Last week ended on a sour note for investors in Palantir Technologies (NASDAQ:PLTR), an uncommon sight indeed for the AI stalwart. The company’s share price has been on a steep incline throughout recent history, and PLTR has skyrocketed upwards by 345% during the trailing twelve months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

And yet, reports of security flaws in a battlefield communications system that Palantir helped to develop sent PLTR down by 7.5% on Friday. The company pushed back, as did the U.S. Army, who noted that any flaws were “identified early and mitigated immediately.”

This was a rare blip indeed for the big data analytics company, which has been on quite the roll. Its revenues are increasing (Q2 2025 brought in more than $1 billion, representing year-over-year growth of 48%), its contracts are blossoming (a total contract value of $2.27 billion in Q2 2025, up 140% year-over-year), and its ambitions are rising (Palantir is guiding for its highest sequential increase in company history for Q3 2025).

In fact, the biggest complaint for many investors has been PLTR’s high valuations – which by almost any metric are above and beyond its software peers.

Could this recent stumble signify that a multiple contraction is arriving? Top investor Rick Orford is focusing on the positive narrative, and he likes what he sees.

“What really drives the story is how Palantir keeps expanding into new markets,” explains the 5-star investor, who is among the very top 1% of stock pros covered by TipRanks.

Orford notes that Palantir has a number of growth drivers that are likely to lead to future gains. First and foremost is the company’s AI Platform, which makes AI accessible for non-tech savvy individuals. The company’s boot camps have gone a long way towards expanding adoption, shortening sales cycles and helping to drive commercial revenues.

The investor also cites PLTR’s government contracts, including a recently inked 10-year deal with the U.S. Army which could be worth $10 billion. Not only does this agreement consolidate multiple contracts, but it creates “a substantial revenue floor” while greasing the wheels for upcoming renewals.

Orford also points to the company’s success in working throughout multiple industries and geographies, including a recent expansion of an existing contract with Japanese insurance company SOMPO Holdings.

“The story here is clear,” emphasizes Orford. “Palantir isn’t just selling apps. They’re embedding itself into its client’s critical infrastructure worldwide … all of this could help fuel the stock even higher.”

While it’s not without risks, the investor thinks PLTR is “a growth story worth owning.” (To watch Orford’s track record, click here)

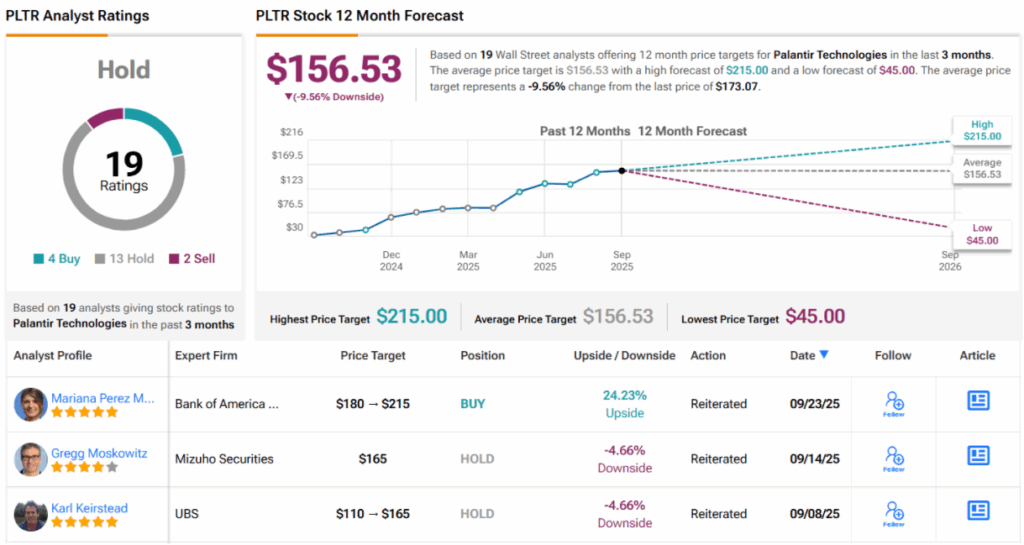

Wall Street is not quite as upbeat as the bullish investor Orford. PLTR’s 13 Holds – coupled with 4 Buys and 2 Sells – give it a consensus Hold (i.e. Neutral) rating. A 12-month average price target of $156.53 implies a downside approaching 10% in the year ahead. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link