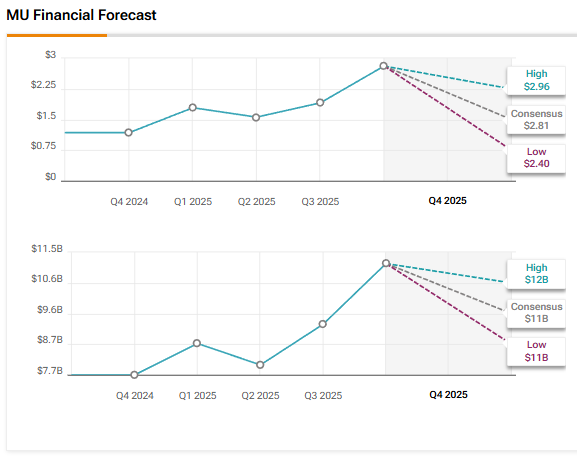

Memory chipmaker Micron (MU) is scheduled to announce its results for the fourth quarter of Fiscal 2025 after the market closes on Tuesday, September 23. MU stock has rallied more than 93% year-to-date, driven by optimism about the demand for the company’s high-bandwidth memory (HBM) chips amid the ongoing artificial intelligence (AI) boom. Wall Street expects Micron to report adjusted earnings per share (EPS) of $2.81, reflecting a year-over-year growth of over 138%. Meanwhile, revenue is expected to increase by 43% to $11.12 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Micron has an impressive track record of beating the Street’s expectations. It has surpassed the consensus earnings estimates for nine consecutive quarters.

Last month, Micron raised its fourth-quarter guidance, citing improved pricing, particularly in DRAM, and solid execution. The company stated that it expects revenue of $11.2 billion ± 100 million and adjusted EPS of $2.85 ± $0.07.

Analysts’ Views Ahead of Micron’s Q4 Earnings

Heading into the results, Rosenblatt analyst Hans Mosesmann reiterated a Buy rating on Micron stock with a price target of $200. The top-rated analyst expects the company to deliver a modest beat relative to its August 11 pre-announcement regarding guidance upgrade, with a stronger upside to the Street’s estimates expected for the November quarter outlook. Mosesmann added that his bullish stance on Micron stock is backed by constrained DRAM and NAND Flash wafer supply through 2026, coupled with accelerating demand from AI workloads.

Mosesmann believes that demand for DRAM has already exceeded available supply. He also highlighted that the need for AI systems to store vast volumes of data is fueling the strength in storage markets. “MU remains our top long idea as the memory up-cycle accelerates into FY26,” said Mosesmann.

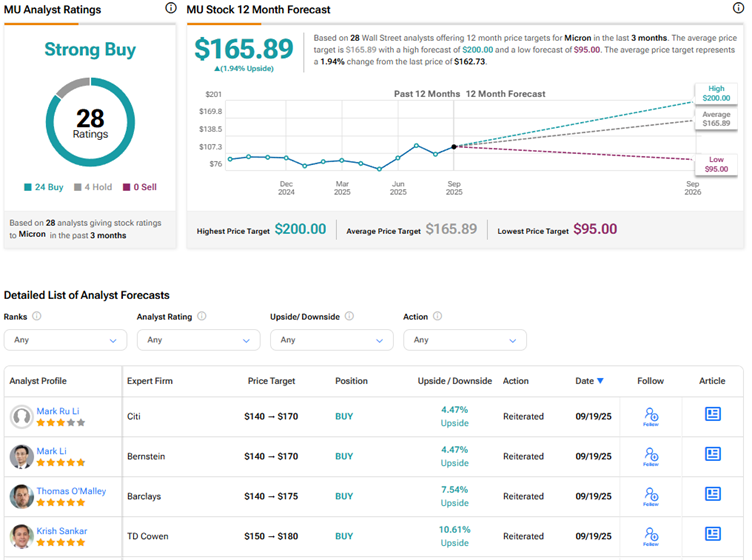

Meanwhile, TD Cowen analyst Krish Sankar raised the price target for Micron Technology stock to $180 from $150 and maintained a Buy rating. The 5-star analyst expects MU stock to continue outperforming in the short term as checks continue to support that momentum. “Typically, this part of the cycle puts more emphasis on ASP [average selling price] trends as we do not expect much multiple expansion from here, but rather continued growth in book value,” said Sankar.

Furthermore, Sankar sees the possibility of the company’s November EPS outlook surpassing the Street’s consensus estimate by about 15%. He believes that the main focus will be on whether HBM pricing is locked for calendar 2026.

AI Analyst Is Bullish on Micron Stock Ahead of Q4 Print

Interestingly, TipRanks’ AI Analyst has assigned an Outperform rating to Micron stock with a price target of $137, indicating a possible downside of 16% from current levels. TipRanks’ AI analysis reflects solid financial performance and positive insights from the earnings call, highlighting robust revenue and strategic investments. Technical analysis supports a bullish outlook, although caution is advised due to nearing overbought conditions.

The AI analysis indicates that the updated guidance further strengthens the positive sentiment, making Micron a compelling investment in the semiconductor industry.

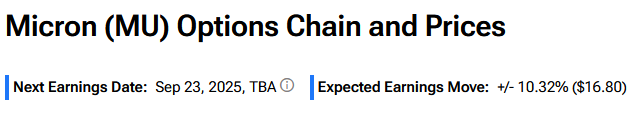

Options Traders Anticipate a Major Move on Micron’s Q4 Earnings

Using TipRanks’ Options Tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 10.3% move in either direction in Micron stock in reaction to Q4 FY25 results.

Is MU Stock a Buy, Sell, or Hold?

Overall, Wall Street has a Strong Buy consensus rating on Micron stock based on 24 Buys and four Holds. The average MU stock price target of $165.89 indicates a modest 2% upside potential.

Source link