The stock of Costco Wholesale (COST) is down about 1% even though the grocery retailer posted quarterly financial results that beat Wall Street forecasts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For what was its Fiscal fourth quarter, the Seattle-based company reported earnings per share (EPS) of $5.87, which was above the $5.81 consensus forecast on Wall Street. Revenue in the period totaled $86.16 billion, which topped the $86.06 billion that had been expected among analysts.

Same-store sales growth of 6.4% bested the 5.9% that was anticipated on Wall Street. E-commerce sales rose 13.6% during the latest quarter from a year earlier. COST stock has struggled this year as analysts and investors worry about the company’s growth trajectory as the U.S. economy shows signs of cooling.

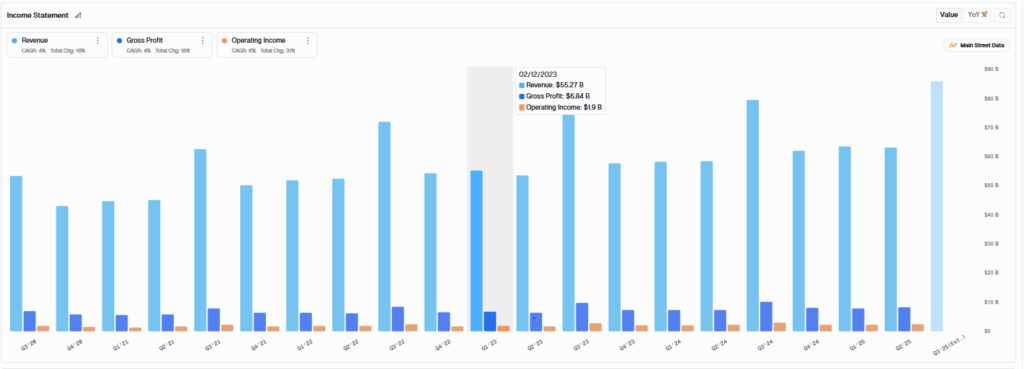

Costco’s income statement. Source: Main Street Data

Decelerating Growth

Costco’s same-store sales growth, which was reported along with the company’s August sales data, marks two consecutive quarters of deceleration. Costco announced that it opened a total of 24 new store locations during the quarter as it continues to expand.

However Costco is not immune to the impacts of tariffs as it imports products from around the world. At the same time, the company faces a deceleration in consumer spending as signs emerge that the U.S. economy is slowing with a deteriorating labor market and signs of persistent inflation.

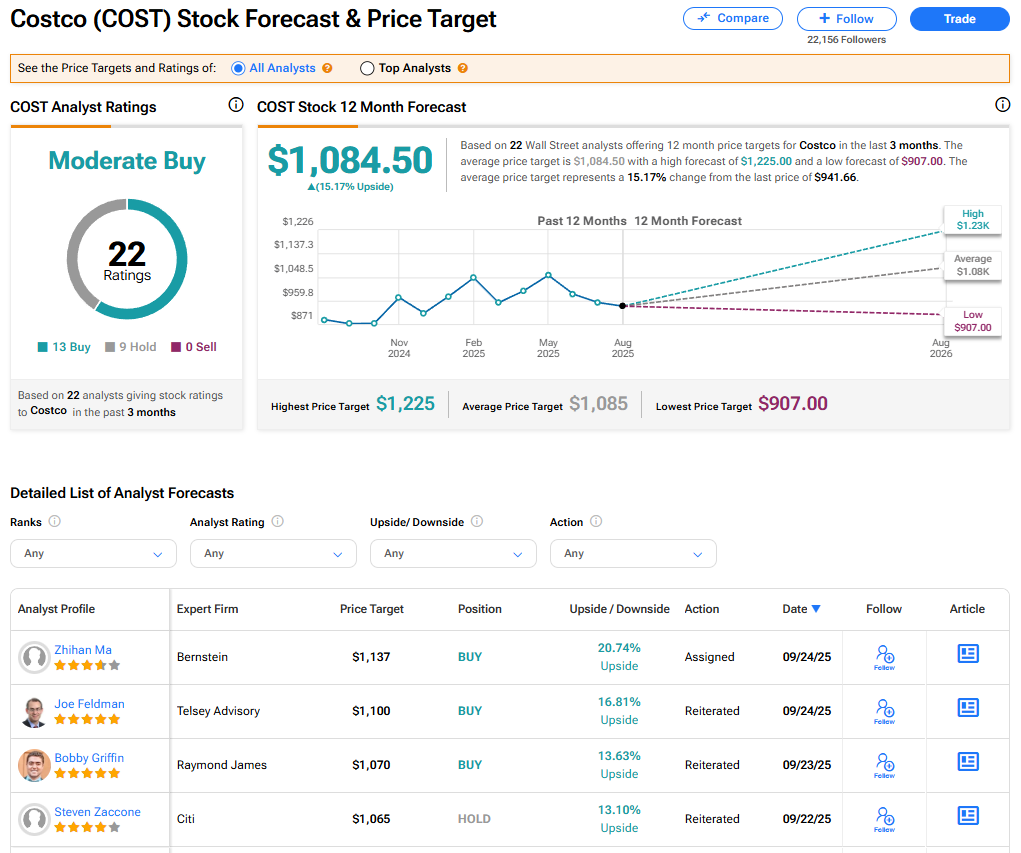

Is COST Stock a Buy?

The stock of Costco Wholesale has a consensus Moderate Buy rating among 22 Wall Street analysts. That rating is based on 13 Buy and nine Hold recommendations issued in the last three months. The average COST price target of $1,084.50 implies 15.17% upside from current levels. These ratings could change after the company’s financial results.

Source link