UnitedHealth (UNH) is making a major shift in its Medicare Advantage offerings for 2026. The healthcare conglomerate plans to exit more than 100 plans across 109 counties nationwide, affecting about 600,000 members.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The cuts will primarily impact preferred provider organization (PPO) plans, which allow members to see providers outside of the plan’s network, and other less-managed products. Most of the cuts are expected in rural counties where costs are harder to control.

This move is expected to push affected patients toward health maintenance organization (HMO) plans, which require more referrals and limit members to a specific network of providers.

Key Reasons Behind the Cuts

The decision comes amid rising medical costs due to increased emergency room visits, higher prescription drug prices, and more frequent use of medical services. Also, tighter reimbursement rules from the Centers for Medicare & Medicaid Services (CMS) make it harder to sustain coverage in certain areas.

Moreover, the company expects a 20% drop in government funding in 2026 compared to 2023, prompting a shift toward more cost-effective plan models.

Potential Threat for UNH

UnitedHealth faces a potential threat from Pfizer’s (PFE) new deal with the Trump administration to offer discounted drugs through a direct-to-consumer platform, TrumpRx, which is expected to launch in early 2026. This could impact the traditional drug pricing model that insurers and pharmacy benefit managers (PBMs) rely on.

Pfizer has agreed to offer steep discounts, up to 85%, on many of its drugs through a government-run direct-to-consumer platform. This would impact other PBMs such as UnitedHealth’s OptumRx.

The move could shrink the “spread” that PBMs earn between list prices and negotiated rebates, putting pressure on margins.

Is UNH a Good Buy Right Now?

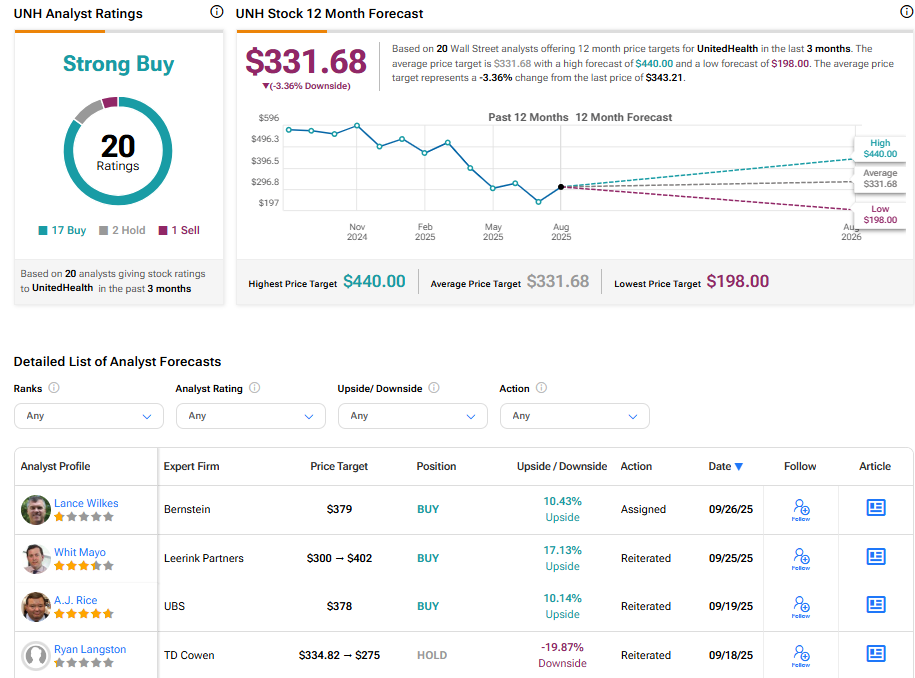

Turning to Wall Street, UNH stock has a Strong Buy consensus rating based on 17 Buys, two Holds, and one Sell assigned in the last three months. At $331.68, the average UnitedHealth stock price target implies a 3.36% downside potential.

Source link