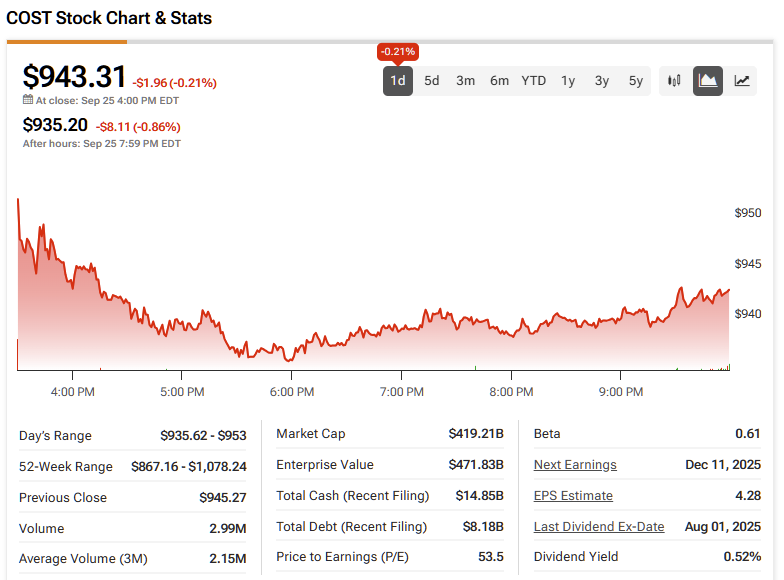

Costco Wholesale (COST), the nation’s largest wholesaler, faces a volatile session this morning after releasing a mixed earnings report late Thursday. Shares slipped 0.21% during the day and fell another 0.86% in after-hours trade.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

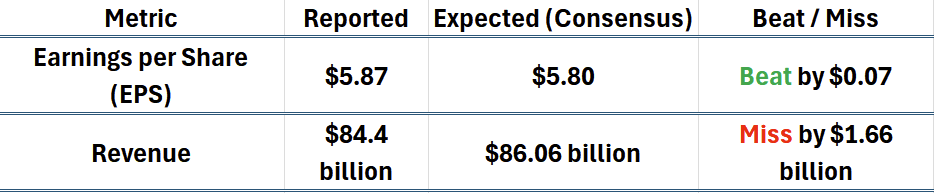

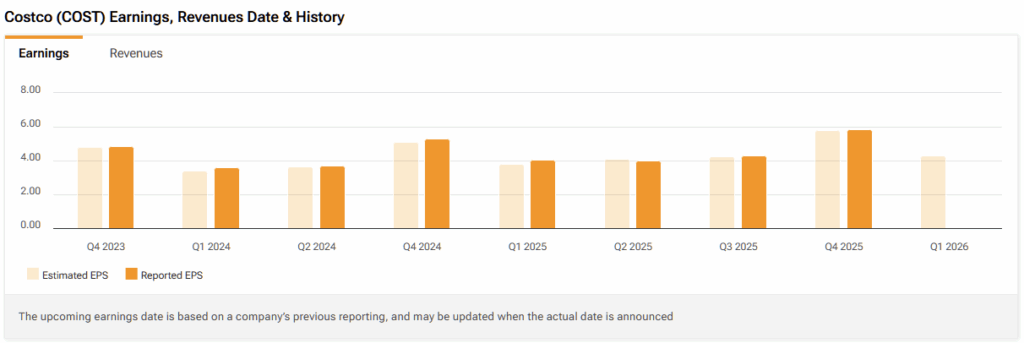

Costco Wholesale reported stronger-than-expected fiscal fourth-quarter earnings, with profit rising to $2.61 billion, or $5.87 per share — beating Wall Street’s consensus by $0.07. Net sales for the quarter climbed 8.0% year over year to $84.4 billion, up from $78.2 billion a year ago, though total revenue came in $1.66 billion below analyst forecasts.

For the full fiscal year, the company posted $8.1 billion in profit, or $18.21 per share, on revenue of $275.24 billion. Net sales rose 8.1% to $269.9 billion, compared with $249.6 billion in the prior year. In a pre-earnings call statement (set for later today), the wholesaler confirmed that it now has 914 warehouses operating worldwide, including 629 in the U.S.

The Fly in the Ointment

Yet amid these results — which on the surface affirm Costco’s scale and resilience — two fresh product safety controversies threaten to cast a shadow over the retailer.

Costco recently initiated a recall of its private-label Prosecco wine after determining that unopened bottles sold between April 25 and August 26 may “spontaneously shatter”, even when not being handled or moved. The recall affects multiple Midwestern states, which is yet another egg-on-face moment for COST, given its focus on the Midwest as a source of future revenue growth. No injuries have been publicly confirmed, though reporting is ongoing.

According to market analysts, Kirkland currently accounts for ~30% of its total revenue, with any revenue impacts likely to be reflected only in the following earnings report, scheduled for early December.

The hits just keep on coming for the wholesaler. Earlier this week, Costco’s private brand was recalled due to potential ‘Listeria monocytogenes’ contamination that can cause listeriosis infections, from green onions, affecting products sold in 32 US states with a sell-by date of September 22.

From a reputational and risk-management standpoint, recent recalls could erode consumer confidence in Costco’s quality control and product safety — particularly since they are high-visibility items and social media is as pervasive as ever.

Costco’s Earnings Shine, but Recalls Cast a Shadow on Brand Trust

Layered atop the mixed earnings (strong EPS but revenue shortfall), these safety incident gives critics fodder to argue that Costco’s scale does not immunize it from lapses in product vetting, especially in its private-label lines. Investors and members alike may now question whether Costco’s sourcing and quality-assurance oversight is as watertight as its financial performance suggests.

All in all, the headline numbers may be solid, but recent recalls should serve as a somber reminder that in retail, brand trust and product safety can sharpen or erode the narrative faster than quarterly profit and loss statistics.

Source link