The AI arms race will intensify heading into 2026.

With only two months remaining in 2025, investors need to start considering what 2026 will bring. By understanding what’s next in the market, investors can get ahead of a large shift that occurs during December as large portfolio managers do the same thing. There is still a ton of resources being poured into the AI computing power buildout, and we may start to see some real benefits emerge from the technology in 2026.

As a result, I think AI stocks will still be excellent investments in 2026. I’ve got five that look like strong buys right now, and I think investors will be well positioned for 2026 by buying these five now.

1. Nvidia

Nvidia (NVDA 0.04%) is the gold standard for AI investing these days for a reason; its graphics processing units (GPUs) have played a part in nearly all of the AI technology we’ve experienced to date. While competition is rising, the Nvidia ecosystem has locked several AI hyperscalers into using its technology, and it will continue to be a dominant force for years to come.

CEO Jensen Huang has stated that global data center capital expenditures are expected to rise from $600 billion this year to $3 trillion to $4 trillion by 2030. That’s monstrous growth, and if he’s right, Nvidia stock will be a must-own. Consider buying it in November to take advantage of this forecasted growth.

Today’s Change

(-0.04%) $-0.09

Current Price

$202.80

Key Data Points

Market Cap

$4921B

Day’s Range

$202.08 – $207.97

52wk Range

$86.62 – $212.19

Volume

6.6M

Avg Vol

177M

Gross Margin

69.85%

Dividend Yield

0.00%

2. Broadcom

One of the rising competitors Nvidia is having to deal with is Broadcom (AVGO 1.71%). Broadcom isn’t entirely focused on the AI arms race like Nvidia, and only about a third of its revenue comes from AI-related sales activity. However, that could quickly change as companies start ot adopt Broadcom’s custom AI accelerators.

Instead of computing units that can be used for multiple calculation types (like Nvidia’s GPUs), Broadcom is working in tandem with the end user to design customized AI chips that are optimized to run its specific workloads. This yields a cheaper and more powerful variability than Nvidia can reproduce, as it sacrifices flexibility. I expect these customized chip sets will become far more popular in the next few years as organizations know better what their AI workloads will look like.

3. Taiwan Semiconductor Manufacturing

Neither Broadcom nor Nvidia produces the chips they design. They contract with Taiwan Semiconductor Manufacturing (TSM 0.92%) to produce their chips en masse. This places TSMC in a neutral role in the artificial intelligence arms race, allowing it to benefit from the trend regardless of who the winning chip designer is.

Taiwan Semiconductor Manufacturing

Today’s Change

(-0.92%) $-2.79

Current Price

$300.43

Key Data Points

Market Cap

$1558B

Day’s Range

$296.68 – $307.68

52wk Range

$134.25 – $311.37

Volume

13M

Avg Vol

12M

Gross Margin

58.06%

Dividend Yield

0.01%

Furthermore, they have the most advanced 2nm (nanometer) chips entering production right now that will see massive adoption in 2026. These chips consume 25% to 30% less energy compared to their 3nm counterparts when configured to run at the same speed. With the massive focus on energy consumption, this technology could drive increased sales as clients rush to adopt this architecture.

4. Alphabet

Alphabet (GOOG +0.00%) (GOOGL 0.07%) is one of the AI hyperscalers that are pouring a ton of money into AI computing capacity. Not all of this is for internal use, as its cloud computing division is also seeing massive demand for AI computing power from its clients.

Alphabet’s primary business, Google Search, is also adapting to the changing landscape by merging generative AI with a traditional search experience through its AI search overviews. This will allow its cash cow business to stay relevant in the future. I’m bullish on Alphabet and think it has a ton of room to run even after the stock saw strong performance in 2025.

5. Meta Platforms

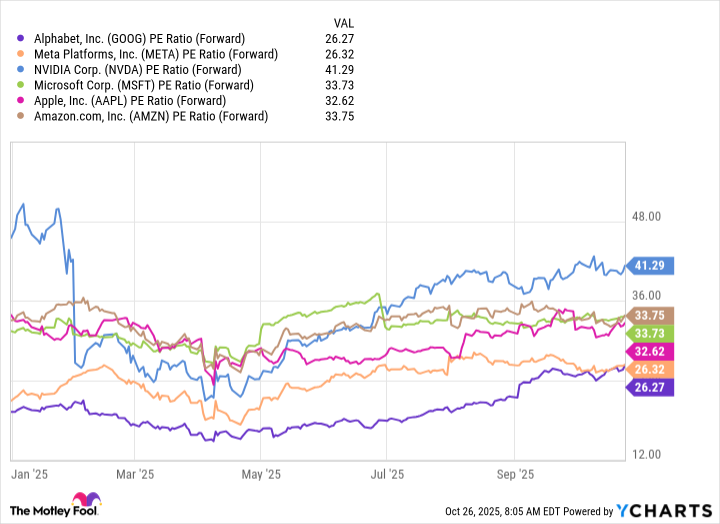

Last is Meta Platforms (META 2.62%). Similar to Alphabet, it has one of the lowest valuations among the “Magnificent Seven” stocks in the market (Tesla was removed from this chart because its valuation is extremely high and skews the chart).

Meta also has a cash cow similar to Alphabet’s Google Search in its social media properties, like Instagram and Facebook. Meta is using the funds from these businesses to heavily invest in AI infrastructure that it thinks can improve user experiences and drive increased ad revenue alongside efficiencies within the company.

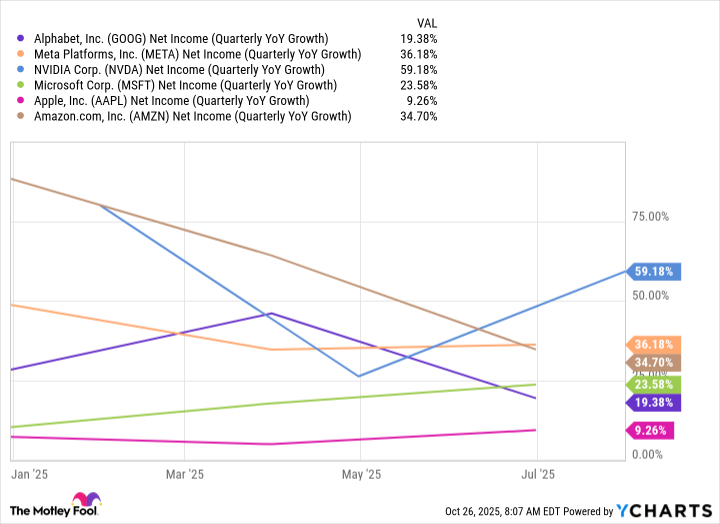

Despite being one of the cheapest Magnificent Seven stocks, based on valuation, Meta has some of the best net income growth.

This combines for an excellent investment to make, and I think Meta Platforms will continue to see success well into 2026, making it an excellent stock to buy now.

Keithen Drury has positions in Alphabet, Amazon, Broadcom, Meta Platforms, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Source link

:max_bytes(150000):strip_icc()/GettyImages-2243611350-37fbf1e9f5bf40e08b746600cee1e907.jpg)