Quite a bit has happened to chip stock Intel (INTC) lately, and it should not be surprising that the analysts are starting to come out with their assessment of the landscape. The picture is, overall, somewhat mixed, and that is getting investors a bit nervous. In fact, Intel shares were down nearly 2.5% in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

First came word from Citi, via analyst Christopher Danely, who has nearly a five-star rating on TipRanks. This proved a mixed bag for Intel; while Danely gave the price target a boost from $24 to $29 per share, he also cut the rating from Neutral to Sell.

What prompted the bearish call? Basically, Danely does not like the sudden run-up in Intel shares, saying that “…the market reaction has overshot fundamentals,” reports note. While the new announcement from Nvidia about a team-up with Intel was a boost, Danely does not look for it to be much of a help either way. Better graphics will be helpful, Danely noted, but Intel still has a lot of heavy lifting to do to make its processors better than the competition’s.

Less Concern Elsewhere

Meanwhile, a different analyst came out with a look at the field, and suggested that Intel has a lot going for it right now. First, there is the matter of the United States government not only taking a hand in Intel, but also, making it clear that a domestic chip program is vital. That kind of endorsement, complete with cash support, certainly does not hurt matters.

The potential for Intel to improve its position in the data center thanks to the Nvidia (NVDA) connection should also help. If Intel’s new product lines can keep cash flow moving in, then Intel can effectively invest in its foundry operations and more likely generate a true win.

Is Intel a Buy, Hold or Sell?

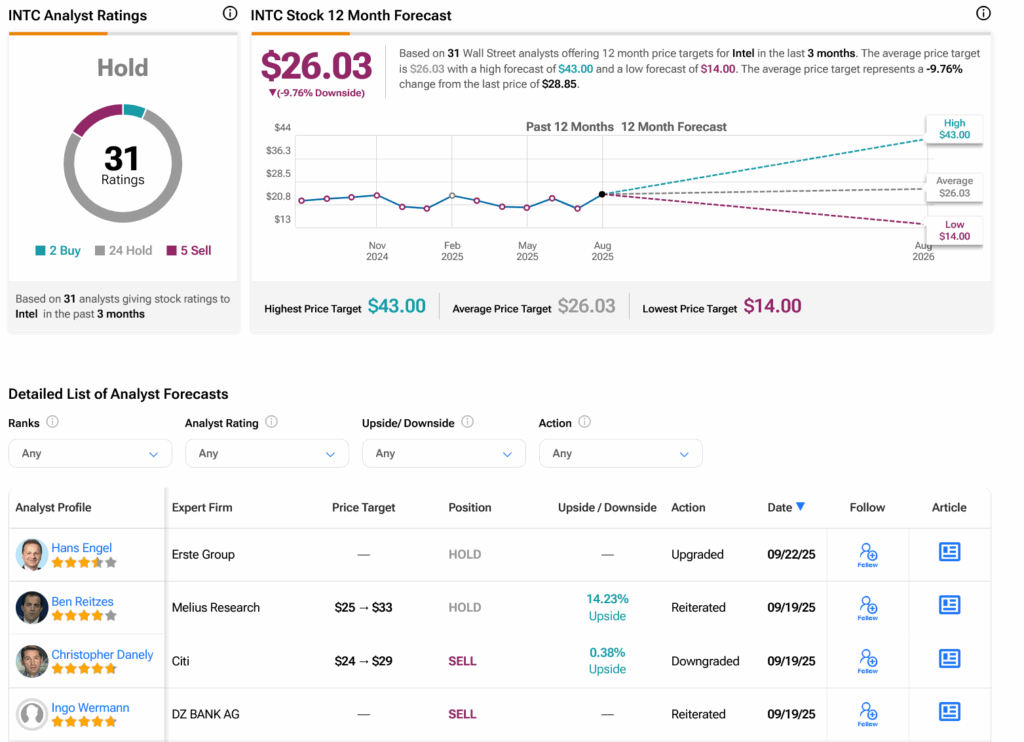

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 24 Holds and five Sells assigned in the past three months, as indicated by the graphic below. After a 31.12% rally in its share price over the past year, the average INTC price target of $26.03 per share implies 9.76% downside risk.

Source link

:max_bytes(150000):strip_icc()/GettyImages-2236196353-39d01839dc3a44e99044c8a1a6247db7.jpg)