The Trump administration is doing so many corrupt, destructive and simply stupid things that the failing attempt to rescue Javier Milei, Argentina’s MAGAesque president, with billions of U.S. taxpayer dollars isn’t even in the top 10. But the Argentina debacle is getting a lot of public attention, for good reason: It’s a teachable moment, a naked demonstration of the administration’s hypocrisy and incompetence.

So let me ask two questions about this deployment of $20 billion, or maybe $40 billion in U.S. funds. (Scott Bessent, the Treasury secretary, has talked about a second facility financed by the private sector, but I don’t see why anyone would put money into this facility without some kind of official U.S. backing that puts taxpayers further on the hook.) First, what if anything does this have to do with U.S. national interest? Second, will this bailout succeed and, if so, for whom?

Bessent has said that Argentina is a “systemically important ally.” As an editorial in the Financial Times — not exactly a left-wing rag — drily notes, this is “news to many.”

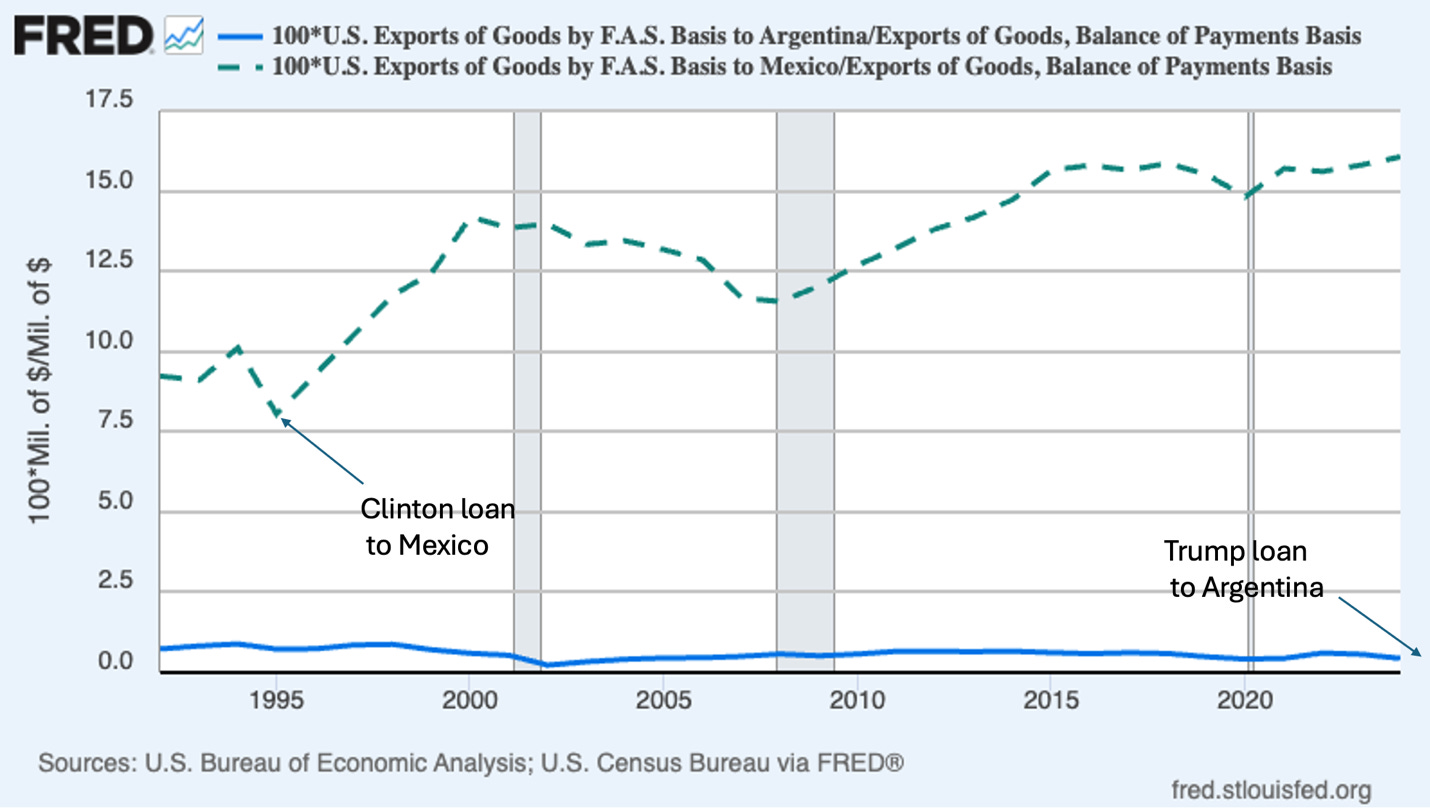

One way to highlight the weakness of the case for this bailout is to compare current U.S. economic links with Argentina with U.S. interest in Mexico back in 1995, when the Clinton administration provided a financial aid package to our neighbor that may, on the surface, look similar to what Bessent is giving the Milei government. Here are U.S. exports to Mexico (dashed green line) and Argentina (blue line) as a percent of total U.S. exports:

In 1994, just before the financial crisis that prompted Clinton to intervene, Mexico accounted for 10 percent of U.S. exports, a number that would rise over time as the North American Free Trade Agreement led to close integration of our national economies. Furthermore, Mexico is right next door, giving the U.S. an obvious interest in Mexico’s political stability.

Argentina is, to say the least, not next door, and accounts for less than 0.5 percent of U.S. exports. Why, exactly, should U.S. taxpayers bail out Javier Milei?

We know why Trump and Bessent want to help Milei. First, he’s a MAGA favorite, fond of posing with U.S. right wingers with a chainsaw as a prop. So the Trumpists want a right-wing, anti-government politician to succeed, no matter how much taxpayer money is required.

Second, some U.S. hedge-fund billionaires, personally close to Bessent, bet big on Milei and bought Argentine bonds. The bailout package almost surely won’t succeed in turning Argentina’s economy around and probably won’t rescue Milei politically. But it may buy enough time for Bessent’s buddies to get much of their money out before the bottom falls out of the Argentine economy.

Yet events may very well overtake Bessent’s bailout plans. As I’ll explain shortly, Milei’s situation appears to be deteriorating fast, and Trump’s intervention may be making it worse.

Milei has succeeded in reducing Argentina’s inflation rate, but only by keeping the peso overvalued against the dollar. This is a time-tested futile strategy — by which I mean that it’s a strategy that has been attempted many times and has consistently failed. Typically, there’s initial euphoria. Then, as the overvalued currency leads to rising unemployment and political backlash, money starts to flee the country in anticipation of a future devaluation.

The final acts of a failed “exchange rate-based stabilization” usually play out as follows: For a short period the government tries to keep capital from fleeing and prop up the currency by raising interest rates, sometimes to incredibly high levels. But soaring interest rates compound the economic pain. Eventually the political pressure becomes intolerable and the currency is allowed to plunge.

Now, even though the US is currently buying pesos, Argentina is supposed to repay the “swap line” borrowing with dollars at the current exchange rate, so US taxpayers won’t lose from a devaluation. But where will the dollars come from? Realistically, taxpayer money is definitely at risk.

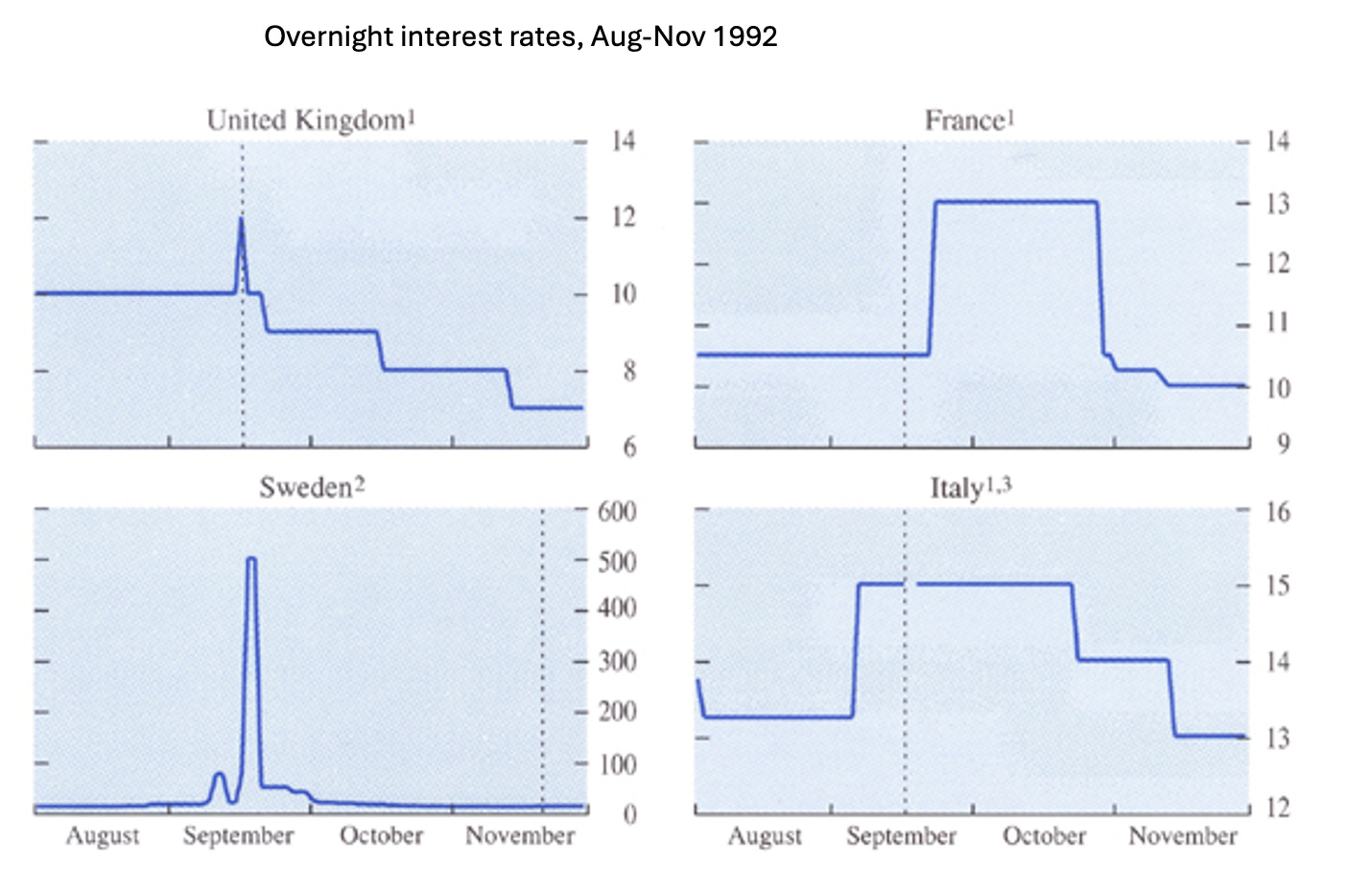

I am sure that Bessent knows this drill very well. After all, he began his career working for George Soros, and was part of the team that hastened Britain’s 1992 devaluation by placing a huge, successful bet against the overvalued pound.

Black Wednesday, Sept. 16, 1992 — the day the British government gave up and let the pound fall — was part of a broader crisis in Europe’s Exchange Rate Mechanism, an attempt to maintain fixed exchange rates between national currencies. As an International Monetary Fund post-mortem documented, all of the nations that faced speculative attacks showed the same pattern: soaring interest rates before the currency devaluation as their governments raised interest rates in an attempt to stanch the outflow of money. In the chart below, the vertical dotted lines for the UK, France and Italy correspond to Sept. 16, while that for Sweden, which had its crisis later, is for November 19:

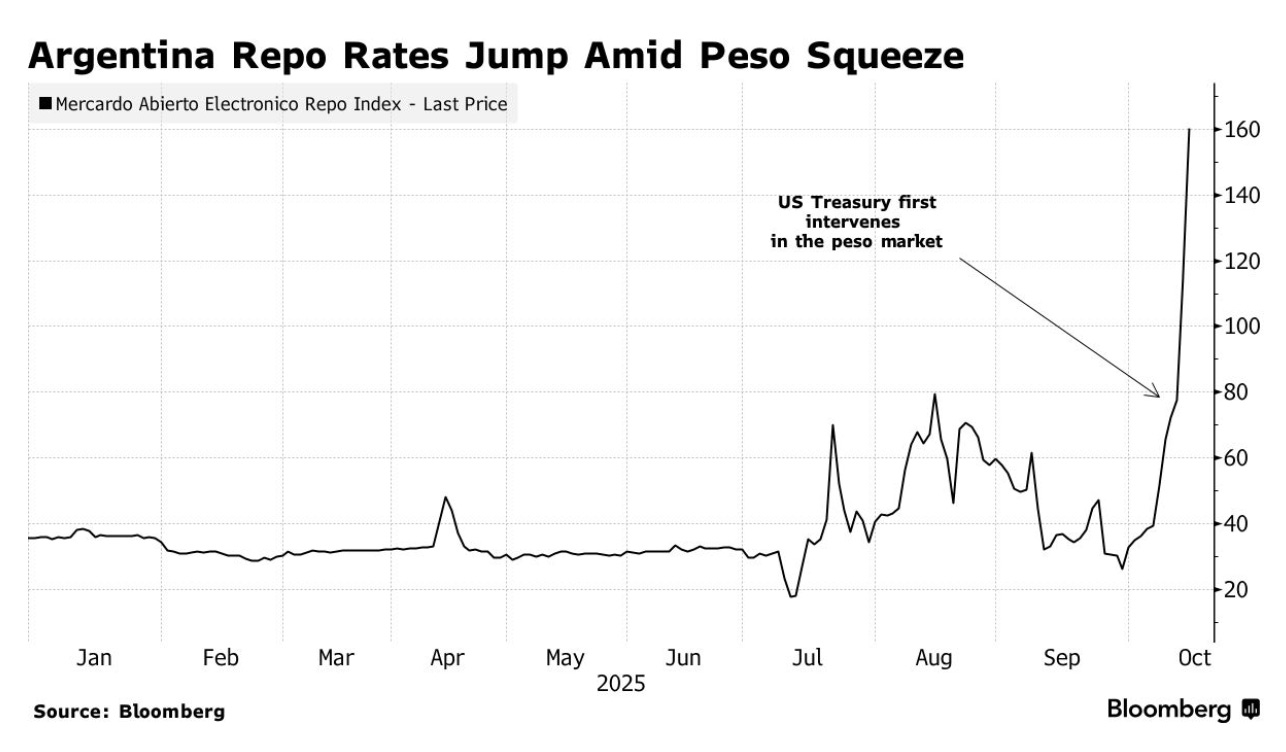

So, what’s happening in Argentina? Glad you asked. The chart at the top of this post shows the overnight collateralized peso repo rate. In practice this rate plays something like the same role as the Federal Funds rate in the United States. The graph shows what a debacle the Argentine bailout has become: while the Argentine rate was rising swiftly before the US Treasury intervention was announced, since that day it has skyrocketed – from 80% to 160%. And as every other country that has gone down this path has discovered, an interest rate this high is catastrophic to any economic plan and any government.

For the sake of clarity, I should note that there have been times when loans, or even the mere promise of loans, to troubled countries have managed to bring stability. For example, Bill Clinton’s loan to Mexico helped stabilize their economy — the economy recovered and the loan was repaid in full, ahead of schedule. However, this was done under a very different set of circumstances compared to Argentina: the Mexican government at the time was realistic and capable, having devalued the Mexican peso before the loan was delivered and following through with responsible economic policies.

In 2012 Mario Draghi, the president of the European Central Bank, stopped a gathering financial crisis in the EU by declaring he would do “whatever it takes” to support troubled countries within the EU (principally Spain, Greece and Portugal). His declaration worked, stabilizing the euro and reducing interest rates in those troubled countries. This worked because the public in those countries were willing to accept years of painful austerity as the price of remaining in the euro zone – something that the Argentine public is clearly unwilling to do.

Neither situation applies to Argentina. Milei and Bessent remain in the grip of magical thinking about what right-wing economics or a bailout by the US Treasury can achieve. Incredibly, Trump’s recent announcements have made the situation even worse. By declaring that U.S. economic support will only continue if Milei wins at the polls, he has galvanized the Argentine opposition to Milei, thus leading to more capital flight and skyrocketing interest rates. Trump clearly inhabits his own magical kingdom, unaware of how unpopular his bullying of other countries is. It now appears likely that Milei will suffer an even bigger loss in this month’s elections than he would have without Trump’s “help”.

However, we do know that at least one set of enablers of this financial fiasco will be helped: hedge funds who bet on Milei. They can use the artificial propping up of the peso to get their money out. For this is the real lesson of Argentina: “American First” really means “Billionaire Buddies First.”

MUSICAL CODA

Help! I’m not going to insult Argentina with Andrew Lloyd Weber, but so far know only one Argentine band (although they’re great.)

Source link