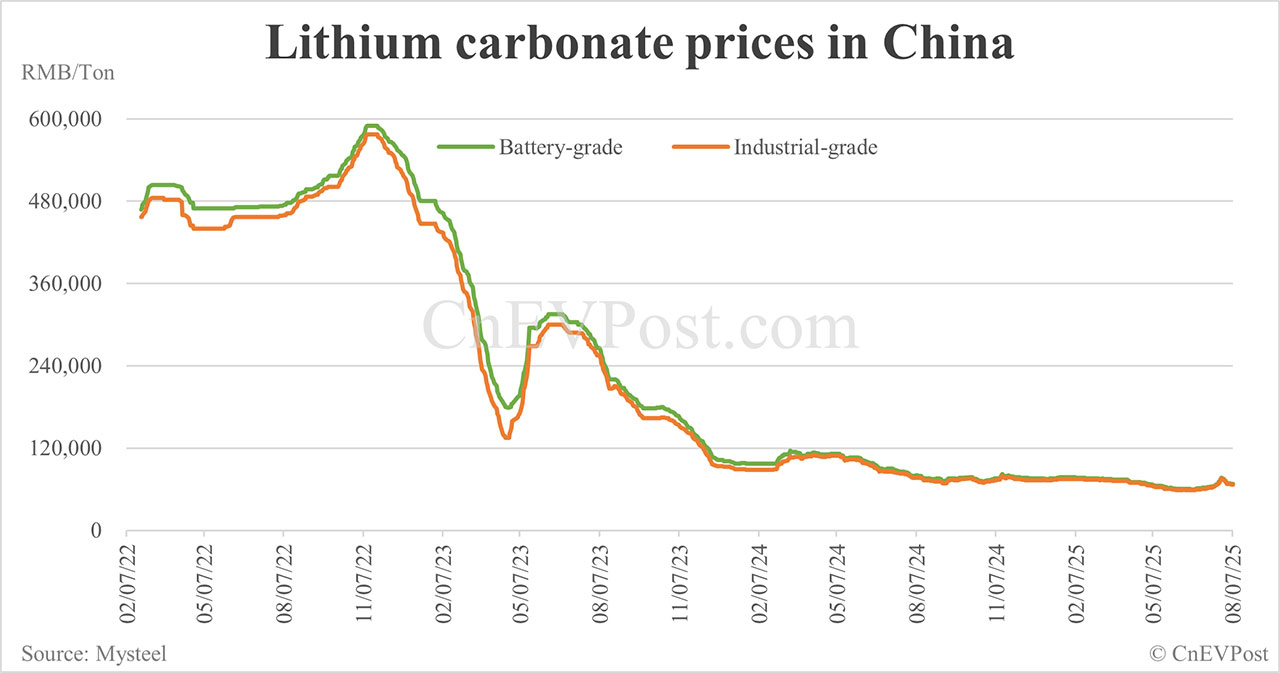

In 2022, lithium prices saw a sharp rise in China, with battery-grade lithium carbonate reaching RMB 590,000 ($82,130) per ton in November of that year, an increase of about 14 times from RMB 41,000 per ton in June 2020.

However, after that, lithium carbonate prices experienced a prolonged decline, with battery-grade lithium carbonate currently priced at around RMB 70,000 per ton in China.

Lithium carbonate and iron phosphate are the primary raw materials for lithium iron phosphate (LFP).

In September 2024, reports indicated that CATL’s cash production cost for lithium ore at the Jianxiawo mine was RMB 100,000 per ton, higher than the RMB 75,000 per ton price for battery-grade lithium carbonate at the time.

($1 = RMB 7.1842)

Source link