Last week, five of the “Magnificent 7” stocks — Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META), Apple (AAPL), and Amazon (AMZN) — revealed their quarterly results. Among them, Apple and Amazon stood out, with both making big strides in artificial intelligence and cloud services. In this article, using the TipRanks Stock Comparison Tool, we compare these two AI leaders to see which stock Wall Street views as the better pick after their earnings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Amazon (NASDAQ:AMZN) Stock

Amazon stock gained 11% in 2025 and jumped nearly 10% on Friday after the company posted solid third-quarter results. The gains were led by solid growth in its cloud computing unit, Amazon Web Services (AWS). Earnings per share came in at $1.95, beating analysts’ estimate of $1.57. Revenue rose 13.4% year-over-year to $180.2 billion, also topping expectations of $177.9 billion. The standout result was a 20% jump in AWS revenue, easing investor concerns about rising competition from Microsoft’s (MSFT) Azure and Alphabet’s (GOOGL) Google Cloud.

CEO Andy Jassy said AWS is “growing at a pace we haven’t seen since 2022,” fueled by demand for artificial intelligence (AI) services. For the fourth quarter, Amazon expects revenue between $206 billion and $213 billion, compared to Wall Street’s forecast of $207.9 billion, reflecting continued strength heading into the holiday season.

Analysts reacted positively to the results. Evercore analyst Mark Mahaney raised his price target on Amazon to $335 from $280 and kept a Buy rating, calling it a “Top Pick.” The five-star analyst described the quarter as the “AWS Unlock Quarter,” noting that strong cloud momentum, record operating margins, and upbeat guidance set the stage for more growth ahead. Also, Citi’s five-star analyst Ronald Josey raised his price target on Amazon from $270 to $320 and kept a Buy rating. He expects AWS revenue growth to keep accelerating and reaffirmed Amazon as Citi’s top internet stock pick.

Apple (NASDAQ:AAPL) Stock

Apple stock has risen about 8% so far in 2025. The stock moved higher after the company posted better-than-expected fiscal fourth-quarter results, driven by strong demand for the new iPhone 17 lineup and continued growth in its high-margin Services segment. Earnings per share came in at $1.85, up 13% year-over-year, beating analysts’ estimate of $1.78. Revenue grew 8% to $102.5 billion, slightly ahead of the $102.17 billion forecast.

For Fiscal Q1, Apple expects revenue to grow between 10% and 12%, reaching $136.7 billion to $139.2 billion, above Wall Street’s estimate of $131.82 billion. During the earnings call, CEO Tim Cook said iPhone sales are on track for double-digit growth and that Apple expects to return to growth in China, where sales fell 3.6% last quarter. He also confirmed that an AI-powered Siri upgrade will launch next year, with more AI features added gradually.

Following the results, JPMorgan analyst Samik Chatterjee maintained a Buy rating and raised his price target to $305 from $290, citing strong management confidence and healthy iPhone demand. He believes Apple’s new product cycle will support steady growth in the coming year. Meanwhile, Bank of America analyst Wamsi Mohan lifted his price target to $325 from $320, noting that Apple surprised Wall Street with a 47.2% gross margin, even after a $1.1 billion tariff charge during the quarter.

AMZN or AAPL: Which Stock Offers Higher Upside, According to Analysts?

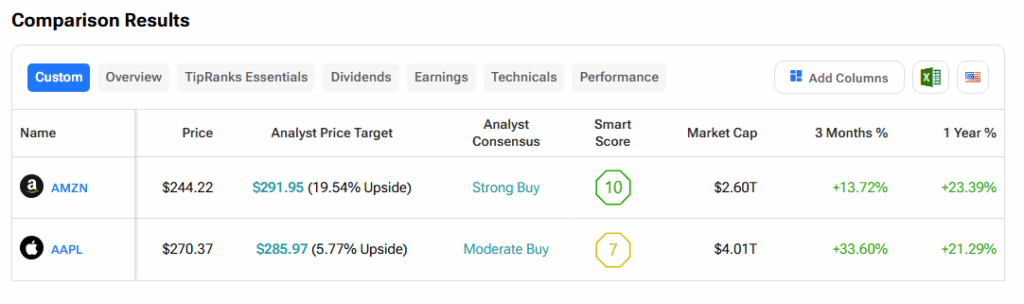

Using TipRanks’ Stock Comparison Tool, we compared Apple and Amazon to see which Magnificent Seven AI stock analysts favor. Amazon holds a Strong Buy consensus rating with a Smart Score of 10, reflecting high confidence in its outlook. The stock trades around $244.22 with an average price target of $291.95, implying a potential 19.5% upside.

Apple, on the other hand, carries a Moderate Buy consensus and a Smart Score of 7. Shares trade near $270.37, with an average price target of $285.97, suggesting a 5.8% upside.

Conclusion

Overall, both Apple and Amazon delivered strong quarterly results and remain key players in the AI and cloud space. However, Wall Street currently sees Amazon as the stronger buy, given its accelerating AWS growth and higher expected returns. Meanwhile, Apple continues to offer steady long-term value backed by strong product demand and expanding AI integration.

Source link

.jpg)