Chip stock Intel (INTC) has been wielding its layoff axe like a butcher’s cleaver lately, and the impact is starting to resonate throughout the entire company. In fact, some are wondering if an entire business unit might not be next on the block thanks to Intel’s new deal with Nvidia (NVDA). There are signs it could be, and signs it may never happen. But Intel investors seem to like the idea. Intel shares were up nearly 3% in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The business line in question is its graphics processing unit. I know what you might be thinking right now, especially if you read what we said just four days ago. Intel is not planning to shut down its Arc lineup. Intel is not planning to get out of the graphics game despite the fact it has inked a deal to work directly with the king of graphics in the field.

While it is possible that Intel will continue to market its Arc lineup, it is possible that Intel might pivot instead to integrated graphics backed up by Nvidia, or to otherwise rebrand the Arc lineup into something completely different. Intel needs to get back its presence in the processor market, and by offering Nvidia-tier graphics with its processors, that may be just the push that Intel needs to get its position back and start bringing in more cash.

Private Sector Critical

Then, Intel’s federal chief technology officer and senior principal engineer Steve Orrin came out with some interesting new remarks about developing artificial intelligence. He also spoke to the importance of private sector operations in getting the government’s AI Action Plan off the ground.

More specifically, Orrin noted, “The way to think about chip innovation for public sector is understanding that public sector writ large is almost a macro of the broader private sector industries. When we talk about chip innovation specific for the public sector, it’s this notion of taking private sector technology solutions and capabilities and federalizing them for the specific needs of the U.S. Government.”

Is Intel a Buy, Hold or Sell?

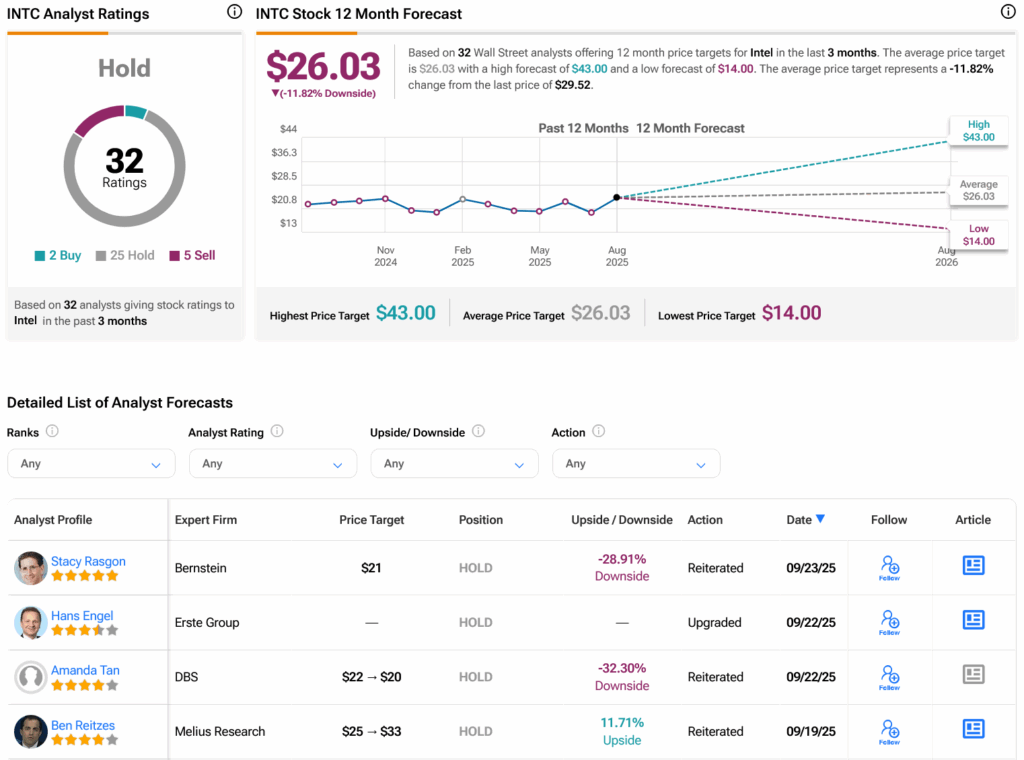

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 25 Holds and five Sells assigned in the past three months, as indicated by the graphic below. After a 26.09% rally in its share price over the past year, the average INTC price target of $26.03 per share implies 11.82% downside risk.

Source link