Intel (NASDAQ:INTC) has found itself in the rare position of being lifted by a rival’s embrace. Nvidia – the giant that has come to define the AI age – decided not just to tip its hat, but to put $5 billion on the line and link arms with Intel. The two will now be working together on AI infrastructure and even PCs, an unexpected pairing that would have sounded improbable not long ago.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For Intel investors, the market’s reaction told the story best. The stock ripped higher, climbing about 20% in a single day, as Wall Street quickly recalibrated its view of a company that many had counted out.

Nvidia’s capital injection is only the latest mega-investment in the firm, and it follows $10 billion from the U.S. government and $2 billion from Softbank. Intel now appears to have the funds and the backing to surge back to the top of the technological ecosystem.

On Wall Street, Benchmark’s 5-star analyst, Cody Acree, thinks this “watershed agreement” suggests further gains up ahead.

“We believe [the] announcement with Nvidia marks a significant fundamental tipping point in Intel’s long-term competitive positioning, a strong vote of confidence by the AI industry’s dominant leader in Intel’s development roadmap,” explains Acree, who is among the top 2% of Wall Street pros.

While the cash is important, Acree notes that it will take more than money to revamp Intel’s money-losing foundry business. While neither party was ready to commit publicly, the analyst believes that the agreement could very well set up Nvidia to become Intel’s first major foundry client using its next-gen 14A process technology.

Furthermore, the analyst points out that the partnership aligns with the president’s larger goal of supporting domestic semiconductor manufacturing. “We believe the financial and political motivation may be swinging in Intel’s favor,” adds Acree.

Moreover, Intel will benefit just by being part of Nvidia’s orbit, details the analyst. Acree predicts that Intel will now be part of design conversations and thrust into more business opportunities directly because of this newfound partnership, which both companies estimate to have a TAM of up to $50 billion.

Previously sitting on the fence, Acree now believes the time is right to pull the trigger.

“We can no longer support our Hold rating and are accordingly upgrading Intel to a Buy,” sums up Acree, whose new $43 price target would translate into additional gains of ~46% from current levels. (To watch Cody Acree’s track record, click here)

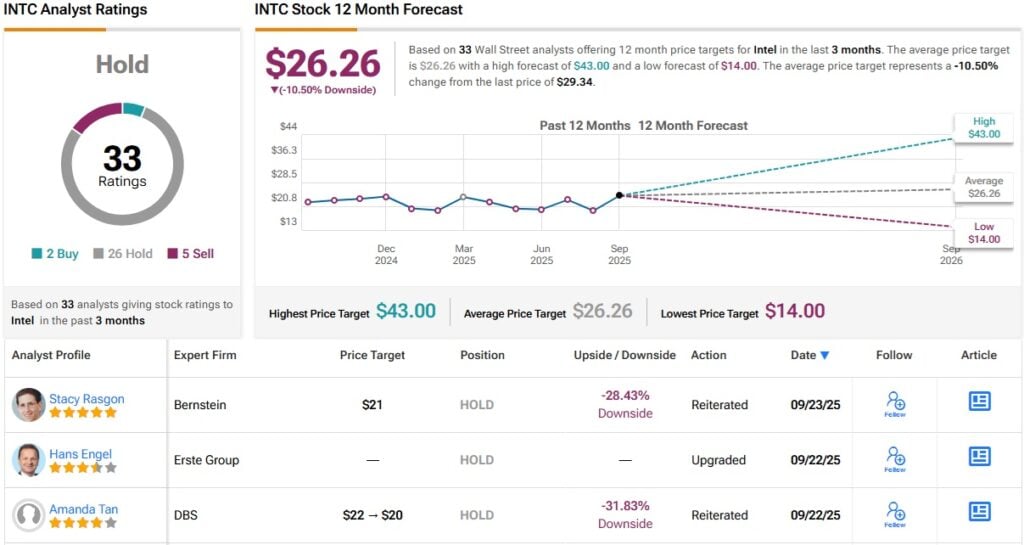

Most of Acree’s colleagues on Wall Street are taking a more patient approach to the news, however. With 26 Holds, and just 2 Buys and 5 Sells – INTC carries a Hold (i.e., Neutral) consensus rating. Its 12-month average price target of $26.26 points to losses of 10.5%. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link