Several Wall Street analysts have raised their price targets for Advanced Micro Devices (AMD) stock after the chip giant announced its game-changing deal with ChatGPT maker OpenAI (PC:OPAIQ). On Friday, top TD Cowen analyst Joshua Buchalter raised his price target for AMD stock to $270 from $195 and reiterated a Buy rating. Buchalter sees continued upside in AMD stock, with the OpenAI deal addressing several concerns about the chip company’s artificial intelligence (AI) growth story. AMD stock has risen about 78% year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Under the partnership with AMD, OpenAI will deploy 6 gigawatts of the chipmaker’s Instinct graphics processing units (GPUs) over multiple years. Moreover, the deal includes a warrant for up to 160 million shares of AMD common stock, which, if fully exercised, will give OpenAI approximately a 10% stake in the semiconductor company.

Top TD Cowen Analyst Is Upbeat on AMD Stock

Buchalter contended that while a formal partnership between AMD and OpenAI is not a total surprise, given Sam Altman’s appearance at the chip company’s AI event and the ChatGPT maker’s “insatiable” demand for compute, the “line of sight” of the deal and magnitude was still shocking. While the 5-star analyst thinks that AMD still has much to prove with its actual deployments, he believes that this deal will help address several investor concerns regarding the semiconductor company’s AI roadmap.

Additionally, Buchalter believes that the partnership offers “significant validation” of AMD’s notable participation in the AI compute race, alongside rival Nvidia (NVDA).

While the analyst is bullish on AMD stock, he is neutral heading into the Q3 results. Buchalter believes that despite AMD’s strong fundamentals ahead of the Q3 print, the results may not be a significant catalyst for the stock, given the spike in shares following the “landmark deal” with OpenAI and the upcoming analyst day on November 11.

Buchalter updated his model following the AMD-OpenAI deal and stated that even “under somewhat conservative assumptions,” he sees the company’s 2027 earnings per share (EPS) approaching $10.

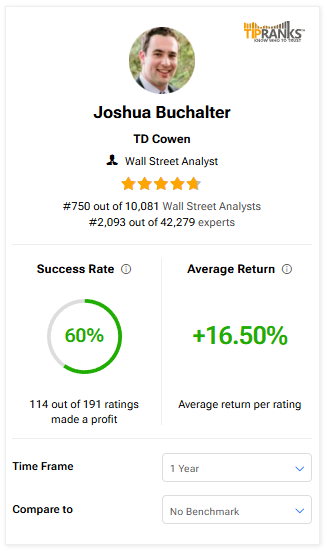

Interestingly, Buchalter ranks No. 750 among more than 10,000 analysts on TipRanks. He has a success rate of 60%, with an average return per rating of 16.5%.

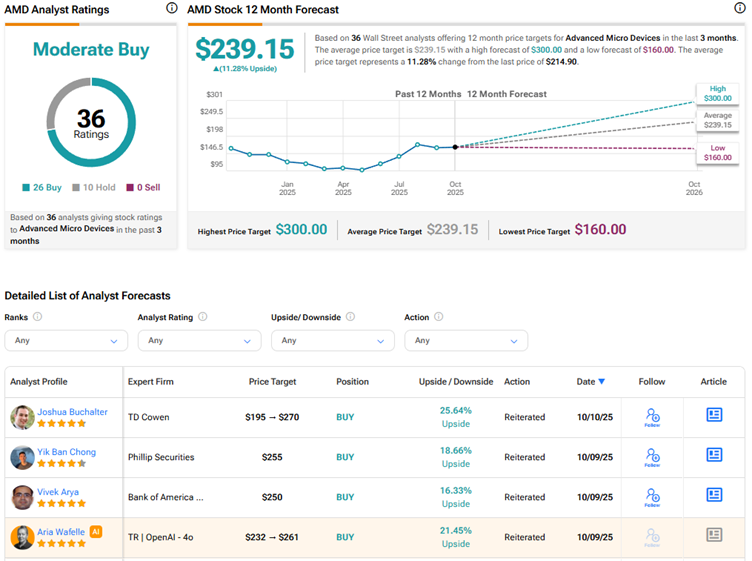

Is AMD Stock a Buy, Hold, or Sell?

Currently, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 26 Buys and 10 Holds. The average AMD stock price target of $239.15 indicates 11.3% upside potential from current levels.

Source link