Sometimes the best investments can come from the most unsuspected places.

Without a doubt, artificial intelligence (AI) is one of the greatest investment trends of our time. Companies such as Nvidia are providing the most powerful AI hardware. Companies such as Comfort Systems USA are also benefiting as they help build out data centers, which are necessary for AI. And AI has high electricity demand, giving power companies such as Vistra a nice tailwind as well.

Nvidia, Comfort Systems USA, and Vistra are all up 1,000% or more over the last five years, showing the AI trend is real and benefiting many businesses in multiple industries. But there’s a little-known monster company that has nothing to do with AI and yet it’s outperforming them all.

If you invested $10,000 in Build-A-Bear Workshop (BBW -1.36%) stock five years ago, you’d have $225,000 now — roughly $90,000 more than a $10,000 investment in Nvidia over the same time period. Indeed, the small toy company has provided investors with a return of 2,150%. It’s a story you’ve got to see to believe.

Image source: Getty Images.

An incredible comeback story

To be fair, setting the clock at five years ago may be cherry-picking a little. Build-A-Bear stock had dropped sharply in the early days of the pandemic. So five years ago is an apt time to start the clock. That said, the company’s profitable growth has been spectacular.

As of Feb. 1, 2020, Build-A-Bear had generated $339 million in total trailing-12-month revenue. By Feb. 1, 2025, that had jumped about 47% to $496 million in trailing-12-month revenue. That represents a roughly 8% compound annual growth rate (CAGR).

Build-A-Bear Workshop has more than 600 stores, some of which are owned by the company and others that are franchised. Customers come in and have an entire experience. They pick out a plush toy and “customize” it by controlling how much fluff goes on the inside.

Build-A-Bear seems to be enjoying an uptick in demand for a few simple reasons. For starters, the company was founded in 1997. Youngsters back then are parents now and are taking their kids in for the nostalgic experience that they had. The company has also done a good job of leaning into trends by licensing popular characters from modern TV shows for kids. And it hasn’t shied away from using e-commerce to its advantage, as well.

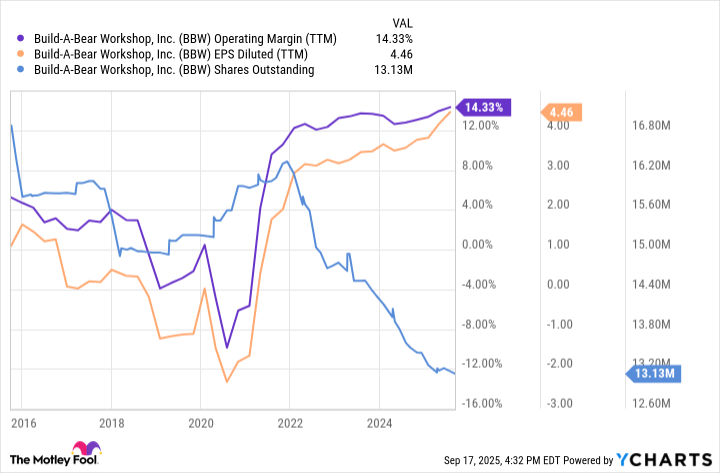

Revenues are steadily increasing for Build-A-Bear. But its profitability and use of cash have been equally impressive. Its current operating margin of 14% is at an all-time high. And its earnings per share (EPS) are also at an all-time high, in part thanks to its share count being at an all-time low.

BBW Operating Margin (TTM) data by YCharts

To summarize, demand is strong for Build-A-Bear, lifting profit margins. The company is debt-free with relatively low capital requirements. Therefore, management gives back to shareholders with stock buybacks. And it’s even paid some special dividends in recent years to go along with its quarterly dividend.

Can the formula keep working for this cheap stock?

Build-A-Bear stock currently trades for a price-to-earnings (P/E) ratio of 16. Granted, it’s been cheaper in the past — much cheaper. But a P/E of 16 is still a discount to the overall stock market and means there’s minimal valuation risk here.

Since Build-A-Bear stock is still relatively cheap, can the business keep delivering on the simple formula that’s made it such a monster stock in recent years? (As a reminder, the formula is consistent growth, strong profits, and generous returns to shareholders.) I believe it can.

There are two factors that can keep growth going for Build-A-Bear. First, consumer traffic is still positive even in a strained U.S. economy. In the second quarter of 2025, store traffic was up 3%. And the company’s evolution into more of a collectible business fueled impressive Q2 e-commerce growth of 15%. Second, Build-A-Bear is opening a lot of new locations in international markets.

This growth can keep margins strong for Build-A-Bear. Higher store traffic at company-owned stores is good for profitability. And its growth overseas is via franchised and licensed locations, which is higher-margin revenue. So its profit margins may be at all-time highs, but it appears sustainable.

Assuming it’s sustainable, I expect Build-A-Bear to continue with paying dividends and doing stock buybacks. After all, there’s not much need when it comes to investing its cash elsewhere in the business.

To be clear, I don’t expect greater than 2,000% stock returns for Build-A-Bear stock over the next five years. But based on everything going right for the business right now as well as its still-cheap stock price, I wouldn’t be surprised if it outperformed the market average again over the next five years.

Source link